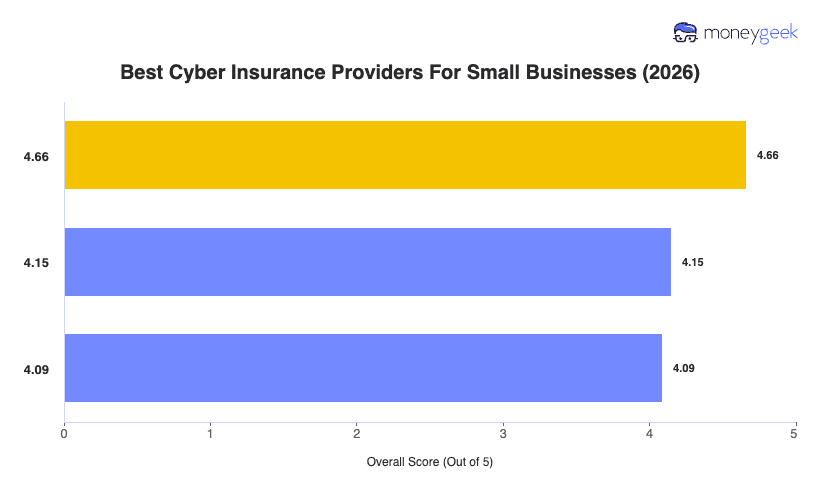

Based on our research, most small businesses can find the best cyber insurance with these providers:

- Chubb: Best Overall, Best for Coverage Depth and Claims Reliability

- Hiscox: Best for Cyber Crime and Social Engineering Protection

- Coalition: Best for Tech-Forward Businesses and Risk Management

These insurers balance competitive pricing, strong post-purchase support, and coverage options built for the most common cyber risks small businesses encounter. However, keep in mind that these choices are a starting point and your best cyber insurance company depends on your business's unique details like industry, location and firm size.