Idaho homeowners pay rates below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major providers to find the best home insurance companies in Idaho.

Best Homeowners Insurance Companies in Idaho

American Family ranks No. 1 in our review of the best home insurance providers in Idaho, followed by USAA and State Farm.

See if you're overpaying for home insurance below.

Updated: February 4, 2026

Advertising & Editorial Disclosure

American Family is the best home insurance provider in Idaho with a score of 4.6 out of 5 from our review team.

USAA, State Farm, Mutual of Enumclaw and Farmers rank high for homeowners insurance in Idaho based on affordable rates, strong customer service and reliable coverage.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Idaho?

American Family ranks first for Idaho homeowners with the state's lowest premiums at $980 annually and customer satisfaction scores above the industry average. USAA, State Farm, Mutual of Enumclaw and Farmers complete the top five, with strengths ranging from military-focused service to local agent networks.

American Family | 4.6 | $980 | Most Idaho homeowners |

USAA | 4.8 | $1,634 | Military families |

State Farm | 4.5 | $1,249 | Coverage quality |

Mutual of Enumclaw | 4.3 | $1,008 | Local agent network |

Farmers | 4.3 | $1,600 | Specialized coverage |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

**Although USAA earned the highest score, we didn't rank it No. 1 due to its eligibility requirements.

J.D. Power Customer Satisfaction Score

643/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$980Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Digital tools for policy management and claims tracking

High financial stability ratings

Lowest rates in Idaho at $980 annually

consSlower claims processing

Not available in all Idaho regions

American Family offers Idaho's most affordable home insurance at $980 annually. The policy includes personal property replacement cost coverage without depreciation deductions and additional living expenses protection. This matters for Idaho's wildfires and severe storms.

American Family charges $980 annually for home insurance in Idaho, 41% less than the state average of $1,673 and 52% below the national average of $3,467. You can save more by bundling multiple policies or installing home security systems.

Older Homes $79 $951 Newer Homes $67 $801 Young Homeowners $83 $999 Senior Homeowners $82 $978 High-Risk Fire Homes $92 $1,098 Smaller Homes $79 $943 Larger Homes $83 $993 American Family earned 643 out of 1,000 points in the J.D. Power customer satisfaction study, above the industry average of 642. The company operates through local independent agents who know Idaho's specific risks. American Family's online platform lets you manage policies digitally while still accessing agent support when needed.

American Family provides standard homeowners coverage with these optional add-ons:

- Equipment breakdown: Covers appliances, home systems and smart home devices that fail from mechanical or electrical problems

- Flash flood: Pays for water damage from flash floods

- Hidden water damage: Covers leaks behind walls, floors, ceilings and cabinets

- Home renovation: Covers foundation collapse, damage or theft of construction materials during renovations

- Matching undamaged siding: Pays to replace remaining siding after a claim

- Roof damage: Bridges the gap between your roof's depreciated value and replacement cost

- Service line: Pays to repair or replace damaged underground piping or wiring

- Sewer back-up, septic back-up and sump overflow: Covers repair costs when water backs up into your home through drains or an overflowing sump

- Scheduled personal property: Increases coverage limits for jewelry, gemstones, watches and furs beyond your base policy

J.D. Power Customer Satisfaction Score

737/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,634Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Digital tools for policy management and claims tracking

High financial stability ratings

Broad coverage options for military families

consRestricted primarily to military-affiliated customers

Claims processing delays during peak demand periods

Agent network focuses on direct sales, reducing personal interaction

USAA offers Idaho homeowners insurance at $1,634 annually, 2% below the state average. It works well for military families. The company provides replacement cost coverage for personal belongings, so you receive full value when filing claims. USAA covers military uniforms damaged or lost during service, a benefit most other insurers don't offer.

USAA charges $1,634 annually for home insurance in Idaho, 2% less than the state average of $1,673 and 52% below the national average of $3,467. This competitive pricing benefits military families seeking affordable coverage in the state's housing market. Available discounts include bundling multiple policies and installing home security systems.

Older Homes $135 $1,618 Newer Homes $82 $989 Young Homeowners $149 $1,785 Senior Homeowners $135 $1,614 High-Risk Fire Homes $153 $1,831 Smaller Homes $125 $1,498 Larger Homes $147 $1,763 USAA earned 737 out of 1,000 points in J.D. Power customer satisfaction ratings, above the industry average of 642. The company operates with a digital-first model that gives you direct access to representatives familiar with military life. USAA offers online tools for policy management and claims processing, making it easy to handle insurance needs digitally.

USAA provides standard homeowners coverage with optional add-ons:

- Home protector: Increases dwelling and other structures coverage limits by 25% when building costs rise unexpectedly

- Water backup: Pays for damage from water or sewage backing up through plumbing or overflowing from a sump pump

- Earthquake: Covers damage to your home and belongings from earthquakes, shock waves or tremors

- Personal injury: Pays legal costs if you're accused of libel, slander, defamation or other reputation damage

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,249Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Rates 25% below Idaho's average

Customizable coverage options

Second-lowest premiums in Idaho at $1,249 annually

consNot available in all Idaho regions

Slower claims processing during peak periods

State Farm offers Idaho's second-most affordable home insurance at $1,249 annually. The company provides replacement cost coverage for personal belongings, so you receive full value rather than depreciated amounts. State Farm offers customizable coverage for regional risks like wildfires, valuable for residents in fire-prone areas.

State Farm charges $1,249 annually for home insurance in Idaho, 25% less than the state average of $1,673 and 52% below the national average of $3,467. You can save more by bundling multiple policies or installing home security systems.

Older Homes $105 $1,264 Newer Homes $79 $944 Young Homeowners $104 $1,250 Senior Homeowners $103 $1,238 High-Risk Fire Homes $117 $1,400 Smaller Homes $93 $1,113 Larger Homes $112 $1,340 State Farm earned 657 out of 1,000 points in the J.D. Power customer satisfaction study, above the industry average of 642. The company operates through local independent agents and direct sales. State Farm offers digital tools for policy management, though online quote options are more limited than digital-first competitors.

State Farm provides standard homeowners coverage with these optional add-ons:

- Personal articles policy: Covers high-value items like jewelry, art and collectibles against more risks than standard policies

- Umbrella policy: Increases personal liability protection beyond your homeowners and auto policies

- Service line coverage: Pays to repair underground utility lines on your property

- Sewer backup coverage: Covers water damage and cleanup costs from sewer backups inside your home

- Energy efficiency upgrade: Provides extra funds to replace damaged systems with energy-efficient models

- Identity fraud protection: Covers costs to restore your identity after theft

J.D. Power Customer Satisfaction Score

N/AFrom the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,008Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

High financial stability ratings

Comprehensive coverage options

Third-lowest rates in Idaho at $1,008 annually

consNot available in all Idaho regions

Limited digital tools compared to national insurers

Mutual of Enumclaw offers Idaho's third-most affordable home insurance at $1,008 annually. The policies include personal property replacement cost coverage without depreciation penalties. Mutual of Enumclaw also provides comprehensive liability coverage for injuries on your property.

Mutual of Enumclaw charges $1,008 annually for home insurance in Idaho, 40% less than the state average of $1,673 and 52% below the national average of $3,467. You can save more by bundling multiple policies or installing home security systems.

Older Homes $89 $1,066 Newer Homes $61 $728 Young Homeowners $85 $1,024 Senior Homeowners $82 $986 High-Risk Fire Homes $94 $1,129 Smaller Homes $98 $1,171 Larger Homes $122 $1,459 Mutual of Enumclaw lacks a J.D. Power rating. The company operates through local independent agents in Idaho. Its digital tools are more limited than larger national insurers, which may not work if you prefer managing insurance online. This traditional approach appeals to homeowners who value in-person service over digital convenience.

Mutual of Enumclaw provides standard homeowners coverage with these optional add-ons:

- Equipment breakdown: Pays to repair or replace appliances and systems that fail mechanically or electrically

- Water backup: Pays for damage when water backs up through sewers or drains

- Identity theft protection: Reimburses identity theft expenses and provides recovery assistance

- Service line coverage: Pays repair costs for damaged utility lines to your home

- Scheduled personal property: Raises coverage limits for valuable items like jewelry and art

- Inland flood: Pays for flood damage away from coastal areas

- Green upgrades: Pays extra costs to rebuild with eco-friendly materials after a loss

- Cyber protection: Reimburses losses from cyber attacks and data breaches

- Umbrella coverage: Raises liability coverage beyond standard policy limits

J.D. Power Customer Satisfaction Score

631/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,600Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Customizable coverage options

High financial stability ratings

Digital tools for policy management and claims tracking

consNot available in all Idaho regions

Add-on coverage availability varies by location

Farmers offers Idaho homeowners home insurance at $1,600 annually, 4% below the state average. The company provides customizable coverage options and replacement cost coverage for personal belongings. This means you receive full value rather than depreciated amounts when filing claims.

Farmers charges $1,600 annually for home insurance in Idaho, 4% less than the state average of $1,673 and 52% below the national average of $3,467. You can save more by bundling multiple policies or installing home security systems.

Older Homes $135 $1,622 Newer Homes $120 $1,435 Young Homeowners $135 $1,626 Senior Homeowners $123 $1,473 High-Risk Fire Homes $149 $1,793 Smaller Homes $119 $1,426 Larger Homes $143 $1,717 Farmers earned 631 out of 1,000 points in J.D. Power customer satisfaction ratings, below the industry average of 642. The company operates through local independent agents who know Idaho's market. Farmers' online platform lets you manage policies digitally while still accessing agent support when needed.

Farmers provides standard homeowners coverage with these optional add-ons:

- Extended replacement cost: Pays up to 25% above your policy limit if rebuilding costs exceed it

- Guaranteed replacement cost: Pays the full cost to rebuild your home after covered losses, even if it exceeds your policy limits

- Building ordinance or law: Pays for upgrades required by current building codes that weren't damaged in the loss

- Sewer and drain water damage: Reimburses you for water damage when water backs up through drains and sumps

- Scheduled personal articles: Raises coverage limits for specific valuable items like jewelry, firearms and silverware

- Identity Shield: Connects you with professional services after identity theft

Best Idaho Home Insurance by City

American Family ranks first in all five major Idaho cities we analyzed. Annual premiums range from $879 to $1,082.

| Boise | American Family | $993 |

| Caldwell | American Family | $961 |

| Declo | American Family | $1,082 |

| Georgetown | American Family | $1,073 |

| Meridian | American Family | $879 |

Cheapest Idaho Home Insurance Companies

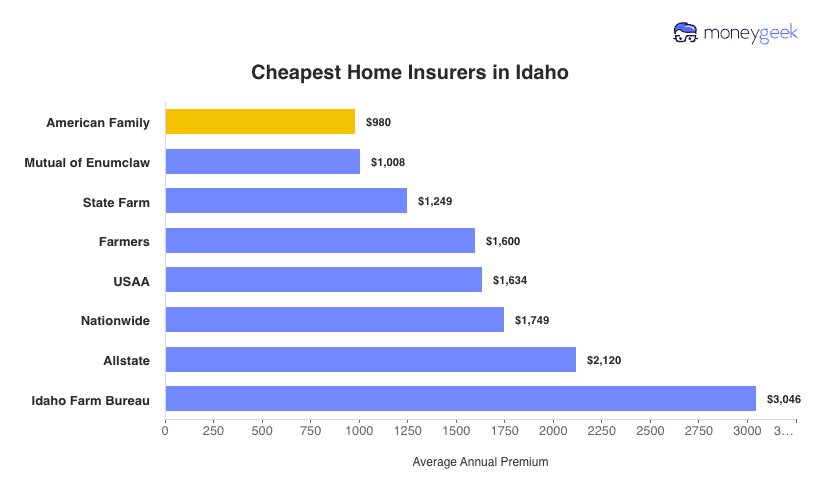

American Family has Idaho's cheapest home insurance at $980 annually, 41% below the state average of $1,673. Mutual of Enumclaw comes in second at $1,008 per year, 40% under average. Idaho homeowners pay 52% less than the national average of $3,467. Idaho Farm Bureau costs the most at 12% above national rates.

Guide to Finding the Best Idaho Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Premiums among Idaho's leading providers range from $980 to $1,634 annually, so get quotes from at least three to five insurers. Don't shop by price alone. The cheapest policy might leave coverage gaps that surface only when you file a claim after severe weather. Compare cost against comprehensive protection.

Look beyond policy prices by checking complaint ratios through the Idaho Department of Insurance and reviewing J.D. Power scores, which range from 631 to 737 among Idaho's top providers compared to the 642 industry average. Focus on recent customer reviews about claims handling during Idaho's hail storm season rather than just policy purchase experiences.

Consider extended or guaranteed replacement cost options since construction costs surge in Idaho after flooding and hailstorms. Base your coverage on replacement cost rather than market value, and review optional protections like flood insurance and wind/hail coverage for your home's risks in Idaho's climate.

Digital-first insurers like Lemonade, Hippo and Root Insurance work well if you prefer online policy management, while State Farm, Farmers and Allstate offer local agent networks for in-person support. Match your service preferences to avoid paying for features you won't use.

Idaho experienced over 1,000 wildfires in 2024 alone, according to the National Interagency Fire Center. These fires are becoming more frequent and intense. Standard homeowners insurance covers wildfire damage to your property but excludes flood damage from firefighting efforts or mudslides after fires. You'll need separate flood insurance through your insurer or the National Flood Insurance Program.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Idaho: FAQ

Here are answers to common questions about Idaho home insurance.

Does home insurance cover damage from fallen trees in Idaho?

Home insurance covers damage to your house from fallen trees when wind, lightning or other covered perils cause the tree to fall. Your policy excludes damage from trees that fell due to rot or neglect, and won't cover tree removal unless the tree damaged a structure. Most policies limit tree removal coverage to $500 to $1,000 per tree.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays the full amount to rebuild your home or replace belongings at current market prices without depreciation. Actual cash value coverage deducts depreciation based on your property's age and condition, so payouts are lower. Actual cash value policies cost less upfront but require you to pay more out of pocket when filing claims.

Does home insurance cover sinkholes in Idaho?

Most Idaho home insurance policies exclude sinkhole damage because the state doesn't require insurers to offer this coverage. Southern Idaho, particularly areas near Boise and Twin Falls, faces higher sinkhole risk due to geological conditions. Review your policy's exclusions and consider buying additional coverage if you live in these regions.

Can I get home insurance if I have a trampoline or swimming pool?

You can get home insurance with a trampoline or swimming pool, though insurers consider these features significant liability risks. Most companies require safety measures like nets and padding for trampolines, plus fencing and self-closing gates for pools. Expect higher premiums, coverage exclusions or requirements for additional liability protection of at least $300,000. Some insurers exclude coverage for these amenities entirely.

Our Methodology: Determining the Best Idaho Home Insurers

Idaho's wildfire risks, winter storms and fluctuating construction costs mean homeowners need a ranking system balancing affordable premiums with quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and reviewed discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback show how insurers handle claims when storms damage your home.

Coverage options (15%): We reviewed add-on availability, including water back-up protection and inland flood options for Idaho's risks.

Our Sample Profile

Rates reflect a homeowner aged 41 to 60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- National Interagency Fire Center. "Coordination and cooperation in wildland fire management." Accessed February 7, 2026.