Among providers offering the cheapest commercial auto insurance for state minimum liability, ERGO NEXT ranks first at $293 monthly ($3,511 per year). The Hartford at $315 and Nationwide at $324 follow, with all three being below the industry average.

Cheapest Commercial Auto Insurance

With rates starting at $58 per month, the cheapest commercial auto insurance providers are ERGO NEXT, The Hartford and Nationwide.

Compare quotes from top providers to find your best rate.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT offers the cheapest commercial auto insurance we analyzed at $293 monthly, about $22 (7%) less than average.

The cheapest provider depends on your business type, vehicle use, coverage needs and driver history.

To get the most affordable business auto insurance, get only coverage you need, take advantage of discounts and compare plenty of quotes.

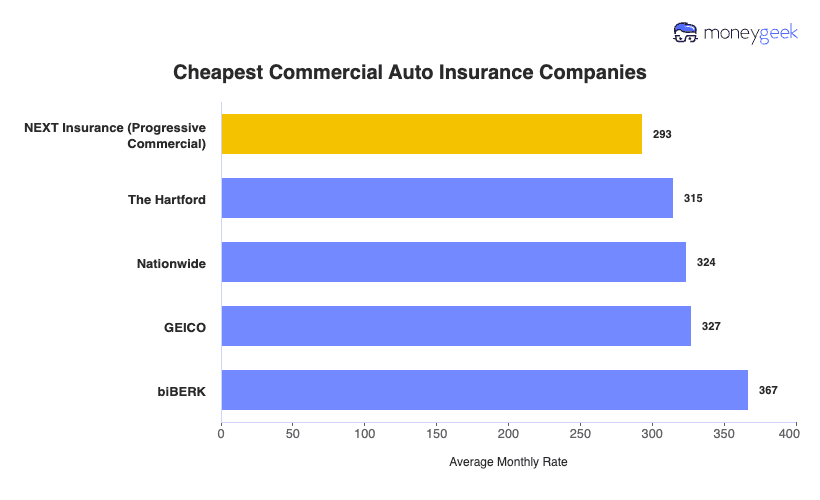

Cheapest Commercial Auto Insurance Companies

| ERGO NEXT | $293 | $3,511 |

| The Hartford | $315 | $3,785 |

| Nationwide | $324 | $3,885 |

| GEICO | $327 | $3,922 |

| biBERK | $367 | $4,401 |

Note

Rates shown reflect average monthly and annual premiums from the companies MoneyGeek surveyed. Your actual costs may vary based on your business type, location, coverage needs and claims history. Compare quotes from multiple insurers to find the best rate for your specific situation.

ERGO NEXT: Cheapest Commercial Auto Insurance Overall

Cheapest rates at $293 monthly

Top overall score in our analysis

Instant digital quotes and certificates 24/7

Strong coverage quality (ranks second)

Fully mobile-accessible platform

Lowest customer experience scores

Offers commercial auto insurance indirectly through Progressive

ERGO NEXT saves contractors, delivery services, landscapers and other small business owners $268 annually. The digital platform provides instant quotes, 24/7 certificate access from your phone and straightforward online purchasing.

ERGO NEXT earned our top overall score and ranks second for coverage quality, protecting business vehicles effectively during equipment hauls or customer deliveries.

Cheapest Commercial Auto Insurance by Coverage Level

ERGO NEXT offers the cheapest commercial auto insurance at $137 monthly for state minimum coverage, beating The Hartford ($148) and Nationwide ($151). Your rate varies by industry, location and drivers.

| $1,000,000 CSL (Combined Single Limit) Liability | ERGO NEXT | $387 |

| 100/300/100 Liability Insurance With $1,000 deductible For Comp and Collision | ERGO NEXT | $354 |

| State Minimum Liability | ERGO NEXT | $137 |

Note

Rates shown reflect annual premiums for our sample commercial vehicle profile and may vary based on your specific business needs, vehicle types, driving records, coverage selections and location. The coverage levels represent different liability limits and optional coverages. Contact insurers directly for personalized quotes based on your business's unique requirements.

Cheapest Commercial Auto Insurance by Vehicle Type

ERGO NEXT has the cheapest rates for every vehicle type, from sedans at $58 monthly to farm tractors at $73, no matter what you drive.

| Box Truck | ERGO NEXT | $297 |

| Bus | ERGO NEXT | $1,025 |

| Dump Truck | ERGO NEXT | $430 |

| Farm Tractor | ERGO NEXT | $186 |

| Flatbed Truck | ERGO NEXT | $439 |

| Food Truck | ERGO NEXT | $317 |

| Pickup Truck | ERGO NEXT | $230 |

| Van | ERGO NEXT | $224 |

| Forklift | ERGO NEXT | $316 |

| Limousine | ERGO NEXT | $854 |

Note

Rates shown represent annual premiums for our sample driver profile operating each vehicle type. Your costs will vary based on factors like your driving record, business location, coverage limits, vehicle value and how you use the vehicle.

Commercial trucks and specialized vehicles often cost more to insure than standard vans or sedans. Get quotes from multiple insurers to find the best rate for your specific vehicle and business needs.

Cheapest Commercial Auto Insurance by State

Pennsylvania drivers pay the cheapest rates for state minimum liability through ERGO NEXT at $65 monthly ($780 yearly). Hawaii follows at $71, with both below average.

| Alabama | The Hartford | $277 |

| Alaska | ERGO NEXT | $324 |

| Arizona | ERGO NEXT | $339 |

| Arkansas | The Hartford | $296 |

| California | ERGO NEXT | $403 |

| Colorado | ERGO NEXT | $369 |

| Connecticut | ERGO NEXT | $390 |

| Delaware | The Hartford | $335 |

| Florida | ERGO NEXT | $447 |

| Georgia | ERGO NEXT | $311 |

| Hawaii | ERGO NEXT | $266 |

| Idaho | ERGO NEXT | $245 |

| Illinois | ERGO NEXT | $378 |

| Indiana | ERGO NEXT | $303 |

| Iowa | Nationwide | $262 |

| Kansas | Nationwide | $259 |

| Kentucky | The Hartford | $311 |

| Louisiana | The Hartford | $472 |

| Maine | ERGO NEXT | $225 |

| Maryland | GEICO | $386 |

Note

Rates shown reflect annual premiums for our sample commercial driver profile in each state and represent quotes from the companies MoneyGeek surveyed. Your costs will vary based on your driving record, vehicle type, coverage selections, business location within the state and claims history.

State regulations, traffic density and local insurance requirements impact pricing. Compare quotes from multiple insurers licensed in your state for accurate rates.

Cheapest Commercial Auto Insurance by Industry

Your industry significantly affects commercial auto insurance rates. Among the industries we analyzed, financial services businesses through ERGO NEXT offer the most affordable rates at $58 monthly ($694 yearly) for state minimum liability. Professional services at $61 and medical/healthcare at $62 follow closely.

| Agriculture/Farming | ERGO NEXT | $244 |

| Cleaning/Janitorial | ERGO NEXT | $185 |

| Contractors/Construction | ERGO NEXT | $337 |

| Financial Services | ERGO NEXT | $151 |

| Manufacturing | ERGO NEXT | $461 |

| Medical/Healthcare | ERGO NEXT | $161 |

| Professional Services | ERGO NEXT | $159 |

| Restaurants and Food Delivery | ERGO NEXT | $253 |

| Retail | ERGO NEXT | $175 |

| Transportation/Trucking | ERGO NEXT | $663 |

Note

Rates shown reflect annual premiums for our sample business profile in each industry sector. Your actual costs depend on factors like your fleet size, driver records, vehicle types, operating radius, cargo value and claims history.

High-risk industries like construction or delivery services pay more than office-based businesses with minimal driving. Contact insurers specializing in your industry for the most accurate quotes.

How to Get the Cheapest Auto Insurance

Knowing the cheapest commercial auto insurance provider helps, but you can lower your insurance costs even further with these strategies:

- 1Compare quotes from multiple insurers

Rates vary significantly between companies for identical coverage. Get quotes from at least three insurers to find the best price for your needs.

- 2Raise your deductible

A higher deductible lowers your monthly premium. If you can cover $1,000 or $2,500 out of pocket after an accident, you'll save on annual costs.

- 3Bundle policies

Combine commercial auto insurance with general liability or property coverage for a multi-policy discount. This reduces your overall business insurance expenses.

- 4Keep driving records clean

Accidents and violations increase premiums. Implement safety training and monitoring programs to keep your drivers' records clean and your rates low at renewal.

- 5Choose vehicles strategically

Newer, expensive vehicles cost more to insure than older models. Your fleet's make, model and safety features directly affect your rates.

- 6Pay annually

Paying your full premium upfront saves money compared to monthly payments. Most insurers charge installment fees that increase your total cost.

- 7Build better credit

In most states, insurers use credit scores to calculate rates. Pay bills on time, reduce debt and fix credit report errors to qualify for lower premiums.

Low Cost Commercial Auto Insurance: Bottom Line

ERGO NEXT offers the cheapest commercial auto insurance at $293 monthly, but your rate varies by industry, location and drivers. Compare quotes from ERGO NEXT, The Hartford and Nationwide to find your best price. Lower your costs by bundling policies, maintaining clean driving records and choosing less expensive vehicles.

Affordable Commercial Auto Insurance: FAQ

Finding the cheapest commercial auto insurance raises questions about coverage, costs and savings. We've answered frequently asked questions to help you decide:

What coverage level should I choose for my commercial auto insurance?

State minimum works for older vehicles you own outright and can afford to replace. Full coverage with 100/300/100 limits protects your business better from major liability claims at $4,252 yearly through ERGO NEXT. Businesses with financed vehicles or valuable assets need higher limits.

Why do commercial auto insurance rates vary so much between industries?

Insurers price based on how you use vehicles. Financial services businesses pay $58 monthly through ERGO NEXT because they drive mainly for client meetings. Delivery services and contractors hauling equipment face higher premiums from increased road time, cargo risks and accident exposure.

Does my state affect how much I pay for commercial auto insurance?

Your location matters. Pennsylvania businesses pay the lowest rates at $65 monthly through ERGO NEXT, while high-traffic states cost much more. State minimum coverage requirements and local claims frequency create these differences

Can I save money by insuring multiple commercial vehicles together?

Most insurers discount multi-vehicle policies by 5% to 15% compared to separate coverage. Contact ERGO NEXT, The Hartford or Nationwide for fleet quotes, as savings grow with more vehicles. You'll also simplify management with one renewal date and single certificate of insurance.

How do I know if NEXT Insurance's cheapest rates will apply to my business?

ERGO NEXT's $293 monthly rate averages state minimum coverage across different business profiles. Your actual cost depends on your industry, location, vehicles, drivers and claims history. Get an instant quote through ERGO NEXT's digital platform and compare it with The Hartford ($315) and Nationwide ($324).

What's the difference between state minimum and full coverage commercial auto insurance?

State minimum covers only liability for damage you cause to others, costing around $1,643 yearly. Full coverage adds comprehensive and collision protection for your own vehicles at $4,252 annually through ERGO NEXT. Choose full coverage for newer vehicles, loans or when you can't afford replacement costs.

Will my commercial auto insurance rates increase after an accident?

At-fault accidents raise premiums at renewal for three to five years. The increase varies by severity and your claims history. Driver safety programs help prevent future incidents and keep rates lower. Compare quotes from ERGO NEXT, The Hartford and Nationwide after accidents.

About Blest Papio

Blest Papio is a Content Producer at MoneyGeek specializing in small business insurance. With five years of experience in insurance and finance writing and hands-on perspective as a former business counselor, he understands the risks that come with running a business and what it takes to protect against them.

Blest focuses on commercial auto, cyber, property and specialty business insurance. He digs deep into policy details, regulations and provider offerings so businesses can find the coverage they need and avoid financial fallout. His goal is to translate technical insurance language and insurer offerings into guides you can act on.

Whether you're insuring company vehicles, managing cyber liability or protecting your commercial property, Blest aims to guide you through your risks to help you find coverage you truly need, not sell you a policy.