Auto-Owners is the cheapest for full coverage at $68 monthly ($811 annually), saving you 26% or $285 per year compared to the state average. GEICO comes in second at $70 monthly ($846 annually), saving you 23% or $249 per year. Switching to Auto-Owners saves you $35 yearly compared to GEICO.

Cheapest Car Insurance in Ohio

Auto-Owners has the cheapest car insurance in Ohio with full coverage rates at $68 monthly ($811 annually) and state minimum liability-only coverage at $27 monthly ($318 annually). GEICO and Cincinnati Insurance are cheapest in Ohio for certain driver profiles.

Get the lowest cost Ohio car insurance for you below.

Updated: February 3, 2026

Advertising & Editorial Disclosure

Full coverage: Auto-Owners, $68

Liability only: Auto-Owners, $27

Teens: GEICO, $112

Young adults: Auto-Owners, $51

Seniors: Auto-Owners, $43

DUI: GEICO, $54

SR-22: Auto-Owners, $49

Non-owner: Auto-Owners, $56

Bad credit: Cincinnati Insurance, $46

Ohio's cheapest car insurance rate analysis updated Nov 17th, 2025

Cheapest Full Coverage Car Insurance in Ohio

| Auto Owners | $68 | $811 | 26% |

| Geico | $70 | $846 | 23% |

| Grange Insurance | $77 | $929 | 15% |

| Erie Insurance | $85 | $1,018 | 7% |

| Ohio Mutual Insurance | $86 | $1,038 | 5% |

Cheapest Minimum Coverage Car Insurance in Ohio

Auto-Owners is the cheapest for minimum coverage at $27 monthly ($318 annually), saving you 40% or $212 per year compared to the state average. Erie comes in second cheapest at $30 monthly ($355 annually), saving you 33% or $175 per year.

Choosing Auto-Owners saves you $37 yearly compared to Erie. Auto-Owners' pricing advantage makes it the obvious starting point for Ohio drivers shopping for cheapest liability-only car insurance.

For lower-income households, pairing minimum coverage rates with affordable car insurance for drivers with low income in Ohio can provide clearer cost comparisons.

| Auto Owners | $27 | $318 | 40% |

| Erie Insurance | $30 | $355 | 33% |

| Ohio Mutual Insurance | $33 | $401 | 25% |

| Geico | $38 | $453 | 15% |

| Cincinnati Insurance | $42 | $501 | 6% |

Should I buy cheaper minimum coverage or full coverage in Ohio? Ohio requires 25/50/25 coverage, which means $25,000 for bodily injury per person, $50,000 total for all injuries per accident, and $25,000 for property damage. This is the cheapest coverage you can buy and drive legally.

Though full coverage is more expensive than cheaper minimum coverage, most Ohio drivers want to protect their car from an at-fault accident and weather damage and theft. Lenders also requires collision and comprehensive coverage for financed and leased cars.

Cheapest Car Insurance in Ohio by City

Car insurance rates in Ohio vary by city location due to traffic, weather, and crime rates. Auto-Owners is the cheapest carrier in all 20 major Ohio cities, saving you up to 32% or $164 annually versus city averages. The lowest rates by city range from $24 monthly in Elyria to $34 monthly in Cleveland, a $120 yearly gap for minimum coverage. For full coverage, Auto-Owners ranges from $68 monthly in Canton to $85 monthly in Cleveland where rates are higher due to increases in claims and theft.

| Akron | Auto Owners | $29 | $72 | 32% |

| Canton | Auto Owners | $26 | $68 | 30% |

| Cincinnati | Auto Owners | $33 | $82 | 28% |

| Cleveland | Auto Owners | $34 | $85 | 27% |

| Columbus | Auto Owners | $32 | $80 | 30% |

| Dayton | Auto Owners | $29 | $72 | 31% |

| Dublin | Auto Owners | $27 | $70 | 30% |

| Elyria | Auto Owners | $24 | $61 | 34% |

| Euclid | Auto Owners | $29 | $74 | 30% |

| Hamilton | Auto Owners | $29 | $73 | 31% |

| Kettering | Auto Owners | $25 | $64 | 32% |

| Lakewood | Auto Owners | $29 | $75 | 27% |

| Lorain | Auto Owners | $25 | $65 | 31% |

| Middletown | Auto Owners | $26 | $66 | 33% |

| Newark | Auto Owners | $27 | $68 | 27% |

| Parma | Auto Owners | $27 | $68 | 29% |

| Springfield | Auto Owners | $26 | $65 | 29% |

| Toledo | Auto Owners | $30 | $76 | 33% |

| Warren | Auto Owners | $27 | $68 | 31% |

| Youngstown | Auto Owners | $32 | $81 | 27% |

Cheapest Car Insurance in Ohio for Teens and Young Adults

Erie is the cheapest for 16-year-olds at $108 monthly, saving you 57% or $1,718 annually compared to the state average. GEICO comes in second at $112 monthly for 18-year-olds, saving you 46% or $803 annually. By age 25, Auto-Owners is cheapest with rates dropping to $51 monthly, a $57 monthly decrease, over over $600 in savings annually.

Teens under 18 cannot legally purchase auto insurance in Ohio without parental or guardian involvement, requiring an adult to cosign any policy. Teens should remain on a family policy to lower rates.

Cheapest Car Insurance for Seniors in Ohio

Erie has the cheapest car insurance for seniors at age 65 at $52 monthly for minimum coverage, saving you 40% or $416 annually compared to the state average. At age 70, Auto-Owners is the lowest cost option at $43 monthly for minimum coverage, saving you 28% or $201 annually. Most seniors qualify for additional discounts and will reduce rates by lowering mileage estimates, making these rates even better deals.

Ohio seniors see rates ranging 28% to 40% below state averages. Learn more about cheapest car insurance for seniors across carriers.

| 65 | Erie | $52 | $49 | 40% |

| 70 | Auto-Owners Insurance Co | $43 | $89 | 28% |

| 80 | Auto-Owners Insurance Co | $64 | $124 | 28% |

Cheapest DUI Insurance in Ohio

Though drivers with DUI's in Ohio pay more for car insurance, you can still get low rates by comparison shopping and finding the insurer that has the lowest penalty for this violation**. GEICO** is the cheapest for DUI minimum coverage at $54 monthly, saving you 33% or $319 annually compared to the state average. Progressive is the second lowest priced at $64 monthly, saving you 28% or $272 annually. For full coverage after a DUI, GEICO remains cheapest at $104 monthly, saving you 33% or $618 annually.

| Geico | $54 | $104 | 33% |

| Progressive | $64 | $108 | 28% |

| Auto Owners | $57 | $127 | 23% |

| Grange Insurance | $66 | $123 | 20% |

| Allstate | $70 | $130 | 16% |

Cheapest SR-22 Insurance in Ohio

Auto-Owners provides the cheapest SR-22 insurance in Ohio at $49 monthly for minimum limits. Erie comes in as the second least expensive at $55 monthly, saving you 15% or $150 annually. You'll save $72 yearly by choosing Auto-Owners over Erie for minimum coverage. For SR-22 full coverage, Auto-Owners stays cheapest at $113 monthly, saving you 27% or $500 annually.

Cheapest Non-Owner Car Insurance in Ohio

Auto-Owners and Nationwide are the cheapest non-owner car insurance in Ohio at $56 to $57 monthly. GEICO charges $59 monthly, while Progressive is still affordable at $67. These policies cost less than standard auto insurance because they provide only liability protection, covering damage you cause to others without protecting any specific vehicle you drive.

| Nationwide | $57 | 44% |

| Auto-Owners Insurance Co | $56 | 44% |

| GEICO | $59 | 38% |

| Progressive | $67 | 33% |

| Travelers | $68 | 29% |

Cheapest Car Insurance After an Accident in Ohio

Auto-Owners is the cheapest for minimum coverage after an accident at $40 monthly, saving you 31% or $216 annually compared to the state average. GEICO comes in second cheapest at $45 monthly, saving you 32% or $215 annually for full coverage. You'll save $60 yearly by choosing Auto-Owners for minimum coverage. For full coverage, GEICO is the lowest cost at $88 monthly, saving you 32% or $497 annually compared to average rates in the state.

| Geico | $45 | $88 | 32% |

| Auto Owners | $40 | $94 | 31% |

| Grange Insurance | $57 | $101 | 20% |

| Erie Insurance | $46 | $122 | 14% |

| Ohio Mutual Insurance | $47 | $121 | 14% |

Cheapest Car Insurance With a Speeding Ticket

Auto-Owners is the cheapest for speeding tickets at $27 monthly for minimum coverage, saving you 42% or $235 annually compared to the state average. Auto-Owners doesn't appear to surcharge for a single violation and is your best choice for low rates after a ticket.

Erie comes in second cheapest at $32 monthly, saving you 25% or $179 annually. You'll save $60 yearly by choosing Auto-Owners over Erie for minimum coverage. For full coverage, Auto-Owners remains cheapest at $68 monthly, saving you 42% or $591 annually.

| Auto Owners | $27 | $68 | 42% |

| Erie Insurance | $32 | $89 | 25% |

| Ohio Mutual Insurance | $37 | $95 | 18% |

| Geico | $43 | $85 | 21% |

| Cincinnati Insurance | $50 | $107 | 4% |

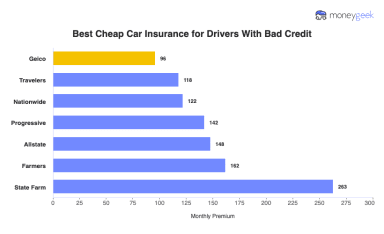

Cheapest Bad Credit Car Insurance in Ohio

Cincinnati Insurance is the cheapest for bad credit at $46 monthly for minimum coverage, saving you 46% or $470 annually compared to the state average. Ohio Mutual comes in second at $50 monthly, saving you 37% or $335 annually. You'll save $48 yearly by choosing Cincinnati Insurance over Ohio Mutual for minimum coverage.

For full coverage, Grange leads at $99 monthly, saving you 46% or $1,012 annually. Ohio allows credit-based pricing, so improving your credit score will lower premiums. See our guide to car insurance for drivers with bad credit.

| Cincinnati Insurance | $46 | $111 | 46% |

| Ohio Mutual Insurance | $50 | $132 | 37% |

| Grange Insurance | $59 | $99 | 46% |

| Geico | $66 | $152 | 24% |

| Erie Insurance | $75 | $186 | 10% |

How to Get the Cheapest Car Insurance in Ohio

If you haven't switched auto insurance carriers in Ohio in the last several years, you are probably paying too much. Here are strategies that actually work to reduce your car insurance rates in Ohio:

- 1Get Quotes From Ohio's Regional Carriers

Auto-Owners, Erie, and Grange consistently beat national brand rates in Ohio. Regional carriers will save you $200 to $300 annually compared to GEICO or Progressive. Get at least three quotes from regional and national quotes to find your best deal.

- 2Shop Often and After Life Changes

Your current insurer rarely rewards loyalty. They often charge existing customers more than new shoppers pay. Shop every 6 to 12 months even if you're happy with your coverage. Major life changes like marriage, adding a vehicle, or moving cities trigger rate adjustments and new discounts. A move from Cleveland to Columbus, a new job, or a teen driver getting licensed are all reasons to get comparision quotes.

- 3Maximize Available Discounts & Bundles

You can bundle home and auto policies in Ohio for 5% to 25% savings, use multi-car discounts for 10% to 25% off, enroll in defensive driver programs (a strong option for seniors), claim good student discounts for 10% to 15% off and qualify for low-mileage discounts of 15% to 30%.

- 4Adjust Deductible and Coverage Based on Your Car's Age

Raising your deductible from $500 to $1,000 saves 10-14% on a full coverage policy in Ohio. For older vehicles worth under $5,000, consider dropping comprehensive and collision entirely and keep only liability. For newer cars financed or leased, keep full coverage since your lender requires it.

- 5Improve your Credit Score

Ohio insurers have a high penalty for lower credit credit scores. Though improving your credit score can take time, Ohio drivers will see a 35-60% reduction in car insurance rates by improving from “poor credit" to "good credit".

Cheap Car Insurance in Ohio: FAQ

These are some of the most common questions Ohio drivers have about affordable car insurance, along with clear answers from our team.

How much does car insurance cost in Ohio?

Ohio car insurance costs depend on your location, driving record and the coverage level you choose. Minimum coverage in Ohio ranges from $24 monthly (Elyria) to $75 monthly (bad credit drivers). Full coverage ranges from $49 monthly (seniors at age 65) to $262 monthly (teens at age 16).

Should you buy the cheapest car insurance in Ohio?

The cheapest car insurance might not cover major expenses when you need it most. Make sure the policy you choose provides enough financial protection for larger losses.

Does Ohio allow gender-based insurance pricing?

Yes, Ohio allows insurers to consider gender when setting car insurance rates. Male drivers, especially younger ones, often pay higher premiums than female drivers with similar profiles. Still, some Ohio insurers choose not to use gender as a rating factor.

Can I get insured if I'm a high-risk driver in Ohio?

Yes. Ohio's AIPSO program (Automobile Insurance Plan Service Office) provides last-resort coverage for drivers unable to secure standard policies. Rates run higher than normal market pricing, but it's a guaranteed getting coverage as you clean up your driving record.

Most Affordable Car Insurance in Ohio: Related Articles

How We Analyzed the Most Affordable Car Insurance Rates in Ohio

We analyzed quotes from 10 major insurers across Ohio's residential ZIP codes, comparing over 150 million rates. Our baseline uses a 40-year-old driver with a clean record. Since Ohio allows credit score and gender-based pricing, your driving history, location, age, and credit profile are your biggest rate factors.

We compared two coverage levels: minimum coverage (25/50/25 liability) and full coverage ($100,000/$300,000/$100,000 liability plus comprehensive and collision with a $1,000 deductible) for each specified driving profile in Ohio.

See our detailed methodology here for more information.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 7, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 7, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 7, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 7, 2026.