The best insurer for you depends on what you value most. If claims support matters more than saving $20/month, Nationwide's top-ranked customer service is worth the premium. If you've got expensive implements or need equipment breakdown coverage, The Hartford's 5.0 coverage score edges out the competition. For tighter budgets, ERGO NEXT costs $50/month less than biBERK with better scores across the board.

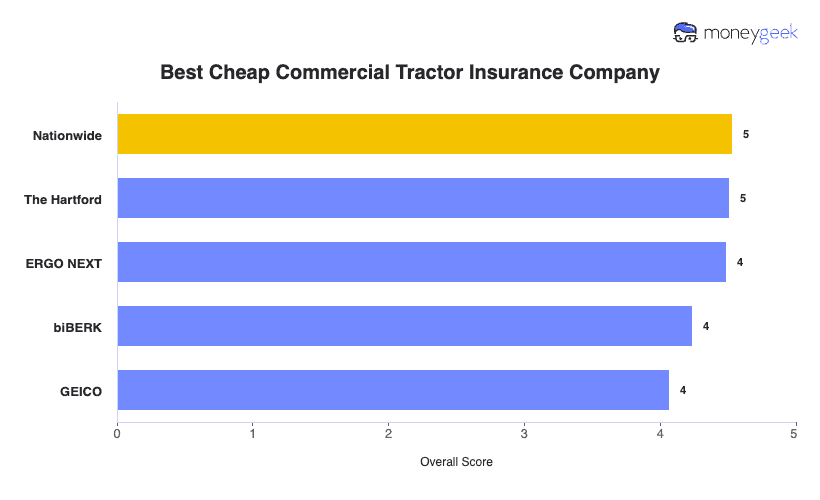

Best Cheap Commercial Tractor Insurance

With rates starting at $186/mo, the best cheap commercial tractor insurance is offered by ERGO NEXT, The Hartford and Nationwide.

Get matched to top commercial tractor insurance providers below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Nationwide ranks as the best cheap commercial tractor insurance overall with a 4.53 score and 4.90 coverage rating. Strong customer service (#1 ranked) and flexible farm policy options make it ideal for large agricultural operations.

ERGO NEXT is the cheapest at $186/month ($2,235 annually) for 100/300/100 liability coverage on farm tractors, saving $173/year versus the provider average.

Commercial tractor insurance averages $203/month ($2,435 annually) for farm operations, ranging from $131/month in Vermont to $322/month in New York.

Compare quotes from at least three insurers and stack discounts (paid-in-full, multi-vehicle, bundling) to save 10-25% on your equipment.

MoneyGeek scored commercial tractor insurance providers across three weighted factors: Affordability (40%), Customer Experience (30%) and Coverage & Terms (30%). We analyzed 100/300/100 liability quotes with $1,000 deductibles for comprehensive and collision from five major insurers across all 50 states. Affordability scores compare each provider's rates against market averages. Customer experience reflects claims handling, agent support and policyholder satisfaction. Coverage scores evaluate policy terms, endorsement options and coverage flexibility.

Best Commercial Tractor Insurance Companies

| Nationwide | 4.53 | $205 | 4.64 | 4.9 |

| The Hartford | 4.51 | $203 | 4.51 | 5 |

| ERGO NEXT | 4.49 | $186 | 4.27 | 4.36 |

| biBERK | 4.24 | $236 | 4.3 | 4.37 |

| GEICO | 4.07 | $209 | 3.96 | 4.03 |

Disclaimer

MoneyGeek rated insurers based on affordability, customer experience and coverage terms for commercial farm truck insurance with $1,000,000 CSL liability coverage. Data collected November 2025.

Get Your Commercial Farm Truck Insurance Quote

Compare rates from top providers for your business. Enter your fleet size and location to see customized quotes in minutes.

Best Commercial Tractor Insurance by State

Location affects your rate more than any other factor. A Vermont farmer pays $131/month while a New York operator pays $322 for identical coverage, a $2,300 annual difference. If you're in a high-cost state like Florida, Louisiana or New York, shopping multiple insurers matters even more since the spread between cheapest and priciest providers widens in expensive markets.

| Alaska | ERGO NEXT | $170 | 4.27 | 4.36 |

| Arizona | ERGO NEXT | $176 | 4.27 | 4.36 |

| California | ERGO NEXT | $213 | 4.27 | 4.38 |

| Colorado | ERGO NEXT | $187 | 4.27 | 4.36 |

| Florida | ERGO NEXT | $242 | 4.27 | 4.36 |

| Georgia | ERGO NEXT | $171 | 4.27 | 4.36 |

| Hawaii | ERGO NEXT | $135 | 4.27 | 4.36 |

| Idaho | ERGO NEXT | $126 | 4.27 | 4.36 |

| Illinois | ERGO NEXT | $197 | 4.27 | 4.36 |

| Indiana | ERGO NEXT | $159 | 4.27 | 4.36 |

| Maine | ERGO NEXT | $116 | 4.27 | 4.36 |

| Massachusetts | ERGO NEXT | $207 | 4.27 | 4.36 |

| Michigan | ERGO NEXT | $219 | 4.27 | 4.36 |

| Minnesota | ERGO NEXT | $181 | 4.27 | 4.36 |

| Mississippi | ERGO NEXT | $157 | 4.27 | 4.36 |

| Missouri | ERGO NEXT | $203 | 4.27 | 4.36 |

| Nevada | ERGO NEXT | $181 | 4.27 | 4.36 |

| New Hampshire | ERGO NEXT | $123 | 4.27 | 4.36 |

| New Mexico | ERGO NEXT | $168 | 4.27 | 4.36 |

| New York | ERGO NEXT | $270 | 4.27 | 4.36 |

| North Carolina | ERGO NEXT | $145 | 4.27 | 4.36 |

| Ohio | ERGO NEXT | $165 | 4.27 | 4.36 |

| Oregon | ERGO NEXT | $174 | 4.27 | 4.36 |

| Pennsylvania | ERGO NEXT | $178 | 4.27 | 4.36 |

| South Carolina | ERGO NEXT | $175 | 4.27 | 4.36 |

| Texas | ERGO NEXT | $204 | 4.27 | 4.36 |

| Utah | ERGO NEXT | $144 | 4.27 | 4.36 |

| Virginia | ERGO NEXT | $177 | 4.27 | 4.36 |

| Washington | ERGO NEXT | $202 | 4.27 | 4.36 |

| Iowa | Nationwide | $136 | 4.72 | 4.96 |

| Kansas | Nationwide | $151 | 4.71 | 4.9 |

| Maryland | Nationwide | $235 | 4.63 | 4.9 |

| Nebraska | Nationwide | $138 | 4.71 | 4.9 |

| New Jersey | Nationwide | $242 | 4.63 | 4.9 |

| Rhode Island | Nationwide | $236 | 4.63 | 4.9 |

| South Dakota | Nationwide | $192 | 4.63 | 4.9 |

| Vermont | Nationwide | $112 | 4.63 | 4.9 |

| Wisconsin | Nationwide | $148 | 4.69 | 4.9 |

| Alabama | The Hartford | $138 | 4.5 | 5 |

| Arkansas | The Hartford | $153 | 4.5 | 5 |

| Connecticut | The Hartford | $223 | 4.58 | 5 |

| Delaware | The Hartford | $176 | 4.5 | 5 |

| Kentucky | The Hartford | $163 | 4.5 | 5 |

| Louisiana | The Hartford | $251 | 4.5 | 5 |

| Montana | The Hartford | $147 | 4.5 | 5 |

| North Dakota | The Hartford | $129 | 4.5 | 5 |

| Oklahoma | The Hartford | $154 | 4.5 | 5 |

| Tennessee | The Hartford | $181 | 4.5 | 5 |

| West Virginia | The Hartford | $162 | 4.5 | 5 |

| Wyoming | The Hartford | $151 | 4.5 | 5 |

Data Source

State averages reflect quotes for farm tractor coverage with 100/300/100 liability limits and $1,000 deductibles across multiple providers. National average calculated at $203 monthly ($2,435 annually). MoneyGeek analysis, November 2025.

Best for Large Farming Operations

Average Cost

$205/monthlyOur Survey: Claims Process

3.9/5Our Survey: Likely to Recommend

4.3/5

- pros

Ranks first for customer experience with dedicated farm insurance agents

Strong coverage score (4.90) with flexible policy customization

Bundle with broader farm policies for 10-15% savings

Available in all 50 states

consPremium costs $19 more monthly than the cheapest option

Requires agent consultation for quotes in most states

Nationwide leads our rankings with a 4.53 overall score, driven by top customer experience marks. Farm insurance agents understand agricultural equipment risks and can customize policies for large-scale operations. Monthly costs run $205, just $19 more than the cheapest option. That premium buys dedicated agent support and claims expertise.

Nationwide ranks third for affordability at $205 monthly ($2,455 annually). You'll pay $19 more per month than ERGO NEXT, but the gap narrows if you bundle with other farm policies. Multi-policy discounts of 10-15% can offset the base rate difference for operators with broader coverage needs.

Nationwide scores 4.64 for customer experience, ranking first among reviewed insurers. Dedicated farm insurance agents handle quotes and claims with agricultural expertise. The 3.9/5 claims process rating and 4.3/5 recommendation score reflect consistent service quality across policyholder interactions.

Nationwide covers farm tractors in all 50 states with 100/300/100 liability as the standard option. Policies include comprehensive and collision with $1,000 deductibles, plus options for equipment breakdown and attached implements. The 4.90 coverage score reflects flexible policy structures for different operation sizes.

Best for Coverage Options

Average Cost

$203/monthlyOur Survey: Claims Process

4.5/5Our Survey: Likely to Recommend

4.5/5

- pros

5.0 coverage score with equipment breakdown protection

A++ AM Best rating shows strong financial stability

Covers attached implements without separate policies

Over 200 years of industry experience

consPremium costs $17 more monthly than cheapest option

Quote process slower than digital competitors

The Hartford scores 4.51 overall and ranks #1 for coverage options. Policies include flexible liability limits, equipment breakdown protection and options for attached implements like loaders, mowers and tillers. It works well for operators with high-value tractors or specialized attachments who need tailored coverage beyond standard liability.

The Hartford ranks second for affordability at $203 monthly ($2,431 annually), just $17 more than ERGO NEXT. The small premium difference buys superior coverage options and claims handling. For operators with expensive equipment, the additional protection often justifies the cost.

The Hartford scores 4.51 for customer experience, ranking second overall. The 4.5/5 claims process rating leads all reviewed insurers, and the 4.5/5 recommendation score reflects consistent policyholder satisfaction. Traditional agent support means slower quotes but more personalized service.

The Hartford covers farm tractors nationwide with the highest coverage score (5.0) in our analysis. Standard policies include 100/300/100 liability with options to increase limits. Equipment breakdown protection, attached implement coverage and flexible deductibles let you build coverage that matches your operation's risk profile.

Best for Affordability

Average Cost

$186/monthlyOur Survey: Claims Process

3.9/5Our Survey: Likely to Recommend

4.8/5

- pros

Offers the cheapest commercial tractor insurance rates nationally

Digital platform speeds up applications and claims

No agent fees reduce overall costs

Available in 48 states with flexible coverage

consCustomer experience ranks fourth among reviewed insurers

Limited in-person support compared to traditional carriers

ERGO NEXT offers the lowest rates in the industry at $186 monthly ($2,235 annually), saving you $173 annually compared to the provider average. The digital platform cuts out traditional overhead and passes those savings straight to you. The 4.36 coverage score shows these policies handle tractor operators' needs well.

ERGO NEXT wins on affordability, making it ideal for budget-conscious tractor operators. You'll pay $186 monthly, $17 less than the $203 provider average for 100/300/100 liability coverage. Your operation gets solid financial protection without straining the budget.

ERGO NEXT scores 4.27 for customer experience, landing in fourth place. The digital-first model excels at quick quotes and policy management but offers less personal support than traditional insurers. Reviews highlight fast claims processing and transparent pricing, reflected in the 4.8/5 recommendation score.

ERGO NEXT operates in 48 states with 100/300/100 liability as the standard. You can increase limits based on your operation's needs, add physical damage coverage and get specialized endorsements for attached implements or seasonal use. The flexible structure lets you build exactly the protection you need without paying for extras you don't.

About These Reviews

Our provider evaluations are based on rate analysis, customer surveys, coverage options and financial stability. Rates shown are national averages. Contact each insurer directly for personalized quotes and to verify current coverage availability in your state.

How Much Does Commercial Tractor Insurance Cost?

Plan on budgeting $200-250/month for a standard farm tractor policy with full coverage. The $203 national average is a useful benchmark, but your actual quote could land anywhere from $131 to $322 depending on your state. If you're quoted above $250/month, that's a signal to shop more providers or ask what's driving the price up.

Average Monthly Premium | $203 |

Average Annual Premium | $2,435 |

Lowest State (Vermont) | $131/month |

Highest State (New York) | $322/month |

Monthly Range | $131 - $322 |

Data Source

Rates for 100/300/100 liability coverage with $1,000 deductibles. Averages based on five major providers. MoneyGeek analysis, November 2025.

Commercial Tractor Insurance Requirements

Your coverage requirements depend on where the tractor goes, not just what it does. A tractor that never leaves your property has no legal insurance mandate in most states, though your lender or landlord might still require it. The moment you cross onto a public road, even briefly, state liability minimums kick in. Larger tractors over 26,000 lbs add CDL requirements and higher coverage floors.

Compact Tractor (under 40 HP) | Under 10,000 lbs | State minimum if road use | No | Equipment breakdown optional |

Utility Tractor (40-100 HP) | 10,000-14,000 lbs | $300,000 if for-hire | No | Implement coverage recommended |

Agricultural Tractor (100+ HP) | 14,000-26,000 lbs | $300,000-$750,000 | No* | Crop/livestock liability |

Industrial/Commercial Tractor | 26,000+ lbs | $750,000 | Yes (Class B) | Pollution liability if hauling |

Data Source

CDL required if towing over 10,000 lbs on public roads in some states. Requirements vary by state, use type and operating authority. Tractors used exclusively on private land may be exempt from state liability minimums. Verify requirements with your state's DOT and insurance professional before operating.

Factors That Affect Commercial Tractor Insurance Costs

Some pricing factors are fixed (your state, your tractor's value), but others you can control. A clean driving record, secure storage and seasonal-only use can each cut 10-20% off your premium. Understanding what insurers weigh helps you ask the right questions and avoid overpaying for risk factors that don't apply to your operation.

Agricultural tractors, utility models, compact tractors and industrial equipment each carry different risk profiles. A $150,000 John Deere with 200 horsepower costs more to insure than a $30,000 Kubota with 50 horsepower. Insurers base comprehensive and collision coverage on replacement costs.

Farming operations qualify for agricultural-specific policies with different rate structures than tractors used for construction or landscaping. Commercial landscaping use falls under general commercial auto policies with higher pricing.

Loaders, mowers, tillers and specialized equipment add to the total insured value. Some policies require separate coverage for expensive attachments, while others include implement protection within the base policy.

Vermont operators pay $131/month while New York businesses pay $322/month for identical coverage. High-litigation states charge premium rates. Rural operations with limited road use qualify for lower rates than operators hauling between multiple job sites.

Operators running tractors only during planting and harvest seasons can qualify for seasonal coverage discounts of 10-20%. Year-round commercial use costs more due to increased exposure time.

Tractors stored in locked buildings with security systems get lower rates than equipment left in open fields. Climate-controlled storage reduces weather damage claims and earns additional discounts.

One at-fault accident raises premiums 15-30% for three to five years. Operators with clean records for 3+ years qualify for preferred rates. Adding inexperienced drivers increases rates 10-20%.

How to Get the Best Cheap Commercial Tractor Insurance

Getting the best rate takes about an hour of prep work, but it can save you $500+ per year. The key is requesting quotes with identical coverage limits so you're comparing apples to apples. Most operators skip this step and end up overpaying or underinsured.

- 1Gather Your Tractor Information

Collect your tractor's make, model, year, horsepower and market value. Document attached implements, annual usage hours, primary use classification and storage arrangements. Insurers ask for this during quoting.

- 2Request Quotes From Multiple Providers

Contact ERGO NEXT, The Hartford and Nationwide at minimum. Provide identical coverage limits (100/300/100 liability, $1,000 deductibles) to each insurer for accurate comparison. ERGO NEXT and GEICO offer online quotes. Nationwide and The Hartford require agent calls.

- 3Review Coverage Details

Confirm liability limits meet your state's requirements and your risk exposure. Check whether attached implements need scheduled additions. Verify comprehensive covers theft and weather damage. Read exclusions for road use if applicable.

- 4Provide Documentation

Submit your driver's license, tractor registration (if applicable), proof of storage location and any existing insurance declarations. Commercial operations may need business formation documents and loss history.

- 5Pay and Bind Coverage

Choose your payment schedule. Paying annually saves 5-10% versus monthly billing. Confirm your coverage start date and get your insurance certificate.

- 6Add Certificate Holders

If you lease land or have contracts requiring proof of insurance, request certificates of insurance naming those parties. Most insurers provide these within 24-48 hours at no charge.

Farm Tractor Insurance Cost: Bottom Line

ERGO NEXT offers the lowest rates at $186/month, while Nationwide costs $19 more but ranks #1 for customer experience if claims support matters to you. Start by getting quotes from ERGO NEXT, Nationwide and The Hartford using the same coverage limits, then choose based on what your operation needs most.

Tractor Insurance: FAQ

These are the questions we hear most from farm and commercial tractor operators. If you're new to tractor insurance or switching providers, start here.

How much does tractor insurance cost?

Commercial tractor insurance costs $203 monthly ($2,435 annually) on average for 100/300/100 liability with $1,000 deductibles. Rates range from $186 to $236 monthly depending on the provider. Vermont operators pay 36% below average while New York operators pay 59% above average.

Is a tractor covered under homeowners insurance?

Standard homeowners insurance doesn't cover tractors used for commercial or agricultural purposes. Some policies provide limited coverage for small lawn tractors used exclusively for residential property, but farm tractors and commercial equipment require separate policies. Contact your homeowners insurer to verify any incidental coverage.

What does tractor insurance cover?

Tractor insurance includes liability coverage for injury or property damage you cause, plus comprehensive coverage for theft, vandalism and weather damage. Collision coverage pays for accident damage to your tractor. Agricultural policies can add equipment breakdown protection and coverage for attached implements.

Do I need insurance for a farm tractor?

Insurance requirements depend on how and where you operate. Most states require liability coverage for tractors on public roads, though farm equipment can qualify for exemptions. Even for private-land-only use, insurance covers you if the tractor gets stolen or causes injury. Lenders require full coverage on financed tractors.

Can I get tractor insurance online?

ERGO NEXT and GEICO offer online quotes and purchasing for commercial tractor coverage. Nationwide and The Hartford have online quote requests but require agent follow-up for customized agricultural policies. Online shopping allows quick comparison across providers.

What's the difference between farm tractor insurance and commercial tractor insurance?

Farm tractor insurance covers equipment used for agricultural purposes like planting, harvesting and livestock operations. Commercial tractor insurance covers tractors used in non-agricultural businesses such as construction, landscaping or property maintenance. Farm policies include ag-specific features and different rate structures. Your primary use determines which policy type fits.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.