ERGO NEXT ranks best for commercial taxi insurance with a 4.62 overall score and the lowest rates at $910/month. The Hartford leads in customer experience with a 4.6 score. Nationwide offers solid bundling options at $1,011/month. Start with quotes from all three to find your best fit.

Best Cheap Commercial Taxi Insurance for Small Business

ERGO NEXT, The Hartford and Nationwide offer the best cheap commercial taxi insurance, with rates starting at $910 monthly.

Get matched to top commercial taxi insurance providers below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT ranks best overall with a 4.62 score and perfect 5/5 coverage rating due to the lowest rates combined with comprehensive for-hire livery coverage options for independent hackney operators and small medallion holders.

ERGO NEXT is also the cheapest at $882/month ($10,589 annually) for 100/300/100 liability with $1,000 deductible for comp and collision, saving $840/year versus the provider average.

Commercial taxi insurance averages $952/month ($11,424 annually), ranging from $551/month in Maine to $1,544/month in New York.

Compare quotes from at least three insurers and stack discounts (paid-in-full, multi-vehicle, bundling) to save 25% to 40% on your cab fleet.

MoneyGeek scored commercial taxi insurance providers across three weighted factors: Affordability (40%), Customer Experience (30%) and Coverage & Terms (30%). We analyzed 100/300/100 liability with $1,000 deductible for comp and collision quotes from 5 major insurers across all 50 states. Rankings updated quarterly using rate data current as of November 2025.

Best Cheap Commercial Taxi Insurance Companies

| ERGO NEXT | 4.62 | $910 | 4.27 | 4.99 |

| The Hartford | 4.56 | $983 | 4.60 | 4.96 |

| Nationwide | 4.33 | $1,011 | 4.40 | 4.38 |

| biBERK | 4.32 | $1,148 | 4.32 | 4.77 |

| GEICO | 4.14 | $1,022 | 4.06 | 4.19 |

Data Source

Rates based on 100/300/100 liability with $1,000 deductible for comp and collision. Local taxi commissions often require higher limits. Rankings reflect MoneyGeek's methodology; data current November 2025.

Get Matched With a Commercial Taxi Insurance Provider

Compare rates from top providers for your business. Enter your fleet size and location to see customized quotes in minutes.

Best Commercial Taxi Insurance By State

Maine hackney operators pay as low as $643/month while New York medallion holders pay $1,544/month for identical coverage. ERGO NEXT offers the lowest rates in 25 states, The Hartford in 15 states and Nationwide in 10 states. Check your state below to find the top-rated carrier in your market.

| Alabama | The Hartford | $820 | $9,836 |

Data Source

We rank commercial taxi insurance carriers using weighted scores: affordability (40%), customer experience (35%), and coverage options (25%). Awards like "Best for Customer Experience" go to the top scorer in that category. Our summaries explain why each carrier earned its ranking. MoneyGeek doesn't accept payment for rankings. Your results may differ based on state and fleet profile.

Best Cheap Commercial Taxi Insurance for Owner-Operators

Average Cost

$882/monthOur Survey: Claims Process

3.9/5Our Survey: Likely to Recommend to Others

4.8/5

- pros

Cheapest commercial taxi insurance rates nationally for owner-operators

Digital platform gives instant quotes and policy management

Built for independent taxi drivers and small operators

File claims online 24/7 through mobile app

consDigital-only service (no local agents)

Customer service scores lower than traditional carriers

ERGO NEXT has the lowest taxi cab insurance rates for owner-operators who handle coverage online. You'll pay $882 monthly for operations with one to three vehicles, $70 less than traditional insurers. Get instant quotes, change your policy in minutes and file claims from your phone. This setup works best for street-hail operators running metered service in cities.

ERGO NEXT has the lowest commercial taxi insurance rates for independent operators. At $882 monthly ($10,589 annually), you pay $70 less each month than the $952 industry average. You save $840 annually and still get full for-hire liability coverage.

ERGO NEXT scores 4.3 out of 5 for customer experience and ranks fourth among taxi insurance providers. Trustpilot users like the fast quotes and easy policy changes online. Some complain about slow responses to complicated claims involving passenger injuries or fare disputes.

ERGO NEXT covers taxis with 100/300/100 liability limits for owner-operators and independent hackney drivers. You can add hired and non-owned auto for temporary vehicles, passenger liability for fare-paying riders and comprehensive for theft, vandalism or weather damage.

Cheapest Commercial Taxi Insurance for Small Fleets

Average Cost

$948/monthOur Survey: Claims Process

4.5/5Our Survey: Likely to Recommend to Others

4.5/5

- pros

Lowest rates for small cab fleets (4 to 10 vehicles) nationally

Top-rated customer service and claims handling for dispatch company operators

Specialized fleet management tools and dedicated livery account support

A+ Superior AM Best financial strength rating

consHigher than single-vehicle rates (about $66/month more than independent hackney coverage)

Digital experience could improve for fleet tracking and driver roster management

The Hartford offers the cheapest taxi cab insurance for small business fleet operators backed by industry-leading customer service. At $948 monthly for 4 to 10 vehicle operations, you get affordable for-hire coverage from an A+ rated carrier with proven claims expertise handling passenger injury and collision claims. Customer service scores (4.6/5) lead the industry for dispatch company accounts.

The Hartford ranks second overall for cheap taxi insurance while offering the best fleet value for medallion holders operating multiple cabs. At $948 monthly ($11,371 annually), you save about 12% compared to state averages in high-cost markets. Florida operators save $158 monthly; California fleet owners pocket $143 each month on their metered fare vehicle coverage.

The Hartford scores 4.6/5 for customer experience, leading all taxi insurance providers in claims processing. Trustpilot business owners highlight fast claim approvals for fleet accidents involving fare-paying passengers and knowledgeable reps who understand hackney carriage operations and TLC requirements.

Small fleet taxi insurance from The Hartford covers 4 to 10 cabs under one policy with 100/300/100 liability limits. Fleet operators get access to loss control services, driver safety programs and chauffeur training resources at no extra cost. Coverage extends to street-hail, dispatch and app-based fare operations.

Best Value Taxi Insurance for Small Business Owners

Average Cost

$984/monthOur Survey: Claims Process

3.9/5Our Survey: Likely to Recommend to Others

4.3/5

- pros

Balanced pricing and coverage for small business taxi operators

Strong bundling discounts when combining with other business insurance

Nationwide agent network for local support

Solid B+ financial strength (AM Best rating)

consMid-tier pricing (not the absolute cheapest option)

Customer service scores below industry leaders

Fewer specialized taxi insurance features than competitors

Nationwide provides best-value taxi cab insurance for small business owners who prioritize bundling over lowest price. At $984 monthly, about $36 more than the cheapest option, you get reliable for-hire coverage that stays within 5% of state averages nationally. The carrier works well for operators bundling livery coverage with general liability or commercial property insurance.

Nationwide ranks third for affordable taxi insurance with commercial auto rates that hover near state averages. At $984 monthly ($11,804 annually), you get predictable pricing across most service territories. Bundling delivers the biggest savings. Combine your cab coverage with general liability or commercial property insurance to save 15% to 20% on total business insurance costs.

Nationwide scores 4.4/5 for customer experience, landing in solid mid-tier territory among taxi insurance providers. J.D. Power ratings show average satisfaction for commercial insurance claims. Trustpilot users praise responsive local agents familiar with TLC filing requirements but note occasionally slow processing for complex passenger injury claims.

Commercial auto insurance for taxis from Nationwide provides 100/300/100 liability with standard coverage for hired autos, fare-paying passenger liability and collision damage. Bundling options include general liability, workers' compensation or commercial property insurance under one streamlined account covering your entire cab operation.

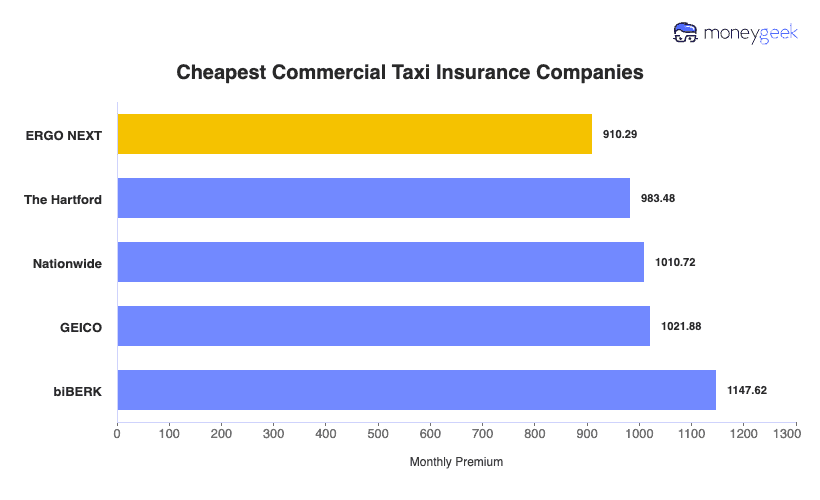

Cheapest Commercial Taxi Insurance Companies

ERGO NEXT offers the cheapest commercial taxi insurance rates at $910 monthly ($10,923 annually). Compare the cheapest options below and request quotes from the top three to maximize savings on your cab operation.

About These Reviews

Our provider evaluations are based on rate analysis, customer surveys, coverage options, and financial stability. Rates shown are national averages. Contact each insurer directly for personalized quotes and to verify current coverage availability in your state.

| ERGO NEXT | 910 | 10923 |

| The Hartford | 983 | 11802 |

| Nationwide | 1011 | 12129 |

| GEICO | 1022 | 12263 |

| biBERK | 1148 | 13771 |

Note

Average commercial taxi insurance costs $1,015/month. Savings calculated against this average. Rates based on 100/300/100 liability with $1,000 deductible for comp and collision.

Cheapest Commercial Taxi Insurance By State

ERGO NEXT offers the cheapest commercial taxi insurance in 35 states, with rates as low as $563/month in Maine. The Hartford leads in 11 states and Nationwide in 4 states. Find your state below and start with a quote from the cheapest carrier.

| Alabama | The Hartford | $707 |

| Alaska | ERGO NEXT | $846 |

| Arizona | ERGO NEXT | $890 |

| Arkansas | The Hartford | $765 |

| California | ERGO NEXT | $1,019 |

| Colorado | ERGO NEXT | $977 |

| Connecticut | ERGO NEXT | $1,011 |

| Delaware | The Hartford | $860 |

| Florida | ERGO NEXT | $1,127 |

| Georgia | ERGO NEXT | $789 |

| Hawaii | ERGO NEXT | $668 |

| Idaho | ERGO NEXT | $627 |

| Illinois | ERGO NEXT | $974 |

| Indiana | ERGO NEXT | $776 |

| Iowa | Nationwide | $665 |

| Kentucky | The Hartford | $817 |

| Louisiana | The Hartford | $1,242 |

| Maine | ERGO NEXT | $563 |

| Maryland | GEICO | $1,020 |

| Massachusetts | ERGO NEXT | $1,018 |

| Michigan | ERGO NEXT | $1,048 |

| Minnesota | ERGO NEXT | $889 |

| Mississippi | ERGO NEXT | $765 |

| Missouri | ERGO NEXT | $948 |

| Montana | The Hartford | $711 |

| Nebraska | Nationwide | $707 |

| Nevada | ERGO NEXT | $907 |

| New Hampshire | ERGO NEXT | $613 |

| New Jersey | GEICO | $1,005 |

| New Mexico | ERGO NEXT | $806 |

| New York | ERGO NEXT | $1,292 |

| North Carolina | ERGO NEXT | $737 |

| North Dakota | The Hartford | $639 |

| Ohio | ERGO NEXT | $775 |

| Oklahoma | The Hartford | $749 |

| Oregon | ERGO NEXT | $848 |

| Pennsylvania | ERGO NEXT | $899 |

| Rhode Island | ERGO NEXT | $1,044 |

| South Carolina | ERGO NEXT | $794 |

| South Dakota | Nationwide | $902 |

| Tennessee | The Hartford | $854 |

| Texas | ERGO NEXT | $973 |

| Utah | ERGO NEXT | $695 |

| Vermont | Nationwide | $589 |

| Virginia | ERGO NEXT | $849 |

| Washington | ERGO NEXT | $1,000 |

| West Virginia | The Hartford | $786 |

| Wisconsin | Nationwide | $730 |

| Wyoming | The Hartford | $721 |

Data Source

Rates based on 100/300/100 liability with $1,000 deductible for comp and collision. Data current November 2025.

How Much Does Commercial Taxi Insurance Cost on Average?

Commercial taxi insurance costs $983 monthly ($11,794 annually) on average for 100/300/100 liability with $1,000 deductible for comp and collision. Your state drives the biggest price gap: Maine operators pay $651/month while New York businesses pay $1,549/month.

Average Monthly Premium | $983 |

Average Annual Premium | $11,794 |

Lowest State (Maine) | $651/month |

Highest State (New York) | $1,549/month |

Monthly Range | $651 - $1,549 |

Data Source

Rates shown are state averages across all providers. Average % Savings compares your state to the $988/month national average. Rates based on 100/300/100 liability with $1,000 deductible for comp and collision. Data current November 2025.

Factors That Affect Commercial Taxi Insurance Costs

Eight factors determine your commercial taxi insurance premium. Review each factor below to identify where you can lower your rate.

Standard 4-passenger sedans cost less to insure than 6-passenger minivans or wheelchair-accessible paratransit vehicles. Minivans and SUVs used as hackney carriages pay 15% to 25% more due to higher passenger counts. ADA-compliant vehicles may qualify for accessibility discounts of 5% to 10%.

Airport ground transportation and highway driving increase accident exposure compared to hotel shuttle or corporate account routes. Urban hackney operators in New York, Chicago or Los Angeles pay 40% to 60% more than suburban or rural cab services. App-based dispatch services face variable conditions across shifting territories.

Chauffeurs with 5+ years of for-hire experience earn 10% to 20% lower premiums than new hackney operators. Clean MVR records (no accidents or violations in 3 years) qualify for preferred rates. Each at-fault accident adds 20% to 40% to your premium for 3 to 5 years.

Late-night and overnight metered fare operations (10 PM to 6 AM) pay 20% to 35% higher premiums than daytime-only services. Weekend bar-close shifts add 10% to 15% due to increased impaired driver exposure. 24/7 hackney services pay the highest rates but can negotiate volume discounts with 5+ cabs.

Single-vehicle independent operators pay the highest per-unit rates. Fleets of 2 to 4 medallions save 5% to 10% through multi-vehicle discounts. Dispatch companies with 5 to 10 cabs qualify for fleet pricing with 15% to 25% savings.

Full-time hackney operators driving 50,000+ miles annually pay 25% to 40% more than part-time drivers logging 20,000 miles. Carriers may request odometer readings or telematics data to verify mileage. High fare volume with frequent passenger pickups increases risk in congested urban zones.

Zero claims earns 10% to 15% claims-free discounts. One at-fault passenger injury claim adds 15% to 25% to premiums. Two or more claims in 3 years can increase rates 30% to 50% or trigger non-renewal.

Newer cabs cost more to insure due to higher replacement values but may qualify for safety discounts. Vehicles over 10 years old have lower physical damage premiums but may exceed TLC age limits. Dashcams reduce premiums 5% to 15%; GPS tracking and telematics earn 10% to 20% discounts.

Commercial Taxi Insurance Requirements

Commercial taxi insurance requirements fall under state and local regulation, not federal FMCSA jurisdiction. Hackney carriages transporting fare-paying passengers operate under city and state taxi and limousine commission (TLC) rules. Check the tables below for your state's minimums before purchasing coverage.

Coverage Types Required for For-Hire Taxi Operations

Commercial Auto Liability | Bodily injury and property damage to third parties including fare-paying passengers | $100,000 to $500,000 CSL or 100/300/100 split | All states, TLC commissions |

Hired and Non-Owned Auto | Liability for rented or borrowed cabs used in metered fare operations | Match primary limits | Many taxi commissions |

Physical Damage (Collision) | Damage to your cab from accidents | Actual cash value | Lenders if financed |

Physical Damage (Comprehensive) | Theft, fire, vandalism, weather damage to your hackney vehicle | Actual cash value | Lenders if financed |

Uninsured/Underinsured Motorist | Protection when at-fault driver lacks coverage for passenger injuries | $25,000 to $100,000 | 22 states require UM/UIM |

Personal Injury Protection (PIP) | Medical expenses, lost wages regardless of fault for chauffeur and riders | $10,000 to $50,000 | 12 no-fault states |

Medical Payments (MedPay) | Medical expenses for chauffeur and fare-paying passengers | $1,000 to $10,000 | Some states, recommended |

Hackney Carriage Licensing and Insurance Requirements

Requirement | Details |

|---|---|

State Liability Minimums | California: City-regulated, typically $750,000 CSL for livery vehicles. New York: $100,000+ per person (NYC TLC requires higher for medallion cabs). Florida: County varies, typically 100/300/50 to $300,000 CSL. Texas: City varies, $500,000 common for metered fare operations. Illinois: $350,000+ (Chicago specific rules for hackney permits). Arizona: $250,000 with UM required. Nevada: 250/500/50 (gaming commission regulated for casino ground transportation). |

Taxi Medallion or Hackney Permit | Most cities require a taxi medallion, hackney badge or livery permit to operate legally. NYC medallions historically cost $1 million+ (now $80,000 to $200,000 post-TNC disruption). Other cities charge $500 to $5,000 for permits. Proof of for-hire insurance required before permit issuance. |

Taximeter Certification | Taximeters must be inspected and sealed by city weights and measures departments. Annual or biannual certification required. Metered fare rates set by local taxi and limousine commission. Tampering results in permit revocation. |

Vehicle Inspection | Annual or semi-annual safety inspections required for hackney carriages. Some cities mandate specific vehicle age limits (5 to 10 years maximum). Wheelchair accessibility and paratransit requirements in some jurisdictions. Roof light and livery markings inspected. |

Chauffeur Licensing | Standard driver's license (no CDL required for vehicles under 26,001 lbs with 1 to 7 passengers). Chauffeur's license, hackney badge or TLC driver permit required in most cities. Background check and fingerprinting mandatory. Drug testing in many jurisdictions. English proficiency and geographic knowledge tests in some markets. |

Insurance Filing Requirements | Certificate of Insurance (COI) filed with taxi and limousine commission. 30-day cancellation notice to TLC required. Some cities require specific endorsements naming the city as certificate holder. Policy must remain active for medallion or hackney permit validity. |

UM/UIM Requirements by State | Required in 22 states: Arizona, California, Connecticut, Illinois, Kansas, Maine, Maryland, Massachusetts, Minnesota, Missouri, Nebraska, New Jersey, New York, North Dakota, Oregon, Rhode Island, South Carolina, South Dakota, Vermont, Virginia, West Virginia, Wisconsin. Limits vary from $25,000 to matching liability limits. |

PIP/No-Fault Requirements | Required in 12 states: Delaware, Florida, Hawaii, Kansas, Kentucky, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, Utah. Coverage ranges $10,000 to $50,000. Pays medical expenses regardless of fault for chauffeur and passengers. |

Airport Ground Transportation Authority | Separate permits required for airport curbside pickups in most cities. Additional insurance requirements common (often $1 million+ CSL for airport livery). Background checks and vehicle inspections specific to airport operations. Annual ground transportation fees range $500 to $2,000. Queue permits and staging area access fees apply. |

Disclaimer

Taxi insurance requirements are regulated at the state and local level. Verify current requirements with your city's taxi and limousine commission (TLC), state insurance department and local business licensing office.

How To Get The Best Cheap Commercial Taxi Insurance

Follow these five steps to cut taxi cab insurance costs 25% to 40% while maintaining proper for-hire coverage.

- 1Compare Quotes From Multiple Insurers

Contact ERGO NEXT, The Hartford and Nationwide, plus one specialty for-hire livery insurer. Request quotes 30 to 45 days before your medallion renewal for better rates. Use identical coverage limits (100/300/100 liability with $1,000 deductible) across all quotes to compare accurately.

- 2Verify Coverage Meets TLC Requirements

Call your city's TLC to confirm current liability minimums, usually $100,000 to $500,000 CSL for hackney carriages. Check whether your state requires UM/UIM and PIP coverage. Get a Certificate of Insurance (COI) to file with your taxi commission before renewing your medallion.

- 3Lower Your Insurance Risk

Put dashcams in all cabs to cut premiums 5% to 15%. Add GPS tracking for 10% to 20% off. Make all chauffeurs take defensive driving courses. Hire only operators with clean MVR records. Keep detailed vehicle maintenance records for underwriting reviews.

- 4Stack Available Discounts

Bundle commercial taxi insurance with general liability to save 15% to 20%. Pay annually to avoid monthly installment fees. You get multi-vehicle discounts with two or more medallions. Keep a clean claims record for better rates.

- 5Review Your Policy Every Year

Get new quotes 30 to 45 days before your medallion renews and compare them to your current rate. Update your policy when you add or remove cabs. Ask about new discounts like telematics or hackney industry associations at each renewal.

Commercial Taxi Insurance for Small Business: Bottom Line

ERGO NEXT offers the cheapest commercial taxi insurance at $882 monthly, saving $70 versus the $952 industry average. Your state determines the biggest price difference: Maine hackney operators pay $643 monthly while New York medallion holders pay $1,544. Compare quotes from ERGO NEXT, The Hartford and one additional carrier to find your lowest rate.

Commercial Taxi Insurance for Small Businesses: FAQ

Here are answers to the most common questions taxi operators ask about coverage and costs:

How much does commercial taxi insurance cost?

Commercial taxi insurance averages $952 monthly ($11,424 annually) for 100/300/100 liability with $1,000 deductible. Costs range from $643 monthly in Maine to $1,544 in New York. ERGO NEXT offers the lowest rates at $882 monthly. Your premium depends on service territory, chauffeur records and claims history.

What does taxi insurance cover?

Taxi cab insurance covers bodily injury and property damage liability when your chauffeur causes an accident involving fare-paying passengers. Standard policies include collision coverage, comprehensive coverage for theft and hired/non-owned auto for temporary vehicles. Optional add-ons include uninsured motorist protection and medical payments.

Is taxi insurance more expensive than regular car insurance?

Yes. Taxi cab insurance costs $531 monthly more than personal auto coverage on average. Hackney carriages drive 50,000+ miles annually versus 12,000 to 15,000 personal miles and operate in congested urban areas. For-hire passenger transport creates injury liability that personal policies exclude.

Do I need commercial insurance to drive a taxi?

Yes. Every state requires commercial auto insurance for for-hire livery vehicles. Personal auto policies exclude business use and deny claims if you transport fare-paying passengers. Operating a cab without commercial coverage results in fines up to $10,000, medallion revocation and personal liability. Most TLCs require proof of hackney insurance before issuing your permit.

How can I get cheap taxi insurance?

Compare quotes from at least three carriers to find rates $70 to $223 below average. ERGO NEXT, The Hartford and Nationwide offer the lowest taxi premiums nationally. Raise your collision deductible to $1,000 to save $100 to $150 monthly. Bundle with general liability for 15% to 20% discounts.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.