Finding Cheap Health Insurance for 26-Year-Olds in 2026

Cheap health insurance options for 26-year-olds include Medicaid, employer-sponsored plans and marketplace policies.

Updated: February 24, 2026

Advertising & Editorial Disclosure

Table of Contents

Turning 26 is only relevant in health insurance if you are covered under your parent’s policy, but the actual kick-off age can vary by state and plan. Regardless, most individuals will typically have their own health insurance by this age, whether through an employer or the Health Insurance Marketplace.

If you do not have your own policy yet, MoneyGeek has outlined everything you need to know about health insurance for 26-year-olds. Explore the different health insurance types and decide which is best for you.

In most cases, when a person turns 26, the insurance coverage on their parent's plan ends, triggering a qualifying life event that lets them apply for new coverage.

For a healthy 26-year-old, the average cost of a marketplace plan is $372 per month, but the best plan depends on your health and healthcare objectives.

Having health insurance is wise, even if it's a low-cost, high-deductible plan that primarily covers catastrophic incidents.

Types of Health Insurance for a 26-Year-Old

Outside of employer-sponsored health insurance policies, there are plenty of health insurance options for 26-year-olds, with policies varying by state, provider and plan. You can purchase health insurance from the Health Insurance Marketplace, and you have alternatives such as short-term insurance or joining a spouse’s policy.

Using the Health Insurance Marketplace gives you plenty of coverage choices, so you can choose a plan that benefits your needs most. Plans are organized by metal tiers, ranging from Bronze as the lowest to Platinum as the highest. Metal tiers dictate how you split the costs of healthcare with your insurer. The lower the tier, the more you pay out-of-pocket and vice versa, and it can be ideal health insurance options for students and young adults at age 26.

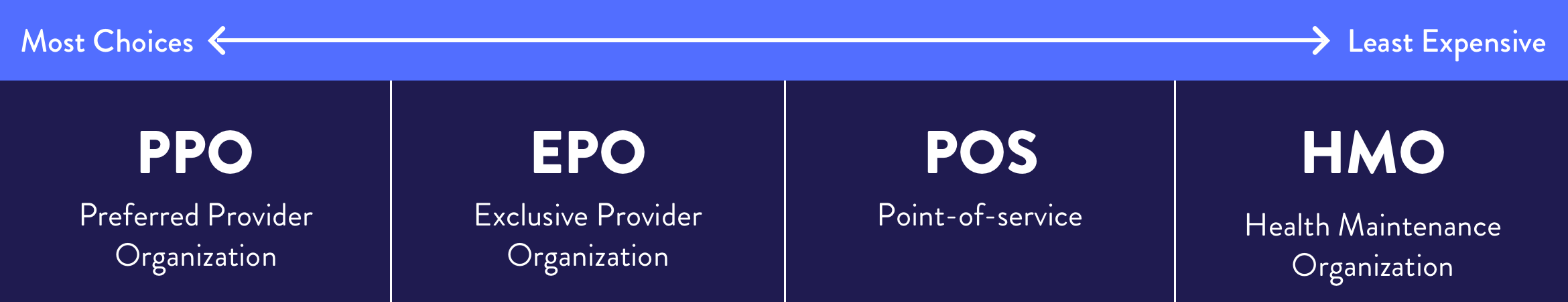

Different plan types affect your premiums, deductibles, copays and physician network access. Plans include Health Maintenance Organization (HMO), Exclusive Provider Organization (EPO), Point of Service (POS) or Preferred Provider Organization (PPO). HMO plans (the most common type) deliver low premiums and deductibles but require you to stay within a provider network.

Types of Health Insurance Plans

Coverage source affects costs and coverage. Get health insurance from employers, government programs, the insurance marketplace or directly from providers.

Below are a few differences between providers:

- Employer: Employer-sponsored plans rank as one of the most common and affordable ways to get health insurance. Employers typically cover some or most of the policy's cost.

- Medicaid: Another health insurance source for 26-year-olds delivers typically low costs. Income limits apply since this program serves low-income individuals or families.

- Marketplace: The Health Insurance Marketplace delivers plans for different needs at different price points. Annual open enrollment or a qualifying event required for special enrollment period applications. Plans may cost more than employer-sponsored or Medicaid options, but qualified individuals can lower premiums through tax credits.

- Directly Through Private Companies: Approaching insurance companies directly lets you purchase individual or family health plans. This convenience comes with higher costs and typically no subsidies.

The Affordable Care Act (ACA) makes it mandatory for employer-sponsored or individual marketplace plans to allow a child beneficiary to stay on the plan until they reach age 26. This applies whether the child is married or unmarried. However, some states may allow them to stay on for longer.

When to Get Health Insurance After Parent Coverage Ends

Twenty-six typically marks the latest age for a parent's plan, though staying on after 26 sometimes works. Getting health insurance coverage before getting kicked off your parent's insurance or before a parent's insurance ends matters. Coverage doesn't start until the designated effective date for some insurers, which may fall a few days or weeks after your application.

Plan ahead to avoid health insurance coverage gaps. Planning ahead lets you determine if your parent's coverage offers a grace period and gives you time to shop for a new provider. Losing a parent's insurance triggers a qualifying event for a special enrollment period on the marketplace, letting you enroll outside the annual enrollment period.

Insurance turns over yearly. Unsatisfied with any plan part? Renew during the next enrollment period or qualifying event.

Premiums aren't the only health insurance policy factor. Copays, coinsurance and maximum out-of-pocket (MOOP) limits matter since these out-of-pocket fees affect annual healthcare spending.

Copay means the flat fee you pay for most services. Coinsurance means the percentage you pay before insurance covers the rest. MOOP means the maximum you'll pay for healthcare outside premiums.

Higher premiums deliver lower copays and coinsurance, benefiting those with more medical needs. Lower premiums mean higher copays or coinsurance.

Can You Stay On Your Parents' Insurance After Age 26?

Some states extend dependent health insurance coverage beyond age 26. The table shows which states extended dependent coverage.

States with Extended Dependent Coverage

State | Age | Dependent Eligibility |

|---|---|---|

Florida | 30 |

|

Illinois | 30 | Must be a veteran. |

Nebraska | 30 |

|

New Jersey | 31 |

|

New York | 29 |

|

Pennsylvania | 30 |

|

South Dakota | 29 |

|

Wisconsin | 27 |

|

How Much Does Health Insurance for a 26-Year-Old Cost?

The most affordable health insurance for 26-year-olds can vary based on several factors, such as the plan’s metal tier, income, health, type of plan and services needed. Beyond that, your policy’s copay, coinsurance and maximum out-of-pocket (MOOP) also affect your overall costs.

Review the table below to get an idea of the average health insurance costs between different health insurance plans.

Average Costs of Health Insurance for a 26-Year-Old by Plan Type

Plan Type | Average Premium Per Month | Average Deductible Per Year | Average MOOP |

|---|---|---|---|

HMO | $373 | $4,882 | $7,447 |

EPO | $378 | $5,659 | $7,840 |

PPO | $389 | $4,920 | $7,283 |

POS | $400 | $5,367 | $8,046 |

While low-premium plans are attractive, comparing the cost of a health insurance policy to its expected treatment costs is important. For instance, a healthy 26-year-old who expects to pay about $3,000 in healthcare costs per year may not benefit from a health insurance policy that costs $12,000 annually.

Make sure your selected plan matches your expected healthcare costs. This means opting for a lower premium and higher deductible may sometimes be your best option, even if it means spending a little more out-of-pocket.

Cheapest Health Insurance for Young Adults

The cheapest health insurance for 26-year-olds includes Medicaid or an employer-sponsored health plan. These options often cost less than marketplace policies.

However, if Medicaid or an employer-sponsored program is unavailable, then the marketplace is the next best option. It’s still possible to get discounts on premiums in the marketplace through premium tax credits, especially if you opt for lower metal tier plans. Review the chart below to see the average costs of different marketplace plans and plan types.

Best Health Insurance for a 26-Year-Old

The best health insurance for 26-year-olds ultimately depends on your situation. Medicaid remains among the best and most affordable options for those who qualify.

If Medicaid is unavailable, you will have to opt for a plan that best suits your needs. For most healthy 26-year-olds, an insurance policy with a low premium, high deductible and high MOOP may be best.

Take a look at a few situations below to see which type best suits your needs.

If you are a full-time employee, getting your employer-sponsored health benefit may be the best option. This could be even cheaper if you qualify for Medicaid, as you can opt for a premium assistance program.

If your employer plan isn’t ideal, then you can get a marketplace plan instead. Some individuals may even qualify for subsidies. A Bronze HMO or Catastrophic HMO are the cheapest options, but a PPO offers a larger network and more coverage choices. If you want a combination of both, you might benefit from a POS.

The best health insurance for unemployed individuals is usually Medicaid. However, if you do not qualify, you may also be eligible for a subsidized marketplace plan, where you might qualify for premium tax credits.

Aside from Medicaid, the cheapest health insurance for college students under 26 is usually a low-tier plan. HMO plans are the cheapest option, and your monthly costs could be lower with premium tax credits.

Another student health insurance option is through your educational institution. Some schools offer affordable health insurance policies but may have varying requirements.

If you have no insurance, but your spouse is insured through an employer-sponsored health plan, it may be best to get coverage through them. If this isn’t enough, you may find a plan through the marketplace.

Keep in mind that despite being married, you do not have to be on the same plan as your spouse.

As a single parent, the best low-cost health insurance option is often Medicaid. You may also be able to get a subsidized marketplace plan.

If your employer also offers health insurance, it may be your best option, and it might also be possible to supplement with premium assistance through the Children’s Health Insurance Program (CHIP).

If you are between jobs, you may opt for a short-term health insurance policy to bridge the gap and ensure you have coverage during your downtime.

If you frequently need medical care, then you might want a high premium, low-deductible plan. Coverage from your insurer will kick in sooner, so you will spend less out-of-pocket in a plan year.

You may also want to get a plan with a bigger network, which could mean avoiding an HMO and opting for a PPO or POS.

A short-term health insurance policy can help you bridge a gap between two periods but isn’t ideal for an extended period.

A short-term plan does not cover Essential Health Benefits (EHB), which include prescription drugs, emergency services, hospitalization and more. Some insurers may deny coverage based on your medical history. This is why it’s crucial to get health insurance coverage before dropping off your parent’s or spouse’s policy.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Health Insurance After Age 26 FAQs

Turning 26 means taking control of your health insurance, especially if you age out of a parent’s policy. To help you understand the options, MoneyGeek answers a few commonly asked questions below.

Do I have to have health insurance?

By federal law, health insurance is not a mandatory requirement, but it is still a good idea to have coverage. Insurance can help you avoid out-of-pocket costs, and with 1 in 10 adults owing more than $10,000 in medical bills, having coverage is smart.

How long can you be on your parent's health insurance?

In most states, you can remain dependent on your parent's health insurance until you turn 26. However, some states, including Wisconsin, New Jersey and New York, will let you stay on even past the age of 26 if you meet certain requirements.

When do you get kicked off your parent’s health insurance plan?

Individuals who are 26 years old may age out of their parent's health insurance plan. However, this limit can vary from state to state.

How can I stay on my parent’s insurance after 26?

Depending on your age, location and situation, you may be able to stay on your parent's insurance plan after age 26. However, in most states, insurers no longer provide coverage for dependents after they turn 26, so you must plan ahead to avoid a health insurance gap. Ask your parent’s provider when you age out of the plan.

About Brenna Kelly

Brenna Kelly, the former Health Insurance Content Manager at MoneyGeek, is a licensed health insurance agent and real estate associate. She is qualified to provide expert insight and advice on medical insurance, disability, long-term care, critical illness, Medicare Supplements and Medicare Advantage Plans.

Kelly has a Bachelor of Science and a Master of Arts in Applied Sociology from the University of Central Florida. She uses her content production experience and health insurance expertise to deliver informative articles.

sources

- Centers for Medicare & Medicaid Services. "Information on Essential Health Benefits (EHB) Benchmark Plans." Accessed December 19, 2024.

- Employee Benefits Security Administration. "Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Businesses and Families FAQs." Accessed December 19, 2024.

- KFF. "1 in 10 Adults Owe Medical Debt, With Millions Owing More Than $10,000." Accessed December 19, 2024.