MoneyGeek's investment calculator estimates your investment balance over time. Enter your initial deposit, contribution details, expected return rate and compound frequency. The calculator shows cumulative totals for principal and interest, helping you see exactly how each factor impacts long-term growth. Adjust values to test different scenarios and find the strategy that works for your goals.

Investment Calculator

Use MoneyGeek's free investment calculator to estimate your investment balance. Enter your initial deposit and contribution amounts, contribution frequency, and other details to see how your money could grow over time.

Total Balance

$0

YEAR

Investment Growth and Return Calculator

MoneyGeek is dedicated to providing trustworthy information to help you make informed financial decisions. Each article is edited, fact-checked and reviewed by industry professionals to ensure quality and accuracy.

Editorial Policy and StandardsUpdated: December 29, 2025

Advertising & Editorial Disclosure

How to Use MoneyGeek’s Investment Calculator

Enter your investment details to see how your money could grow over time.

- 1Set Your Initial Deposit and Contributions

Your initial deposit forms the foundation of your investment. Enter the amount you're starting with, and all future gains build from this base. Add your contribution amount and choose monthly or annual frequency. Regular contributions grow your balance and expand total returns over time. Monthly contributions compound more often, accelerating growth. Annual contributions compound less frequently but still add long-term value.

The calculator treats contributions as if made at the end of each period. End-of-period contributions reflect typical deposit timing, where money enters accounts after the period completes. Beginning-of-period contributions would compound slightly faster, but most financial calculators use end-of-period as the standard assumption.

- 2Define Your Investment Timeline

Enter your investment period in years. Longer time frames let compound interest work through more cycles. A 25-year-old investing for 40 years sees substantially more growth than someone investing for 20 years, even with identical contributions. Extended investments achieve greater returns through repeated compounding cycles.

- 3Input Your Expected Rate of Return

Use average return rates that match your investment type and risk tolerance. For conservative projections, use 4% to 5%. Moderate growth portfolios average 6% to 7% annually. Aggressive stock-heavy portfolios historically return 8% to 10%. Stocks typically return 9% to 10% (S&P 500 Index average), while diversified bond portfolios average closer to 5%. Choose a rate that reflects your actual asset mix and comfort with market volatility.

- 4Select Your Compound Frequency

Choose how often interest compounds on your investment. Monthly compounding applies interest more often, boosting your balance efficiently over time. Daily compounding maximizes growth for larger or longer-term investments. This frequency enhances results by calculating gains on previous gains more frequently throughout the year.

How to Read the Results

The calculator displays three key figures: Total Balance (your investment's overall value), Total Principal (amount you contributed) and Total Interest (what you earned from compounding). The graph tracks growth over time, showing how contributions and interest work together. An upward trend indicates healthy growth, while a flatter trajectory suggests you may need to adjust contributions, timeline or expected returns.

Starting with $5,000 and adding $200 monthly at a 6% annual return compounded monthly over 10 years yields around $41,873. Your contributions total $29,000, while compounding interest adds $12,873. Interest compounds on both your initial deposit and each monthly contribution, accelerating growth each year. Adjusting your timeline or monthly amount increases returns proportionally.

Why Use an Investment Calculator?

MoneyGeek's investment calculator estimates potential returns, explores different contribution strategies and plans for long-term financial growth.

Estimate how much your investment will grow over time based on your starting amount and regular contributions. Realistic expectations help you plan for your financial goals.

If you're thinking about retirement, this tool helps you figure out how much you need to save to reach your goals. Test different scenarios, like adjusting your monthly contributions or expected return, to match your retirement plans. As your investment portfolio grows, consider life insurance to protect the wealth you're building. Adequate coverage ensures your family can maintain financial stability and continue funding long-term goals if something happens to you.

Experiment with contribution frequency or amount to see how small changes boost growth. Monthly contributions of $250 versus $200 can add thousands to your final balance. Consistent contributions, especially when planned thoughtfully, accelerate long-term returns and help you reach financial milestones faster.

Investment calculators show nominal returns, but taxes and inflation reduce actual purchasing power. A 7% return with a 25% combined tax rate and 3% inflation yields roughly 2.25% in real after-tax growth. Understanding this difference helps you set realistic targets and plan for higher contributions to meet your true financial needs.

This calculator lets you compare conservative and aggressive strategies side by side. Test how a 5% return versus a 9% return affects your 20-year balance. Match your investment choices with your goals and comfort with risk to create a plan that works for you.

Types of Investments

The calculator projects growth for stocks, bonds, real estate and commodities. Each type has unique potential returns and risks.

Type | Description | How to Use the Calculator |

|---|---|---|

Stocks | Stocks represent company ownership with returns from price appreciation and dividends, averaging 9% to 10% annually (S&P 500 Index). | Start with your initial amount and monthly contribution. Use a 9% to 10% return rate as a benchmark for long-term stock portfolios. |

Mutual Funds | Mutual funds pool investor money to buy diversified assets, reducing individual risk with returns varying by fund focus (equity funds ~9% to 10%, bond funds ~5%). | Add your initial investment and monthly contributions. Use a rate matching your fund type (equity or bond) to project growth. |

Bonds | Bonds provide predictable interest income through corporate or government debt, with diversified portfolios averaging around 5% annually. | Enter your deposit and contribution amount. Use a 5% rate to model steady bond interest compounding over time. |

Real Estate | Real estate investment provides returns through property appreciation and rental income, with private commercial real estate yielding 8% to 12% annually over the long term. | Input your property investment and planned contributions. Use an 8% to 12% growth rate to project value appreciation and rental income. |

Commodities | Commodities like gold, oil and agricultural goods serve as inflation hedges, with gold averaging 7% to 8% annual returns since the 1970s though prices fluctuate significantly. | Set your initial investment and expected return range. The calculator models value changes based on price fluctuations over time. |

Different investments compound at different frequencies. Stocks and mutual funds: Use daily compounding for modeling purposes (actual returns are driven by market prices and reinvested dividends). Bonds and savings accounts: Match your account's stated compound frequency, typically monthly. Real estate and commodities: Annual compounding reflects typical valuation cycles for these asset classes.

Managing Investment Risk

Investment returns aren't guaranteed, and market volatility can impact short-term performance. Diversification reduces risk by spreading money across different asset types: stocks, bonds, real estate and commodities. When one sector underperforms, others may offset losses and stabilize your overall portfolio.

Your asset allocation should match your timeline and risk tolerance. Younger investors typically hold 80% to 90% stocks for growth potential, accepting short-term volatility for long-term gains. Those nearing retirement shift toward 50% to 60% bonds for stability, protecting accumulated wealth from market swings.

Rebalancing annually maintains your target allocation as different investments grow at different rates. This disciplined approach prevents overexposure to any single asset class and helps you avoid emotional decisions during market downturns.

Consider dollar-cost averaging by investing fixed amounts regularly regardless of market conditions. This strategy reduces timing risk and builds positions during both market highs and lows. Regular contributions through market cycles often outperform attempts to time perfect entry points.

Investment Growth vs. Investment Return

Investment growth and return measure different aspects of performance.

Investment growth tracks your total balance over time: initial deposit, regular contributions, compounded interest and reinvested earnings like dividends. This shows your portfolio's cumulative value.

Investment return measures the percentage gained relative to your initial deposit. This rate focuses on income generated from your starting capital, including dividends, without counting additional contributions.

Start with $10,000 and add $500 monthly at a 5% annual return compounded monthly over 10 years.

Investment growth: After 10 years, your balance reaches around $94,111. This includes your initial $10,000 deposit, all monthly contributions ($60,000 total) and $24,111 in compounded interest. Growth reflects your portfolio's total accumulated value.

Investment return: Your initial $10,000 deposit earns around $500 in the first year, a 5% return. This measures only what your starting capital generates, excluding monthly contributions. Growth tracks total balance; return tracks starting capital performance.

Investment Calculator FAQ

Find answers about choosing a return rate, calculating ROI and planning your investment period.

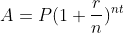

What is the basic formula for investment?

The basic investment formula is:

This equation calculates your investment's future value. A is your ending balance, P is your initial investment, r is the annual interest rate (as a decimal), n is how many times interest compounds per year, and t is how many years you invest.

How accurate are investment calculators?

Investment calculators provide estimates based on your inputs, but actual returns vary with market conditions, fees and taxes.

How do you calculate ROI?

To calculate return on investment (ROI), divide net profit by initial investment and multiply by 100 to get a percentage. For example, earning $1,000 on a $10,000 investment yields a 10% ROI. This metric measures how well your investment generates profit.

How often should I review my investment strategy?

Review your investments at least annually. Regular check-ins keep your strategy on track. Major life changes (new job, home purchase or retirement goal) warrant additional reviews to confirm your approach matches current goals.

How do taxes affect my investment returns?

Taxes reduce your effective return. Capital gains taxes apply when you sell investments for profit. Long-term rates (held over one year) range from 0% to 20% based on income, while short-term gains face ordinary income tax rates up to 37%. Dividend income and interest also face taxation. Tax-advantaged accounts like 401(k)s and IRAs defer or eliminate these taxes, boosting long-term growth.

What's the difference between nominal and real returns?

Nominal returns show percentage gains without adjusting for inflation. Real returns account for inflation's impact on purchasing power. A 7% nominal return with 3% inflation yields a 4% real return. Real returns reveal your actual wealth increase and buying power over time.

Should I choose monthly or annual contributions?

Monthly contributions compound more frequently, generating slightly higher returns over time. A $6,000 annual contribution ($500 monthly) compounded monthly outperforms a single $6,000 yearly deposit. Monthly contributions also smooth market volatility through dollar-cost averaging and match typical paycheck schedules.

Find Additional MoneyGeek Calculators

About Nathan Paulus

Nathan Paulus is the Head of Content at MoneyGeek, where he conducts original data analysis and oversees editorial strategy for insurance and personal finance coverage. He has published hundreds of data-driven studies analyzing insurance markets, consumer costs and coverage trends over the past decade. His research combines statistical analysis with accessible financial guidance for millions of readers annually.

Paulus earned his B.A. in English from the University of St. Thomas, Houston.