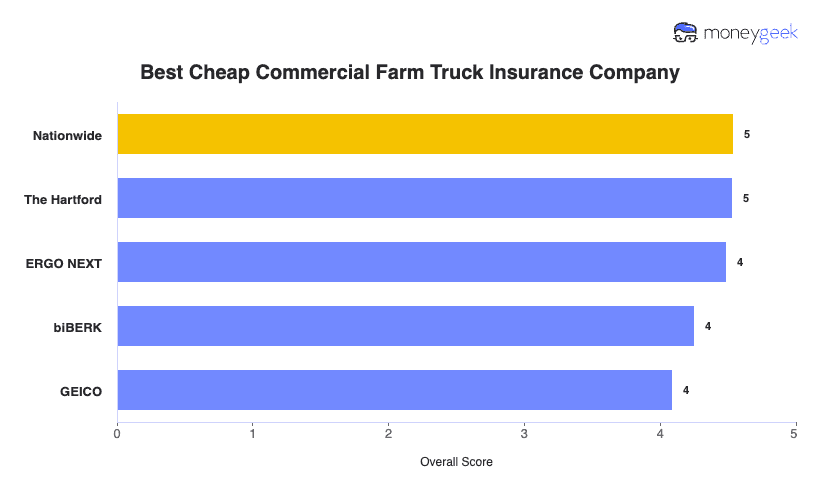

Nationwide and The Hartford score nearly identically overall. Nationwide wins on customer experience, but The Hartford leads in coverage terms. ERGO NEXT ranks third but costs $23 less monthly. Go with ERGO NEXT for the lowest price, Nationwide for better service or The Hartford for broader coverage.

Best Cheap Commercial Farm Truck Insurance

Nationwide ranks best overall with a 4.54 rating for service and coverage. ERGO NEXT is cheapest at $248/mo.

Get matched to the top providers below.

Updated: January 28, 2026

Advertising & Editorial Disclosure

Nationwide ranks as the best commercial farm truck insurer with a 4.54 overall rating, earning the highest customer experience score (4.64) and near-perfect coverage terms (4.93) at $271 monthly.

ERGO NEXT offers the cheapest rates at $248 monthly, saving farms $204 annually compared to the industry average.

Commercial farm truck insurance costs $268 monthly on average, ranging from $170 in Maine to $412 in New York.

Compare quotes from at least three insurers, raise your deductible to $1,000 or higher and bundle with other farm policies to save 10% to 25%.

Best Commercial Farm Truck Insurance Companies

| Nationwide | 4.54 | $271 | 4.64 | 4.93 |

| The Hartford | 4.53 | $266 | 4.51 | 5 |

| ERGO NEXT | 4.49 | $248 | 4.27 | 4.39 |

| biBERK | 4.25 | $313 | 4.3 | 4.39 |

| GEICO | 4.09 | $276 | 3.96 | 4.05 |

Disclaimer

MoneyGeek rated insurers based on affordability, customer experience and coverage terms for commercial farm truck insurance with $1,000,000 CSL liability coverage. Data collected November 2025.

Get Your Commercial Farm Truck Insurance Quote

Compare rates from top providers for your business. Enter your fleet size and location to see customized quotes in minutes.

Best Overall Commercial Farm Truck Insurance

Average Cost of Commercial Farm Truck Insurance

$271/monthlyOur Survey: Claims Process

4.6/5Our Survey: Likely to Recommend

4.5/5

- pros

Ranks first overall for commercial farm truck insurance with 4.54 rating

Best coverage and terms score at 4.93 out of 5

Highest customer experience rating at 4.64 out of 5

Offers lowest rates in 12 states including Iowa, Kansas and Wisconsin

consPremium exceeds company average by $6 monthly

Shopping for farm truck insurance shouldn't feel like explaining your operation to someone who's never left the city. Nationwide gets it. The company scored 4.64 out of 5 for customer service in our analysis (the highest mark among insurers we reviewed) and earned a 4.93 for coverage quality. Those aren't just numbers. They mean Nationwide understands what agricultural vehicles actually do and how to protect them properly.

You can work with a local independent agent who knows farming or buy coverage directly online. Farm owners value this flexibility since agricultural equipment needs different protection than standard commercial vehicles.

Nationwide charges $271 monthly ($3,246 annually) for farm truck coverage. That's $6 more per month than the $265 company average, but you're paying for the best customer service we found and more comprehensive coverage. For about a dollar a day extra, you get an insurer that won't make you explain what a hay baler does when you file a claim.

The company offers the most competitive rates in 12 states. Iowa farmers using Nationwide pay just $172 monthly, Kansas operators pay $196 and Wisconsin policyholders pay $205. If you're in the Midwest, Nationwide's pricing advantage becomes even clearer.

Nationwide tops every insurer we analyzed for customer experience. The difference shows up when you actually need to use your insurance. Agricultural vehicle claims get complicated. You might need coverage for equipment attached to the truck, damage from field conditions or liability from farm operations. Nationwide's agents handle these situations regularly and know what documentation you need.

You have multiple ways to manage your policy: meet with your local agent, call the customer service line or handle routine tasks through your online account. File a claim at 6 a.m. before heading to the fields, or sit down with your agent to review coverage when harvest ends. The flexibility matters during planting and harvest seasons when you can't spare an afternoon in an office.

Nationwide processes claims efficiently and responds quickly to questions. When your farm truck breaks down during harvest, speed matters as much as coverage.

Nationwide scored highest among all insurers for coverage and terms. The company offers $1 million in combined single limit liability coverage, which protects you if your farm truck causes an accident. This coverage pays for injuries to other people, damage to their property and your legal costs if someone sues.

Agricultural operations face different risks than standard commercial vehicles. You might haul equipment between fields, drive on unpaved farm roads or use your truck for both business and limited personal use during planting season. Nationwide structures its policies to handle these situations without forcing you into expensive specialty coverage you don't need.

The insurer also works with farms that operate multiple vehicles. If you're running three tractors, two grain trucks and a livestock trailer, Nationwide can bundle coverage and simplify your paperwork.

What Makes Nationwide Stand Out for Farm Operations

Nationwide operates in rural communities where other insurers have pulled back. The company maintains agent networks in agricultural regions and understands seasonal income patterns that affect when farms can pay premiums. You won't get declined for coverage because your ZIP code is too rural or because underwriters don't recognize agricultural vehicle uses.

The combination of competitive pricing, top-tier customer service and comprehensive coverage makes Nationwide our best overall choice for commercial farm truck insurance. You can get cheaper rates elsewhere, but the modest price difference buys you an insurer that actually understands farm operations.

Compare quotes from at least three insurers, including Nationwide, to see your actual costs. Farm truck insurance rates vary significantly based on your location, vehicle type and coverage needs.

Commercial farm truck insurance from Nationwide provides financial protection up to $1 million per accident with combined single limit liability coverage. Nationwide's policies meet all state requirements while offering flexibility to increase limits based on your operation's size and risk exposure.

You can customize your policy with additional coverages including physical damage protection, hired and non-owned auto coverage, and medical payments. Nationwide's comprehensive policy options exceed basic requirements.

Cheapest Commercial Farm Truck Insurance

Average Cost of Commercial Farm Truck Insurance

$248/monthlyOur Survey: Claims Process

4.3/5Our Survey: Likely to Recommend

4.2/5

- pros

Cheapest commercial farm truck insurance at $248 monthly

Ranks first in affordability with 4.67 out of 5 score

Offers lowest rates in 35 states nationwide

Saves farms $204 annually compared to company average

Digital-first platform provides quick quotes and easy policy management

consLimited agent support compared to traditional insurers

Fewer customization options than Nationwide or Hartford

ERGO NEXT makes commercial farm truck insurance affordable and accessible through its digital-first platform. The company leads all providers in affordability, delivering real savings without sacrificing essential coverage quality for agricultural operations.

The streamlined online experience lets farms get quotes and purchase coverage in minutes, eliminating the traditional agent process. This approach works well for cost-conscious operations comfortable with digital tools, particularly in high-cost states like California and New York where savings exceed $50 monthly.

ERGO NEXT ranks first in affordability at $248 monthly ($2,974 annually), making it the cheapest commercial farm truck insurance nationwide. You'll save $17 per month compared to the $265 company average, totaling $204 in annual savings while maintaining combined single limit liability protection.

ERGO NEXT focuses on digital service rather than traditional agent relationships. ERGO NEXT works well for online policy management and quick quote processing, with 24/7 access to policy documents, certificates of insurance and account management through mobile apps and web portals.

ERGO NEXT handles customer service by phone and email rather than through local agents. That setup works well if your questions are straightforward. File claims online and track their progress digitally. Response times match what you'd expect from other insurers.

Commercial farm truck insurance from ERGO NEXT provides up to $1 million combined single limit liability coverage per accident. Standard policies include bodily injury and property damage liability meeting all state requirements, with options to add physical damage coverage for your farm trucks.

The company's streamlined approach focuses on solid fundamental protection and essential coverages. This works well for farms needing straightforward coverage without complex risk management requirements.

Best Customer Service

Average Cost of Commercial Farm Truck Insurance

$266/monthlyOur Survey: Claims Process

4.5/5Our Survey: Likely to Recommend

4.4/5

- pros

Earns 5.0 out of 5 for coverage and terms, best among all providers

Ranks second overall at 4.53 out of 5

Second most affordable at $266 monthly

Customer experience score of 4.51 out of 5

Offers best overall value in eight states

consCosts $1 more monthly than company average

Agent-based model may not appeal to digital-first farms

The Hartford scored highest for coverage and terms among all commercial farm truck insurers we reviewed. You work with independent agents who specialize in commercial insurance and help you pick the right coverage for your farm.

The Hartford isn't the cheapest option at $266 monthly, but you get broader coverage and reliable service for the extra dollar. That beats a bare-bones policy that leaves gaps in your protection.

The Hartford costs $266 monthly ($3,187 annually), or $1 above the $265 average. That extra dollar buys much stronger coverage terms. Farms that can afford the slightly higher premium get the best value.

The Hartford ranks second for customer experience. Responsive agents and efficient claims processing back this rating. Farms work with independent agents who represent multiple insurers and give objective advice on coverage and pricing.

Hartford's claims process gets positive feedback for fair treatment and fast payments. Agents advocate for farms during claims. They help document losses and negotiate fair settlements when accidents involve agricultural equipment.

The Hartford provides up to $1 million combined single limit liability coverage per accident. You can increase limits based on your farm's needs. The Hartford offers more policy options than any other provider we reviewed. Customize coverage with endorsements like hired and non-owned auto, physical damage protection and specialized agricultural coverages.

Standard policies cover newly acquired vehicles automatically and waive the deductible for glass damage. Learn more about commercial auto insurance coverage options for your business vehicles.

Disclaimer

Ratings based on MoneyGeek's analysis of affordability, customer experience and coverage terms for commercial farm truck insurance with $1,000,000 CSL liability. Rates reflect averages and may vary by location, driving record and coverage selections.

Best Cheap Commercial Farm Truck Insurance Cost by State

The best commercial farm truck insurance varies by state. ERGO NEXT leads in 28 states for overall value while dominating affordability rankings nationwide. If your state's best provider isn't the cheapest, compare coverage quality before choosing on price alone.

| New Jersey | GEICO | 289.65 |

| Alaska | NEXT Insurance (Progressive Commercial) | 222.37 |

| Arizona | NEXT Insurance (Progressive Commercial) | 234.68 |

| California | NEXT Insurance (Progressive Commercial) | 291.13 |

| Colorado | NEXT Insurance (Progressive Commercial) | 263.39 |

| Florida | NEXT Insurance (Progressive Commercial) | 326.53 |

| Georgia | NEXT Insurance (Progressive Commercial) | 214.09 |

| Hawaii | NEXT Insurance (Progressive Commercial) | 175.03 |

| Idaho | NEXT Insurance (Progressive Commercial) | 165.37 |

| Illinois | NEXT Insurance (Progressive Commercial) | 275.46 |

| Indiana | NEXT Insurance (Progressive Commercial) | 212.23 |

| Massachusetts | NEXT Insurance (Progressive Commercial) | 280.4 |

| Michigan | NEXT Insurance (Progressive Commercial) | 288.73 |

| Minnesota | NEXT Insurance (Progressive Commercial) | 238.68 |

| Mississippi | NEXT Insurance (Progressive Commercial) | 216.58 |

| Missouri | NEXT Insurance (Progressive Commercial) | 265.54 |

| Nevada | NEXT Insurance (Progressive Commercial) | 247.75 |

| New Hampshire | NEXT Insurance (Progressive Commercial) | 149.64 |

| New Mexico | NEXT Insurance (Progressive Commercial) | 231.02 |

| New York | NEXT Insurance (Progressive Commercial) | 347.24 |

| North Carolina | NEXT Insurance (Progressive Commercial) | 192.62 |

| Ohio | NEXT Insurance (Progressive Commercial) | 217.57 |

| Oregon | NEXT Insurance (Progressive Commercial) | 229.98 |

| Pennsylvania | NEXT Insurance (Progressive Commercial) | 230.21 |

| South Carolina | NEXT Insurance (Progressive Commercial) | 224.91 |

| Texas | NEXT Insurance (Progressive Commercial) | 264.93 |

| Utah | NEXT Insurance (Progressive Commercial) | 189.16 |

| Virginia | NEXT Insurance (Progressive Commercial) | 220.11 |

| Washington | NEXT Insurance (Progressive Commercial) | 274.75 |

| Iowa | Nationwide | 171.8 |

| Kansas | Nationwide | 195.67 |

| Maine | Nationwide | 166.47 |

| Maryland | Nationwide | 316.11 |

| Nebraska | Nationwide | 180.62 |

| South Dakota | Nationwide | 241.44 |

| Vermont | Nationwide | 152.93 |

| Wisconsin | Nationwide | 205.04 |

| Alabama | The Hartford | 189.11 |

| Arkansas | The Hartford | 198.76 |

| Connecticut | The Hartford | 294 |

| Delaware | The Hartford | 226.29 |

| Kentucky | The Hartford | 210.01 |

| Louisiana | The Hartford | 340.05 |

| Montana | The Hartford | 186.94 |

| North Dakota | The Hartford | 169.51 |

| Oklahoma | The Hartford | 208.3 |

| Rhode Island | The Hartford | 304 |

| Tennessee | The Hartford | 234.28 |

| West Virginia | The Hartford | 212.96 |

| Wyoming | The Hartford | 193.29 |

Disclaimer

State averages based on commercial farm truck insurance quotes for $1,000,000 CSL liability coverage. Rates reflect statewide averages; your location within a state may affect pricing.

Factors That Affect Commercial Farm Truck Insurance Costs

Four factors determine your commercial farm truck insurance premium. Location creates the widest cost gap, with rates ranging from $170 in Maine to $412 in New York. Your driving record, vehicle type and coverage choices also heavily influence what you pay.

Your state is the single biggest rate factor. Maine farmers pay $170 monthly while New York operations pay $412 for identical coverage. States with higher accident rates, more litigation and stricter regulations charge more. Midwest and New England states consistently offer the lowest premiums.

Farm tractors, dump trucks and flatbeds each carry different risk profiles. Larger vehicles with higher liability exposure cost more to insure. Specialized equipment like hazmat tankers commands the highest premiums due to increased accident severity risk.

Clean driving records earn the lowest premiums. A single at-fault accident typically raises rates 20% to 40%. DUIs or multiple violations can increase costs 50% to 200%. Most insurers review the past three to five years of driving history.

GPS tracking, dash cameras and advanced braking systems may qualify for discounts of 5% to 15%. Driver safety training programs can also reduce premiums. Ask your insurer which equipment and certifications earn credits.

How to Get the Best Cheap Commercial Farm Truck Insurance

Nationwide is the best commercial farm truck insurer overall with a 4.54 rating, top customer experience and strong coverage terms at $271 monthly. ERGO NEXT is the cheapest at $248 monthly, ideal for farms comfortable with digital service. The Hartford offers the best coverage quality at $266 monthly. For most farms, Nationwide delivers the best balance of price, service and protection. Get quotes from all three to find the right fit for your operation.

- 1Assess Your Coverage Needs

Determine your liability requirements, vehicle values and risk exposure before shopping. Farms hauling goods off-property or hiring drivers typically need higher limits. Know whether you need liability-only or full physical damage coverage.

- 2Get Quotes From at Least Three Insurers

Request quotes from ERGO NEXT, Nationwide and The Hartford as a starting point. Rates vary widely by company and state. ERGO NEXT offers the lowest rates in 35 states while Nationwide and The Hartford lead in service and coverage quality.

- 3Compare Coverage Quality, Not Just Price

Review customer experience scores and coverage terms alongside premiums. The cheapest policy may exclude protections your operation needs. Nationwide scores highest for customer experience (4.64); The Hartford leads coverage terms (5.0).

- 4Raise Your Deductible

Increasing your deductible from $500 to $1,000 cuts premiums 10% to 15%. A $2,500 deductible saves 20% to 25%. Only choose a deductible you can afford to pay out of pocket after an accident.

- 5Bundle and Stack Discounts

Combine farm truck insurance with general liability, property or equipment coverage for 10% to 25% bundling discounts. Ask about safe driver credits, annual payment discounts and safety equipment savings (GPS, dash cams).

- 6Review and Shop Annually

Your rates change as your operation grows and driving records age. Shop new quotes every one to two years. Switching insurers saves farms $200 to $400 annually on average.

Cheap Commercial Farm Truck Insurance: Bottom Line

The cheapest and most expensive commercial farm truck insurance differ by more than $60 monthly. Compare multiple quotes, raise your deductible and bundle policies to cut costs 25% to 40%. Follow these steps to get the best coverage at the lowest price.

Farm Truck Insurance Cost: FAQ

We answer common questions about commercial farm truck insurance costs:

How much is commercial farm truck insurance?

Commercial farm truck insurance costs $268 per month on average for farm tractors with $1 million combined single limit liability coverage. Rates range from $170 monthly in Maine to $412 monthly in New York depending on location, driving record and coverage choices.

What's the cheapest commercial farm truck insurance?

ERGO NEXT offers the cheapest commercial farm truck insurance at $248 per month on average. The company provides the lowest rates in 35 states and saves farms in expensive insurance markets hundreds of dollars annually.

What does commercial farm truck insurance cover?

Commercial farm truck insurance covers liability for bodily injury and property damage when your farm trucks cause accidents. You can add physical damage coverage for your vehicles, hired and non-owned auto coverage, and medical payments. Policies typically provide $1 million combined single limit liability coverage per accident.

For comprehensive protection, consider pairing farm truck insurance with other types of business insurance for your agricultural operation.

Is farm truck insurance cheaper than regular commercial truck insurance?

Farm truck insurance typically costs 15% to 30% less than standard commercial truck insurance because agricultural vehicles drive fewer annual miles and operate in lower-risk rural areas. However, rates vary by state regulations and your specific operation.

What factors affect commercial farm truck insurance rates?

Your location, driving record, vehicle value, coverage limits, deductibles and annual mileage affect rates. States with higher accident rates charge more, while clean driving records and higher deductibles reduce premiums.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.