Oregon homeowners pay rates well below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Oregon.

Best Homeowners Insurance Companies in Oregon

American Family ranks No. 1 in our review of the best home insurance in Oregon, followed by USAA and State Farm.

See if you're overpaying for home insurance below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

American Family is the best home insurance provider in Oregon, earning a 4.4 out of 5 rating from our review team.

USAA, State Farm, Capital Insurance Group and Farmers rank high for homeowners insurance in Oregon based on reliable coverage, customer service and affordable rates.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Oregon?

American Family ranks first for Oregon homeowners, excelling in affordability and coverage. USAA, State Farm, Capital Insurance Group and Farmers complete the top five, excelling in areas like military-focused service, premium coverage quality and local agent networks.

American Family | 4.4 | $1,092 | Most Oregon homeowners |

USAA | 5.0 | $882 | Military families |

State Farm | 4.2 | $1,202 | Coverage quality |

Capital Insurance Group | 4.1 | $833 | Local agent network |

Farmers | 4.1 | $1,131 | Specialized coverage |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

**Although USAA earned the highest score, we didn't rank it No. 1 due to its eligibility requirements.

J.D. Power Customer Satisfaction Score

643/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,092Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Local agent network delivers personalized service and support

High industry ratings reflect strong financial stability

Customizable coverage options

consPremiums run higher than some competitors

Coverage unavailable in certain Oregon areas

Fewer specialty add-ons than other major insurers

At $1,092 annually, American Family provides Oregon homeowners with competitive rates and valuable coverage features. The company's personal property replacement cost coverage pays full value for damaged or stolen items without depreciation deductions. When wildfires, winter storms or other natural disasters force you out of your home, American Family's additional living expenses coverage handles temporary housing costs during repairs.

American Family's $1,092 annual rate sits 3% below Oregon's $1,124 state average and substantially undercuts the $3,467 national average by 68%. The company rewards policy bundling and home security system installations with additional discounts.

Older Homes $97 $1,166 Newer Homes $71 $847 Young Homeowners $92 $1,106 Senior Homeowners $90 $1,077 High-Risk Fire Homes $102 $1,223 Smaller Homes $86 $1,030 Larger Homes $93 $1,120 American Family balances traditional service with digital convenience for Oregon homeowners. The insurer earned 643 out of 1,000 J.D. Power points, slightly above the industry's 642 average, while operating through local independent agents who offer personalized support. An online management platform handles routine policy tasks for those who prefer self-service options.

American Family provides standard homeowners coverage with optional add-ons:

- Equipment breakdown: Covers appliances, home systems and smart home devices damaged by mechanical or electrical breakdown

- Flash flood: Inland flood coverage pays for water damage from flash floods

- Hidden water damage: Covers leaks within walls, floors, ceilings and cabinets

- Home renovation: Covers foundation collapse and theft or damage to construction materials during renovations

- Matching undamaged siding: Reimburses costs to replace remaining siding so everything matches

- Roof damage: Bridges the gap between your current roof's depreciated value and replacement cost

- Service line: Pays to repair or replace damaged underground piping or wiring

- Sewer backup, septic backup and sump overflow: Covers repair costs from water backing up through drains or overflowing sumps

- Scheduled personal property: Increases coverage for jewelry, gemstones, watches and furs

J.D. Power Customer Satisfaction Score

737/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$882Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Coverage built around the needs of military households

Lowest average home insurance rates in Oregon

Wide selection of optional coverage add-ons

consClaim timelines can stretch during high-volume periods

Smaller local agent footprint than legacy insurers

Eligibility limits availability in some regions

USAA leads Oregon with the lowest home insurance rates at $882 per year for military families and eligible members. The company pays full repair or replacement costs through its replacement cost coverage. You won't see deductions for depreciation. USAA also protects your belongings while they're in transit, which works well for Oregon's active outdoor culture and military families who move often.

In Oregon, USAA averages $882 per year for home insurance, 22% less than the $1,124 state average and 75% below the national average of $3,467. Policyholders can reduce costs further by bundling policies or adding approved home security systems.

Older Homes $76 $912 Newer Homes $55 $660 Young Homeowners $78 $933 Senior Homeowners $72 $860 High-Risk Fire Homes $82 $989 Smaller Homes $71 $847 Larger Homes $77 $923 USAA earned 737 out of 1,000 points in J.D. Power customer satisfaction surveys, beating the industry average of 642. The company runs a digital-first service model with direct access and few independent agents. USAA provides coverage options built for Oregon homeowners' needs. You can manage your policy online, though the mobile app has fewer features than some tech-focused competitors.

USAA includes standard homeowners coverage with several practical add-on options:

- Replacement cost coverage: Pays to repair or rebuild without depreciation

- Personal property in transit: Covers belongings during moves or travel

- Dwelling protection: Protects the home’s structure

- Personal property coverage: Covers belongings inside the home

- Liability protection: Helps with legal costs if someone is injured on your property

- Additional living expenses: Pays for temporary housing during covered repairs

- Medical payments: Covers minor guest injuries regardless of fault

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,202Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Coverage options that allow homeowners to tailor policies

J.D. Power score that exceeds the industry average

Long-standing financial strength and stability

consCoverage not offered in every Oregon location

Direct purchase option offers limited personal guidance

Regional availability restricts access for some homeowners

State Farm costs Oregon homeowners $1,202 per year. When you lose personal belongings, the replacement cost coverage pays what it costs to buy new items, not what your old stuff was worth. If wildfires or storms force you out, the additional living expenses coverage handles your hotel and meal costs while you're displaced.

Oregon homeowners insured through State Farm pay about $1,202 per year on average, placing rates above the state benchmark but well under the $3,467 national average. Bundling coverage and installing approved security features can reduce costs.

Older Homes $102 $1,219 Newer Homes $75 $901 Young Homeowners $100 $1,198 Senior Homeowners $99 $1,182 High-Risk Fire Homes $112 $1,346 Smaller Homes $94 $1,125 Larger Homes $107 $1,283 State Farm scored 657 out of 1,000 points in the J.D. Power study, beating the industry average of 642. The company works through local independent agents and direct sales, giving you personalized service and local expertise. You can manage your policy and file claims through its digital platform.

State Farm includes standard homeowners coverage with several add-on options:

- Replacement cost personal property: Reimburses the full value of belongings after a covered loss, without depreciation

- Additional living expenses: Pays for temporary housing when covered events force you to leave your home

- Dwelling protection: Protects the home itself along with attached structures

- Personal liability: Helps cover legal costs if you cause injury or property damage to others

- Medical payments: Pays medical bills for guests injured on your property, regardless of fault

- Personal property protection: Covers belongings damaged by covered events

J.D. Power Customer Satisfaction Score

N/AFrom the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$833Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Policy terms that allow added coverage options

Simple digital tools for basic policy management

Consistent financial strength ratings

consCoverage not offered in all Oregon locations

Limited ease of use for direct online purchases

Smaller agent presence in some regions

At $833 per year, Capital Insurance Group offers the lowest average home insurance pricing in Oregon. Rather than relying on broad national templates, its policies reflect local conditions, with coverage that addresses water damage tied to heavy coastal and mountain rainfall along with wildfire exposure in higher-risk regions.

Oregon homeowners pay an average of $1,124 per year for home insurance, while Capital Insurance Group charges about $833 annually, a 26% difference. This pricing also sits 76% below the national average of $3,467. Additional savings apply through policy bundling and qualifying home security system installations.

Older Homes $77 $922 Newer Homes $43 $516 Young Homeowners $70 $846 Senior Homeowners $67 $800 High-Risk Fire Homes $78 $933 Smaller Homes $66 $788 Larger Homes $79 $943 Local independent agents manage customer service for Capital Insurance Group across Oregon, providing direct support throughout the policy lifecycle. This agent-led structure emphasizes personal guidance rather than self-service digital tools. Homeowners should expect strong in-person assistance with fewer options for online policy management.

Capital Insurance Group includes standard homeowners coverage with add-ons tailored to Oregon conditions:

- Water damage protection: Covers damage tied to heavy rainfall and moisture exposure

- Wildfire coverage: Addresses fire risks in higher-risk Oregon regions

- Standard dwelling coverage: Protects the home’s structure and attached features

- Personal property protection: Covers belongings damaged by covered events

- Liability coverage: Helps cover legal costs tied to injuries on your property

- Additional living expenses: Pays for temporary housing during covered repairs

J.D. Power Customer Satisfaction Score

631/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,131Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Policy options that allow added coverage flexibility

Consistently solid financial strength ratings

Places near the top among Oregon home insurance providers

consCustomer satisfaction score falls below the industry average

Some claims take longer to resolve than expected

Fewer digital tools than insurers with tech-first platforms

Farmers charges Oregon homeowners about $1,131 per year for home insurance. The company offers flexible coverage options that let homeowners tailor policies to their specific needs. Equipment breakdown coverage adds protection for appliances and home systems that many standard policies leave out. This coverage appeals to homeowners who want support beyond basic structural protection.

In Oregon, Farmers averages $1,131 annually for home insurance, about 1% higher than the state average of $1,124 while remaining 68% below the national average of $3,467. Homeowners can lower premiums by bundling multiple policies under one account. Discounts also apply when qualifying home security systems are installed.

Older Homes $93 $1,119 Newer Homes $97 $1,166 Young Homeowners $96 $1,152 Senior Homeowners $92 $1,102 High-Risk Fire Homes $105 $1,259 Smaller Homes $91 $1,096 Larger Homes $96 $1,147 Farmers scored 631 out of 1,000 points in J.D. Power customer satisfaction surveys, falling short of the industry average of 642. The company works through local independent agents who give you personalized service. Its online platform handles basic policy management but doesn't include advanced digital tools.

Farmers includes standard homeowners coverage with a wide range of optional add-ons:

- Dwelling coverage: Covers the home’s structure against covered events

- Personal property coverage: Protects belongings inside the home

- Liability protection: Helps cover legal costs if someone is injured on your property

- Additional living expenses: Pays for temporary housing during covered repairs

- Equipment breakdown coverage: Covers mechanical failures of home systems and appliances

- Personal umbrella coverage: Extends liability protection beyond standard limits

- Identity theft coverage: Helps with recovery after identity theft

- Water backup coverage: Covers damage from sewer or drain backups

Best Oregon Home Insurance by City

American Family has the best rates for home insurance in six Oregon cities: Gresham, Heppner, Hillsboro, Portland, Salem and Union. Annual premiums run from $905 in Hillsboro to $1,511 in Union. Farmers offers the lowest rates in Eugene at $901 per year.

| Eugene | Farmers | $901 |

| Gresham | American Family | $948 |

| Heppner | American Family | $1,321 |

| Hillsboro | American Family | $905 |

| Portland | American Family | $1,008 |

| Salem | American Family | $1,170 |

| Union | American Family | $1,511 |

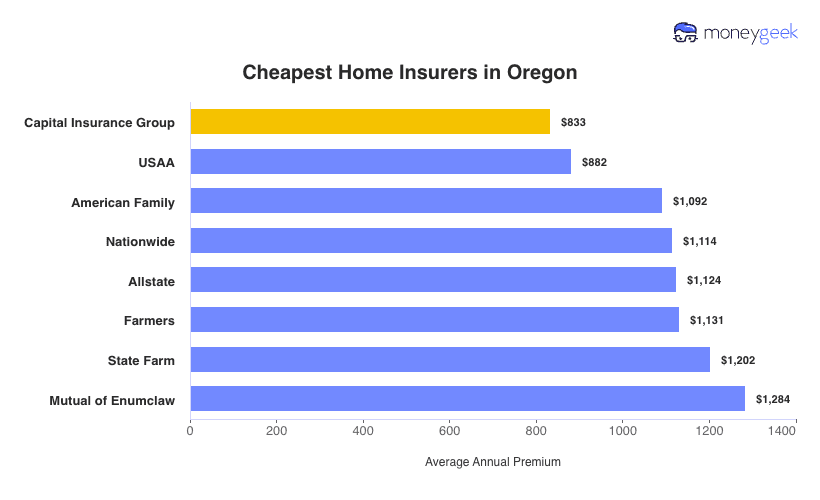

Cheapest Oregon Home Insurance Companies

Oregon homeowners pay $1,124 per year for home insurance, which is 68% less than the national average of $3,467. Capital Insurance Group has the state's lowest rates at $833 per year, running 26% below the state average. USAA comes in second at $882 per year (22% below average), but only covers military members, veterans and their families. Rates vary widely between insurers, with Mutual of Enumclaw charging the most.

Guide to Finding the Best Oregon Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Get quotes from at least three to five insurers. Premiums among Oregon's top providers range from $833 to $1,202 annually. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Start by checking complaint ratios through Oregon Department of Consumer and Business Services, then review J.D. Power scores ranging from 631 to 737 among Oregon's leading insurers compared to the 642 industry average. Focus on recent customer reviews that detail claims handling during Oregon's winter storm season rather than just policy purchase experiences.

Base your coverage on replacement cost rather than market value, which becomes especially critical in Oregon, where construction costs surge after flooding and wildfires. Review optional protections like flood insurance and fire damage coverage, then consider extended or guaranteed replacement cost options that address your home's specific risks.

Digital-first insurers like Lemonade, Hippo and Root work well if you prefer online policy management, while State Farm, Farmers and Allstate offer strong local agent networks for face-to-face support. Align your service preferences with provider strengths to avoid paying premium prices for features you won't use.

Oregon experienced over 1,000 wildfires in 2020 alone, according to the Oregon Department of Forestry, and these fires are becoming more frequent and intense. Standard homeowners insurance covers wildfire damage to your property, but it doesn't cover flood damage that often follows major fires. You'll need separate flood insurance coverage through your insurer or the National Flood Insurance Program to protect against water damage.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Oregon: FAQ

Explore our FAQ section for answers to common questions about selecting the right Oregon home insurance provider for your needs.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to rebuild your home or replace belongings at current market prices without factoring in depreciation. Actual cash value coverage deducts depreciation from claim payments, meaning you receive less money based on your property's age and wear. While actual cash value policies cost less upfront, they leave you responsible for covering more expenses out of pocket after a loss.

Does Oregon home insurance cover wildfire damage?

Yes, standard homeowners insurance in Oregon covers wildfire damage to your property structure and belongings. However, you'll need separate flood insurance to protect against water damage that often follows major fires, available through your insurer or the National Flood Insurance Program.

How much does home insurance cost in Oregon compared to the national average?

Oregon homeowners pay $1,124 annually for home insurance, which is 68% less than the national average of $3,467. This makes Oregon one of the more affordable states for homeowners insurance coverage.

Can I get home insurance if I have a trampoline or swimming pool?

You can get home insurance with a trampoline or swimming pool, but insurers view these as liability risks. Most companies require safety measures: nets and padding for trampolines, fencing and self-closing gates for pools. Your premiums will increase, or your policy may exclude coverage for related injuries. Some insurers deny coverage if you have these features. Carry at least $300,000 in liability coverage to protect against accident claims.

Our Methodology: Determining the Best Oregon Home Insurers

Oregon homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Oregon's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Oregon Department of Forestry. "Current Wildfire Protection." Accessed February 7, 2026.