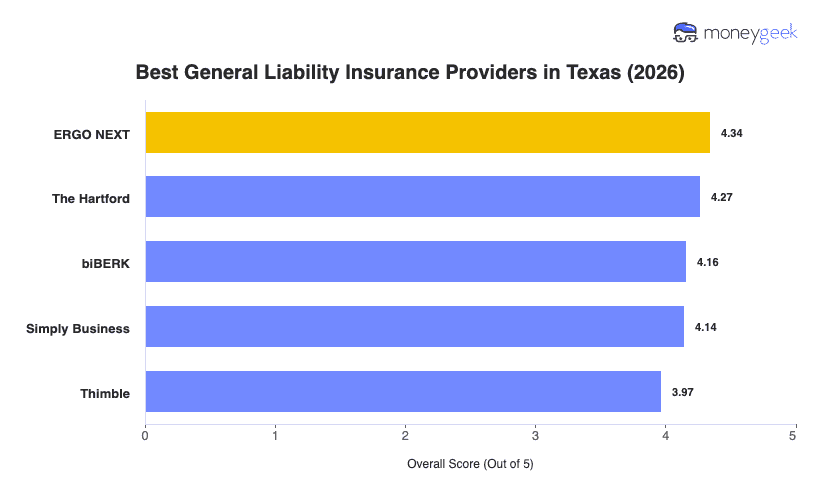

No single general liability insurer fits every Texas business, but these five companies rank highest for balancing competitive pricing, reliable claims handling and coverage breadth. The best general liability insurance companies on this list earned their spots through performance across Houston's humid construction sites, Dallas retail corridors and Austin's growing tech startups.

- ERGO NEXT: Best Overall, Best for Hands-On Industries

- The Hartford: Best Cheap General Liability Insurance

- biBERK: Best for Soloprenuers and Service Businesses

- Simply Business: Best for Simultaneously Carrier Comparison

- Thimble: Best for Flexible Short-Term Coverage

These insurers deliver strong value on cost, customer service and policy flexibility for small businesses operating in Texas. The profiles below show where each provider excels and they stack up for businesses navigating the state's diverse markets.