Iowa homeowners pay rates well below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Iowa.

Best Homeowners Insurance Companies in Iowa

Auto-Owners ranks No. 1 in our review of the best home insurance in Iowa, followed by USAA and State Farm.

See if you're overpaying for home insurance below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Auto-Owners is the best home insurance provider in Iowa with a score of 4.7 out of 5 from our review team.

USAA, State Farm, Farmers and American Family rank high for homeowners insurance in Iowa based on affordable rates, strong customer service and reliable coverage.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Iowa?

Auto-Owners ranks first for Iowa homeowners with the state's lowest premiums and above-average customer satisfaction. USAA, State Farm, Farmers and American Family complete the top five, excelling in areas like military-focused service, premium coverage quality and local agent networks.

Auto-Owners | 4.7 | $1,711 | Most Iowa homeowners |

USAA | 4.9 | $1,983 | Military families |

State Farm | 4.4 | $2,215 | Digital tools |

Farmers | 4.4 | $1,850 | Customizable coverage |

American Family | 4.3 | $2,767 | Home-based business owners |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

**Although USAA earned the highest score, we didn't rank it No. 1 due to its eligibility requirements.

J.D. Power Customer Satisfaction Score

621/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,711Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong agent network provides personalized service and local support

Most affordable rates for Iowa homeowners

Comprehensive coverage options for various homeowner needs

consClaims process slower than industry standards

Limited availability in some Iowa areas

Requires agent interaction; no direct online purchase

Auto-Owners offers Iowa homeowners affordable coverage at $1,711 annually. The company provides guaranteed replacement cost coverage that pays full home rebuilding costs after a total loss, even when construction expenses exceed policy limits. Policies include equipment breakdown coverage, protecting you from costly appliance and system failures.

Auto-Owners charges $1,711 annually for home insurance in Iowa, 28% less than the state average of $2,381 and the national average of $3,467. Bundling home and auto policies lowers your rate, as does installing home security systems.

Older Homes $148 $1,771 Newer Homes $112 $1,342 Young Homeowners $142 $1,703 Senior Homeowners $130 $1,565 High-Risk Fire Homes $160 $1,917 Smaller Homes $130 $1,554 Larger Homes $157 $1,879 Auto-Owners scored 621 out of 1,000 points in J.D. Power's customer satisfaction study, below the 642 industry average. Local independent agents handle all customer interactions and guide coverage decisions. Online tools are limited compared to digital insurers. Iowa homeowners who prefer face-to-face service over digital convenience may find this model appealing.

Auto-Owners provides standard homeowners coverage with optional add-ons:

- Guaranteed home replacement cost: Replaces your home when coverage limits fall short

- Water backup coverage: Covers damage from backed-up sewers or drains

- Special personal property: Broader coverage for personal items, including loss, misplacement or staining

- Ordinance or law: Pays to update your home to current building codes after covered damage

- Homeowners Plus: Package with household appliance leak coverage, increased food spoilage limits, limited fungi coverage and automatic inflation protection

- Equipment breakdown: Covers electrical and mechanical failures of air conditioners, heating units, computers and major appliances

- Identity theft expense: Up to $15,000 for expenses restoring your financial identity

- Home cyber protection: Covers costs for professional help recovering stolen or corrupted data and device restoration

- Inland flood: Coverage for homes in low-to-moderate flood zones, including home, contents, debris removal and additional living expenses

J.D. Power Customer Satisfaction Score

737/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,983Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

User-friendly digital platform simplifies policy management and claims filing

Comprehensive coverage designed for military families' unique needs

Flexible policy choices with multiple add-on options

consEligibility restricted to military members and their families

Claims processing slows during high-volume periods

Limited service availability in certain Iowa areas

USAA offers home insurance at $1,983 annually. The company provides replacement cost coverage for personal property, ensuring full value replacement without depreciation when you file claims. USAA also covers home-sharing, accommodating homeowners who rent through platforms like Airbnb. Low rates and specialized coverage make USAA our top choice for eligible Iowa residents.

USAA charges $1,983 annually for home insurance in Iowa, 17% less than the state average of $2,381 and 43% below the national average of $3,467. Bundling multiple policies and installing home security systems lowers your premium further.

Older Homes $157 $1,884 Newer Homes $89 $1,063 Young Homeowners $166 $1,986 Senior Homeowners $169 $2,028 High-Risk Fire Homes $185 $2,222 Smaller Homes $143 $1,713 Larger Homes $184 $2,205 USAA earned 737 out of 1,000 points in J.D. Power customer satisfaction ratings, well above the 642 industry average. The digital-first approach streamlines policy management and claims processing. USAA tailors home insurance for military families in Iowa, understanding their unique housing situations and deployment schedules. Robust online tools handle most policy changes and claims without phone calls or agent visits.

USAA provides standard homeowners coverage with optional add-ons:

- Replacement cost personal property: Covers belongings at full replacement value without depreciation

- Home-sharing coverage: Protects homeowners who rent their property short-term

- Dwelling coverage: Rebuilds your home after covered losses

- Personal liability: Protects against lawsuits from injuries on your property

- Additional living expenses: Pays hotel and meal costs during home repairs

- Medical payments: Covers minor injuries to guests regardless of fault

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,215Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Extensive agent network provides personalized service and local support

Strong financial stability with high industry ratings

Digital tools enable convenient policy management and claims tracking

consLimited availability in some Iowa areas

Slow and complex claims process

Direct purchase lacks personalized agent guidance

State Farm offers home insurance at $2,215 annually. The company provides replacement cost coverage, ensuring you can fully rebuild your home after a loss, plus personal property coverage that protects belongings against theft and damage. This combination is valuable for Iowa's weather-related risks.

State Farm charges $2,215 annually for home insurance in Iowa, 7% less than the state average of $2,381 and 36% below the national average of $3,467. Bundling multiple policies lowers your rate, as does installing home security systems.

Older Homes $186 $2,236 Newer Homes $135 $1,615 Young Homeowners $184 $2,213 Senior Homeowners $184 $2,213 High-Risk Fire Homes $207 $2,481 Smaller Homes $168 $2,012 Larger Homes $203 $2,433 State Farm earned 657 out of 1,000 points in J.D. Power customer satisfaction ratings, above the 642 industry average. Local independent agents handle personalized service, while direct services provide additional support options. The mobile app handles policy management and gives customers digital access alongside traditional agent support.

State Farm provides standard homeowners coverage with optional add-ons:

- Replacement cost coverage: Rebuilds your home after a covered loss

- Personal property coverage: Protects belongings against theft and damage, including weather-related risks

- Dwelling protection: Covers your home's structure against covered perils

- Liability coverage: Protects against lawsuits for injuries or property damage

- Additional living expenses: Pays for temporary housing during home repairs

- Medical payments: Covers medical expenses for guests injured on your property

J.D. Power Customer Satisfaction Score

631/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,850Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Wide range of customizable coverage options

Strong financial stability with high ratings

User-friendly digital tools for policy management

consCustomer satisfaction score below industry average

Slower claims process than expected

Limited availability in certain areas

At $1,850 annually, Farmers delivers affordable home insurance while giving Iowa homeowners control over their coverage. You can customize your policy to match your specific needs rather than settling for a one-size-fits-all package. Farmers also offers replacement cost coverage for personal belongings as an endorsement, which pays full value after a loss instead of depreciated amounts.

Iowa homeowners with Farmers pay $1,850 annually, well below what most Americans spend on home insurance. The rate comes in $531 less than Iowa's average and $1,617 below the national average. If you qualify, security system installations and policy bundling can help lower your costs.

Older Homes $150 $1,800 Newer Homes $93 $1,115 Young Homeowners $147 $1,764 Senior Homeowners $149 $1,788 High-Risk Fire Homes $173 $2,072 Smaller Homes $141 $1,690 Larger Homes $161 $1,932 Farmers scored 631 out of 1,000 in J.D. Power's customer satisfaction study, falling 11 points below the 642 industry average. Local independent agents handle Iowa homeowners' policies with face-to-face service, while the company's online platform lets you manage coverage digitally. This hybrid model gives you both personal agent relationships and the convenience of digital policy management.

Farmers provides standard homeowners coverage with optional add-ons:

- Dwelling coverage: Protects your home's structure against covered perils

- Personal property coverage: Covers belongings with replacement cost options

- Liability protection: Covers legal expenses if someone is injured on your property

- Additional living expenses: Pays for temporary housing during covered repairs

- Medical payments: Covers minor injuries to guests regardless of fault

- Personal umbrella: Extra liability protection beyond standard limits

J.D. Power Customer Satisfaction Score

643/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,767Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Extensive agent network with personalized, local service

Excellent financial stability backed by strong industry ratings

Reliable claims handling through established regional presence

consPremium costs run higher than Iowa state average

Limited coverage availability in certain areas statewide

Fewer additional coverage options than competitors

American Family offers home insurance in Iowa at $2,767 annually. Its personal property replacement cost coverage ensures homeowners can fully replace lost items at current prices rather than depreciated values. The company also provides optional coverage for home-based businesses, addressing Iowa's growing entrepreneurial community.

American Family charges $2,767 annually for home insurance in Iowa,16% more than the state average of $2,381, but 20% below the national average of $3,467. Bundling multiple policies lowers your rate, as does installing home security systems.

Older Homes $211 $2,532 Newer Homes $169 $2,034 Young Homeowners $228 $2,733 Senior Homeowners $229 $2,746 High-Risk Fire Homes $258 $3,100 Smaller Homes $212 $2,542 Larger Homes $233 $2,790 American Family earned 643 out of 1,000 points in J.D. Power customer satisfaction ratings, slightly above the 642 industry average. Local independent agents provide personalized service for Iowa homeowners' specific needs. The online platform handles policy management, combining traditional agent support with digital convenience. This hybrid approach gives customers flexibility in managing their coverage.

American Family provides standard homeowners coverage with optional add-ons:

- Personal property replacement cost: Covers belongings at current replacement value rather than depreciated cost

- Home-based business coverage: Protection for entrepreneurial activities conducted from your residence

- Standard dwelling protection: Covers your home's structure against covered perils

- Personal liability: Protects against lawsuits from injuries on your property

- Additional living expenses: Pays for temporary housing during covered repairs

Best Iowa Home Insurance by City

Auto-Owners ranks first in all major Iowa cities based on affordability, coverage quality and customer service. Its premiums range from $1,595 in Davenport to $1,888 in Dubuque.

| Cedar Rapids | Auto-Owners Insurance | $1,616 |

| Davenport | Auto-Owners Insurance | $1,595 |

| Des Moines | Auto-Owners Insurance | $1,739 |

| Dubuque | Auto-Owners Insurance | $1,888 |

| Hawkeye | Auto-Owners Insurance | $1,804 |

| Wadena | Auto-Owners Insurance | $1,809 |

Cheapest Iowa Home Insurance Companies

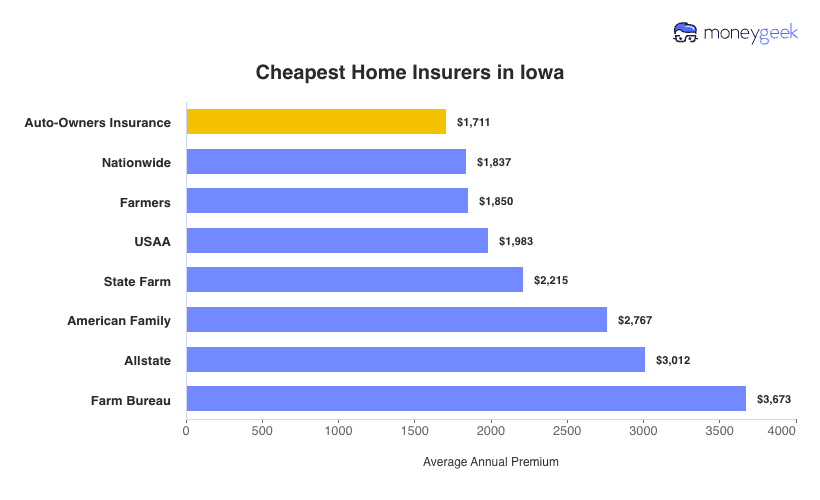

Iowa homeowners pay $2,381 annually for home insurance, 31% less than the national average of $3,467. Auto-Owners offers the state's most affordable home insurance at $1,711 annually, 28% below the state average. Nationwide ranks second at $1,837 annually. Premiums vary among insurers, with Farm Bureau charging 6% more than the national benchmark.

Guide to Finding the Best Iowa Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Get quotes from at least three to five insurers. Premiums among top Iowa providers range from $1,711 to $2,767 annually. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Examine complaint ratios through the Iowa Insurance Division and review J.D. Power scores, which range from 621 to 737 among Iowa's top insurers versus the 642 industry average. Read recent customer reviews that focus on claims handling during Iowa's tornado season rather than just policy purchase experiences to understand real service quality.

Base your coverage on replacement cost rather than market value, especially important in Iowa, where construction costs spike after tornadoes and flooding. Consider extended or guaranteed replacement cost options. Review extended or guaranteed replacement cost options alongside optional protections like wind and hail coverage, flood insurance and extended replacement cost that address your home's specific risks.

Digital-first insurers like Lemonade, Hippo and Root excel if you prefer online policy management, while State Farm, Farmers and Allstate provide robust local agent networks for face-to-face support. Align your service preferences with insurer strengths to avoid paying premium prices for features you won't actually use.

Iowa ranks among the top states for tornado frequency, averaging 48 tornadoes annually between 2018 and 2022, according to the National Weather Service. Standard homeowners insurance covers tornado damage to your property but excludes flood damage from severe storms. You'll need separate flood insurance through your insurer or the National Flood Insurance Program.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Iowa: FAQ

Explore our FAQ section for answers to common questions about selecting the right Iowa home insurance provider for your needs.

How much do Iowa homeowners pay for home insurance compared to the national average?

Iowa homeowners pay $2,381 annually for home insurance, which is 31% less than the national average of $3,467. The state's below-average rates reflect lower risk factors compared to coastal states, though tornado frequency remains a significant concern.

Does Iowa home insurance cover tornado damage?

Yes, standard homeowners insurance in Iowa covers tornado damage to your property, including structural damage and personal belongings.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to rebuild your home or replace belongings at current prices without deducting for depreciation. Actual cash value coverage subtracts depreciation from claim payments. You receive less money based on your property's age and condition. Actual cash value policies cost less up front but leave you covering more expenses out of pocket after a loss.

Can I get home insurance if I have a trampoline or swimming pool?

You can get home insurance with trampolines or swimming pools, though insurers consider these features liability risks. Many companies require safety measures like nets and padding for trampolines, plus fencing and self-closing gates for pools. Some insurers exclude coverage entirely, impose higher premiums or mandate additional liability protection. Maintain at least $300,000 in liability coverage to adequately protect yourself from potential claims.

Our Methodology: Determining the Best Iowa Home Insurers

Iowa homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Iowa's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- National Weather Service. "Tornado Data, Information and Links." Accessed February 7, 2026.