MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Louisiana.

Best Homeowners Insurance Companies in Louisiana

State Farm ranks No. 1 in our review of the best home insurance in Louisiana, followed by USAA and The Hanover.

See if you're overpaying for home insurance below.

Updated: January 22, 2026

Advertising & Editorial Disclosure

State Farm is the best home insurance provider in Louisiana, with a score of 4.6 out of 5 from our review team.

USAA, The Hanover, Allstate and Foremost rank high for homeowners insurance in Louisiana based on reliable coverage, affordable rates and positive customer service.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Louisiana?

State Farm ranks first for Louisiana homeowners with the state's lowest premiums and above-average customer satisfaction. USAA, The Hanover, Allstate and Foremost complete the top five, excelling in areas like military-focused service, premium coverage quality and local agent networks.

State Farm | 4.6 | $4,502 | Most Louisiana homeowners |

USAA | 4.9 | $3,453 | Military families |

The Hanover | 4.4 | $4,860 | Comprehensive coverage options |

Allstate | 4.4 | $4,556 | Financial stability |

Foremost | 4.2 | $1,962 | Affordable coverage |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

**Although USAA earned the highest score, we didn't rank it No. 1 due to its eligibility requirements.

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$4,502Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

User-friendly digital tools simplify policy management and claims processes

J.D. Power customer satisfaction score exceeds industry average

Strong financial stability backed by high AM Best ratings

consPremiums higher than Louisiana state average

Limited coverage in certain areas across the state

Limited coverage options in some regions

State Farm's $4,502 annual rate delivers hurricane protection for a state where storm coverage is necessary for homeowners. Replacement cost coverage, offered as an endorsement, ensures you receive current market value for destroyed items instead of depreciated amounts that won't cover actual replacement.

Louisiana homeowners save 38% with State Farm's $4,502 annual premium compared to the state average of $7,304. The rate sits slightly above the national average of $3,467, reflecting Louisiana's elevated hurricane risk. Stack bundling discounts for multiple policies with home security system discounts to reduce your premium further.

Older Homes $380 $4,566 Newer Homes $283 $3,390 Young Homeowners $375 $4,504 Senior Homeowners $375 $4,496 High-Risk Fire Homes $420 $5,044 Smaller Homes $523 $6,277 Larger Homes $551 $6,614 State Farm's 657 J.D. Power score edges out the 642 industry average by 15 points. It's combined with local independent agents who know Louisiana's insurance landscape, from Lake Charles's hurricane history to Baton Rouge's flood zones. Digital tools handle routine policy tasks smoothly, but expect to call your agent for complex quote adjustments rather than customizing everything online.

State Farm provides standard homeowners coverage with optional add-ons:

- Personal articles policy: Protects high-value items like jewelry, art and collectibles against risks beyond standard coverage

- Umbrella policy: Extends personal liability protection above homeowners and auto policy limits

- Service line coverage: Pays for underground utility line repairs on your property

- Sewer backup coverage: Covers water damage and cleanup from sewer backups originating inside your home

- Energy efficiency upgrade: Provides extra funds to upgrade damaged systems to energy-efficient models

- Identity fraud protection: Covers costs for restoring your identity after theft

J.D. Power Customer Satisfaction Score

737/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$3,453Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

User-friendly digital tools simplify policy management and claims processes

Strong financial stability backed by high industry ratings

Flexible policy options include various add-on coverage choices

consLimited availability in some areas

Agent network relies primarily on phone and online interactions

Geographic coverage gaps

USAA charges Louisiana military families $3,453 annually for home insurance—Louisiana's lowest rate among major insurers. The company covers hurricane damage and offers flood insurance options to address Louisiana's storm and flood risks. USAA's combination of low premiums and military-focused service works well for eligible Louisiana homeowners.

USAA's annual premium of $3,453 runs 53% below Louisiana's state average of $7,304, but 111% above the national average of $3,467. Homeowners can stack savings through bundling discounts for multiple policies and home security system discounts.

Older Homes $282 $3,386 Newer Homes $177 $2,124 Young Homeowners $295 $3,540 Senior Homeowners $286 $3,429 High-Risk Fire Homes $322 $3,869 Smaller Homes $268 $3,214 Larger Homes $299 $3,589 USAA scored 737 out of 1,000 points in J.D. Power's customer satisfaction study, beating the industry average of 642 by 95 points. The insurer operates without agents, providing direct customer support through digital channels. USAA's online tools handle policy management and claims efficiently, with coverage options tailored to military lifestyle needs.

USAA provides standard homeowners coverage with specialized add-ons for Louisiana risks:

- Hurricane damage coverage: Protects against wind and storm damage from Louisiana's frequent hurricanes

- Flood insurance options: Addresses flood risk in Louisiana's coastal and low-lying areas

- Personal property protection: Covers belongings damaged by covered perils

- Liability coverage: Pays legal costs and judgments from injuries on your property

- Additional living expenses: Covers temporary housing during home repairs

- Military deployment protection: Adjusts coverage during active duty deployments

J.D. Power Customer Satisfaction Score

633/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$4,860Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Digital tools simplify policy management with easy online access

High AM Best ratings confirm strong financial stability

Ranks among Louisiana's top home insurance providers

consClaims take longer to process than competitors

Coverage options lack flexibility in specific situations

Not available in all Louisiana areas

The Hanover's Louisiana home insurance costs $4,860 annually and includes hurricane damage protection with flood insurance options. The Hanover works well for Louisiana residents who want coverage for regional weather risks at below-average state costs.

The Hanover's annual premium of $4,860, 33% below Louisiana's state average of $7,304 and 111% above the national average of $3,467. Homeowners can reduce premiums through bundling discounts for multiple policies and home security system discounts.

Older Homes $437 $5,246 Newer Homes $350 $4,203 Young Homeowners $405 $4,863 Senior Homeowners $404 $4,852 High-Risk Fire Homes $454 $5,445 Smaller Homes $571 $6,849 Larger Homes $598 $7,173 The Hanover scored 633 out of 1,000 points in J.D. Power's customer satisfaction study, nine points below the industry average of 642. The insurer works through local independent agents who provide personalized service and regional expertise. The Hanover offers online quotes, though its mobile app lags behind digital-focused competitors.

The Hanover provides standard homeowners coverage with specialized add-ons for Louisiana risks:

- Hurricane damage coverage: Protects against wind damage and storm destruction from Louisiana hurricanes

- Flood insurance options: Available for Louisiana's flood-prone coastal and low-lying areas

- Dwelling protection: Covers your home's structure and attached fixtures

- Personal property coverage: Protects belongings inside your home against covered perils

- Liability protection: Pays legal expenses and judgments from injuries on your property

- Additional living expenses: Covers temporary housing during repairs after covered damage

J.D. Power Customer Satisfaction Score

633/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$4,556Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

High financial stability ratings ensure reliable claim payments

Strong financial backing provides long-term policyholder security

consCustomer satisfaction scores run nine points below industry average

Limited availability in certain Louisiana areas

Direct purchase model offers no agent support

At $4,556 annually, 38% below Louisiana's $7,304 average, Allstate adds storm-specific options to standard coverage. The hurricane deductible option controls your largest potential expense during storm season. Homeowners can also add extended personal property coverage to protect belongings beyond standard limits against theft and weather damage.

Louisiana's hurricane risk drives the state average to $7,304 annually. Allstate's $4,556 rate runs 38% below that benchmark, though 111% above the $3,467 national average, reflecting Gulf Coast's storm exposure. Bundling policies and installing security systems reduce premiums further.

Older Homes $417 $5,006 Newer Homes $290 $3,482 Young Homeowners $380 $4,564 Senior Homeowners $367 $4,402 High-Risk Fire Homes $425 $5,105 Smaller Homes $335 $4,018 Larger Homes $401 $4,815 Local Allstate agents understand Louisiana's weather risks, from Lake Charles's hurricane history to North Louisiana's tornado exposure. They provide personalized guidance on deductibles and flood coverage based on your location . Combined with an online platform that allows homeowners to easily manage their policy, this earned Allstate a 633 J.D. Power score, nine points below the 642 industry average.

Allstate provides standard homeowners coverage with optional add-ons:

- Hurricane deductible option: Lets homeowners adjust out-of-pocket costs through flexible deductible structures during storm season

- Extended personal property coverage: Protects belongings against theft and weather damage beyond basic policy limits

- Dwelling protection: Covers home structure against wind, hail and other covered perils

- Liability coverage: Pays legal expenses and judgments from injuries on your property

- Additional living expenses: Covers temporary housing when your home becomes uninhabitable after covered damage

- Medical payments: Pays medical expenses for guests injured on your property

J.D. Power Customer Satisfaction Score

N/AFrom the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,962Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Digital tools simplify policy management

Louisiana's lowest rates among major insurers

Customizable coverage options

consClaims processing slower than competitors

Limited availability in some Louisiana areas

Not available in all states

Foremost home insurance in Louisiana costs $1,962 annually. The insurer provides wind and hail coverage for hurricane damage and replacement cost coverage that pays current market prices for lost items. Foremost works well for Louisiana residents who want low premiums with storm protection.

Foremost's annual premium of $1,962 runs 73% below Louisiana's state average of $7,304 and 43% below the national average of $3,467. Homeowners can reduce premiums through bundling discounts for multiple policies and home security system discounts.

Older Homes $166 $1,988 Newer Homes $113 $1,358 Young Homeowners $164 $1,963 Senior Homeowners $163 $1,960 High-Risk Fire Homes $183 $2,199 Smaller Homes $228 $2,739 Larger Homes $240 $2,884 Foremost Insurance lacks a J.D. Power rating, preventing direct comparison to the industry average of 642 points. The insurer works through local independent agents who provide personalized service and understand regional coverage needs. Foremost offers tailored coverage options for Louisiana homeowners but provides limited digital tools for policy management and claims.

Foremost provides standard homeowners coverage with specialized add-ons for Louisiana risks:

- Wind and hail coverage: Protects against hurricane and severe weather damage

- Personal property replacement cost: Pays current replacement value rather than depreciated worth for belongings

- Dwelling coverage: Covers your home's structure against covered perils

- Personal liability: Pays legal expenses and judgments from injuries on your property

- Additional living expenses: Covers temporary housing during home repairs

Best Louisiana Home Insurance by City

State Farm ranks best in four Louisiana cities: Baton Rouge, Lafayette, Mandeville and Metairie. The Hanover leads in Alexandria and Logansport. Annual premiums range from $2,355 to $4,404 based on location.

| Alexandria | The Hanover | $2,355 |

| Baton Rouge | State Farm | $4,402 |

| Lafayette | State Farm | $4,404 |

| Logansport | The Hanover | $2,576 |

| Mandeville | State Farm | $4,404 |

| Metairie | State Farm | $4,404 |

| Natchitoches | The Hanover | $2,602 |

| New Orleans | State Farm | $4,399 |

| Shreveport | The Hanover | $2,771 |

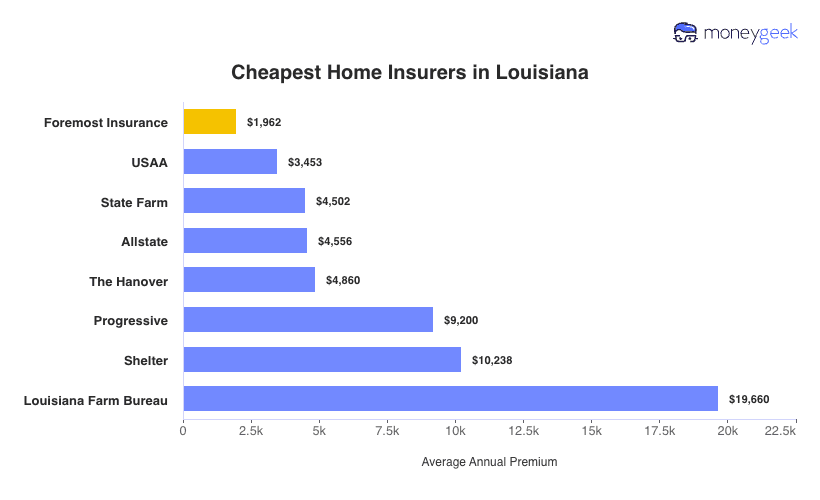

Cheapest Louisiana Home Insurance Companies

Louisiana homeowners pay $7,304 annually for home insurance, 111% less than the national average of $3,467. Foremost offers the state's most affordable home insurance at $1,962 annually, 73% below the state average. USAA follows at $3,453 per year (53% below average), though it's limited to military members, veterans and their families. Premiums vary among insurers. The most expensive provider, Louisiana Farm Bureau, charges 467% above national rates.

Guide to Finding the Best Louisiana Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Gather quotes from at least three to five insurers. Premiums among Louisiana's top providers range from $1,962 to $4,860 annually. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Check complaint ratios with the Louisiana Department of Insurance, then review J.D. Power scores that range from 633 to 737 for the state's top providers, compared to the 642 industry average. Read recent customer reviews that focus on claims experiences during Louisiana's hurricane season rather than just policy purchase satisfaction. These metrics reveal how insurers perform when you need them most.

Extended or guaranteed replacement cost coverage matters in Louisiana, where construction costs jump after hurricanes and floods. Base your coverage on replacement cost, not market value. Add wind/hail coverage and flood insurance based on your home's location and weather exposure. Without enough coverage, you'll face out-of-pocket costs during rebuilding.

Digital-first insurers like Lemonade, Hippo and Root work well if you prefer online policy management and mobile apps. Choose insurers with local agent networks like State Farm, Allstate and Farmers if you value face-to-face support and local relationships. Matching your service style helps you avoid paying premium prices for features you won't actually use.

Louisiana experiences the nation's highest hurricane risk, with an average of six hurricanes per decade between 2010 and 2020, per the National Oceanic and Atmospheric Administration. Insurers include hurricane deductibles in homeowners policies, usually 2% to 10% of your home's insured value. Your homeowners policy covers hurricane damage but excludes flooding. You'll need separate flood coverage through your insurer or the National Flood Insurance Program.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Louisiana: FAQ

Explore our FAQ section for answers to common questions about selecting the right Louisiana home insurance provider for your needs.

Does homeowners insurance in Louisiana cover hurricane damage?

Louisiana homeowners policies cover hurricane wind and hail damage but exclude flooding caused by hurricanes. You'll need separate flood insurance through your insurer or the National Flood Insurance Program to protect against storm surge and flood damage.

What is a hurricane deductible in Louisiana home insurance?

Louisiana insurers include hurricane deductibles in homeowners policies, typically ranging from 2% to 10% of your home's insured value rather than a flat dollar amount. This means if your home is insured for $300,000 with a 5% hurricane deductible, you'll pay $15,000 out of pocket before coverage begins after a hurricane claim.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to rebuild your home or replace belongings at current market prices without factoring in depreciation. Actual cash value coverage deducts depreciation based on your property's age and condition, resulting in lower claim payouts. While actual cash value policies cost less upfront, you'll pay more out of pocket after a loss.

Does home insurance cover sinkholes in Louisiana?

Most Louisiana home insurance policies exclude sinkhole damage from standard coverage. However, Louisiana requires insurers to offer sinkhole coverage as an optional endorsement that you can add to your policy. Southern Louisiana, particularly areas near Baton Rouge and New Orleans, faces higher sinkhole risks. Review your policy exclusions and consider purchasing this additional coverage to protect against potential sinkhole damage.

Our Methodology: Determining the Best Louisiana Home Insurers

Louisiana homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Louisiana's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- NOAA. "National Oceanic and Atmospheric Administration." Accessed February 7, 2026.