We analyzed five major insurers to find the best commercial pickup truck insurance. ERGO NEXT earns the top spot with the highest overall score and lowest rates. The Hartford follows with perfect coverage marks and superior customer service. Each company below offers $1,000,000 CSL liability coverage for pickup truck operators.

Best Cheap Commercial Pickup Truck Insurance For Small Business

With rates as low as $162/mo in Maine, the best cheap commercial pickup truck insurance is offered by ERGO NEXT Insurance, The Hartford and Nationwide.

Get matched to top commercial pickup truck insurance providers below.

Updated: January 28, 2026

Advertising & Editorial Disclosure

ERGO NEXT ranks best overall with a 4.60 score due to superior affordability, strong coverage options and fast digital quotes for contractors and small fleet operators.

ERGO NEXT is also the cheapest at $261/month ($3,137 annually) for $1,000,000 CSL coverage, saving $241/year versus the provider average.

Commercial pickup truck insurance averages $285/month ($3,416 annually), ranging from $185/month in Maine to $448/month in New York.

Compare quotes from at least three insurers and stack discounts (paid-in-full, multi-vehicle, bundling) to save 15-30% on your commercial pickup truck insurance.

MoneyGeek scored commercial pickup truck insurance providers across three weighted factors: Affordability (40%), Customer Experience (30%) and Coverage & Terms (30%). We analyzed $1,000,000 CSL (Combined Single Limit) Liability quotes from five major insurers across all 50 states. Affordability scores compare each provider's rates against market averages. Customer experience shows claims handling, agent support and policyholder satisfaction. Coverage scores evaluate policy terms, endorsement options and coverage flexibility.

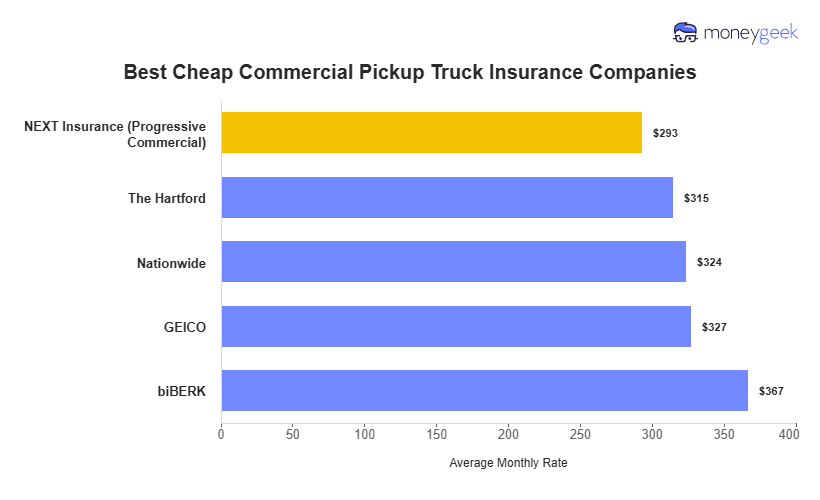

Best Cheap Commercial Pickup Truck Insurance Companies

| ERGO NEXT | 4.59 | $261 | 4 | 2 |

| The Hartford | 4.55 | $282 | 1 | 1 |

| Nationwide | 4.43 | $290 | 2 | 4 |

| biBERK | 4.36 | $331 | 3 | 3 |

| GEICO | 4.25 | $292 | 5 | 5 |

Data Source

MoneyGeek analysis of $1,000,000 CSL (Combined Single Limit) Liability coverage from five insurers, November 2025. Rates are national averages; your costs vary by location, driving record and operations.

Find Insurance for Your Business

Select your industry and state to get a customized quote.

Best Commercial Pickup Truck Insurance by State

Maine operators pay as low as $185/month while New York averages $448/month. ERGO NEXT leads in 31 states, The Hartford ranks first in 11 states, Nationwide wins 6 states and GEICO leads 2 states.

| Alabama | The Hartford | 1 | 1 | 1 |

| Alaska | ERGO NEXT | 1 | 2 | 2 |

| Arizona | ERGO NEXT | 1 | 3 | 2 |

| Arkansas | The Hartford | 1 | 1 | 1 |

| California | ERGO NEXT | 1 | 4 | 2 |

| Colorado | ERGO NEXT | 1 | 4 | 2 |

| Connecticut | ERGO NEXT | 1 | 3 | 2 |

| Delaware | The Hartford | 1 | 1 | 1 |

| Florida | ERGO NEXT | 1 | 4 | 2 |

| Georgia | ERGO NEXT | 1 | 4 | 2 |

| Hawaii | ERGO NEXT | 1 | 2 | 2 |

| Idaho | ERGO NEXT | 1 | 3 | 2 |

| Illinois | ERGO NEXT | 1 | 4 | 2 |

| Indiana | ERGO NEXT | 1 | 4 | 2 |

| Iowa | Nationwide | 1 | 2 | 3 |

| Kansas | Nationwide | 1 | 2 | 3 |

| Kentucky | The Hartford | 1 | 1 | 1 |

| Louisiana | The Hartford | 1 | 1 | 1 |

| Maine | ERGO NEXT | 1 | 3 | 2 |

| Maryland | GEICO | 1 | 5 | 5 |

| Massachusetts | ERGO NEXT | 1 | 3 | 2 |

| Michigan | ERGO NEXT | 1 | 3 | 2 |

| Minnesota | ERGO NEXT | 1 | 3 | 2 |

| Mississippi | ERGO NEXT | 1 | 3 | 2 |

| Missouri | ERGO NEXT | 1 | 4 | 2 |

| Montana | The Hartford | 1 | 1 | 1 |

| Nebraska | Nationwide | 1 | 2 | 3 |

| Nevada | ERGO NEXT | 1 | 3 | 2 |

| New Hampshire | ERGO NEXT | 1 | 3 | 2 |

| New Jersey | GEICO | 1 | 5 | 5 |

| New Mexico | ERGO NEXT | 1 | 3 | 2 |

| New York | ERGO NEXT | 1 | 4 | 2 |

| North Carolina | ERGO NEXT | 1 | 4 | 2 |

| North Dakota | The Hartford | 1 | 1 | 1 |

| Ohio | ERGO NEXT | 1 | 4 | 2 |

| Oklahoma | The Hartford | 1 | 1 | 1 |

| Oregon | ERGO NEXT | 1 | 3 | 2 |

| Pennsylvania | ERGO NEXT | 1 | 4 | 2 |

| Rhode Island | ERGO NEXT | 1 | 3 | 2 |

| South Carolina | ERGO NEXT | 1 | 3 | 2 |

| South Dakota | Nationwide | 1 | 2 | 3 |

| Tennessee | The Hartford | 1 | 1 | 1 |

| Texas | ERGO NEXT | 1 | 4 | 2 |

| Utah | ERGO NEXT | 1 | 3 | 2 |

| Vermont | Nationwide | 1 | 2 | 3 |

| Virginia | ERGO NEXT | 1 | 3 | 2 |

| Washington | ERGO NEXT | 1 | 3 | 2 |

| West Virginia | The Hartford | 1 | 1 | 1 |

| Wisconsin | Nationwide | 1 | 2 | 3 |

| Wyoming | The Hartford | 1 | 1 | 1 |

Data Source

Best company determined by highest Overall Score per state. Scores reflect affordability, customer experience and coverage. MoneyGeek analysis, November 2025.

Best Overall Value

Average Cost of $1M CSL Coverage

$261/monthOur Survey: Claims Process

3.9/5Fast digital claims filing with response times under 24 hoursOur Survey: Likely to Recommend to Others

4.8/5Small business owners praise affordability and ease of use

- pros

Offers the cheapest commercial pickup truck insurance rates nationally

Strong coverage score (4.89) shows strong policy options

Digital-first platform simplifies applications and claims

Available in 48 states with flexible coverage

No agent fees reduce overall costs

consCustomer experience ranks fourth among reviewed insurers

Limited in-person support compared to traditional carriers

ERGO NEXT offers the industry's lowest rates at $261 monthly ($3,137 annually), saving you $241 annually compared to the provider average. The digital platform eliminates traditional overhead and passes those savings directly to you. A strong 4.89 coverage score proves these policies handle pickup truck operators' needs well.

ERGO NEXT has rates ideal for budget-conscious pickup truck operators. You'll pay $261 monthly, $24 less than the $285 provider average for $1 million combined single limit liability coverage. Your business gets reliable financial protection without breaking the budget.

Customer experience ranks ERGO NEXT fourth with a 4.27 score. The digital-first model excels at quick quotes and policy management but offers less personal support than traditional insurers. Reviews praise fast claims processing and transparent pricing.

Coverage spans 48 states with $1 million combined single limit liability as standard protection. Increase limits based on your operation's needs, add physical damage coverage and get specialized endorsements for hauling equipment or working in high-risk areas. This flexible structure lets you build exactly the protection you need without paying for coverage you won't use.

Best for Customer Service

Average Cost of $1M CSL Coverage

$282/monthOur Survey: Claims Process

4.8/5Industry-leading claims handling with dedicated adjustersOur Survey: Likely to Recommend to Others

4.7/5Customers value personalized service and coverage expertise

- pros

Ranks first for customer experience with superior claims service

A++ AM Best rating shows strong financial strength

Dedicated agents provide personalized support

Over 200 years of industry experience

Perfect coverage score (5.0) with broad policy options

consPremium costs $21 more monthly than cheapest option

Traditional model can process quotes slower than digital competitors

The Hartford has strong service quality and proven financial stability. An A++ AM Best rating and 200+ years in business mean your claims get paid when accidents happen. Monthly costs run $282, just $21 more than the cheapest option. That premium buys superior agent support and claims handling.

Affordability ranks The Hartford second at $282 monthly ($3,388 annually). You'll spend $21 more per month than the cheapest option, but that premium buys superior customer service and financial security. The $252 annual difference buys dedicated agent support and claims expertise that can save thousands when you file claims.

The Hartford leads customer experience with a 4.58 score. Claims processing and service quality top the charts as customers consistently praise reps who handle claims efficiently. The traditional model offers less instant online access than newer insurers, but most operators value the expertise and personal attention.

Nationwide coverage includes $1 million combined single limit liability as the foundation. Customize policies with higher liability limits, physical damage coverage and specialized endorsements for construction work or equipment hauling. Bundle pickup truck insurance with general liability and workers' compensation for additional savings and simpler policy management.

Best for Growing Businesses

Average Cost of $1M CSL Coverage

$290/monthOur Survey: Claims Process

3.9/5Reliable claims handling with solid digital and phone supportOur Survey: Likely to Recommend to Others

4.3/5Growing businesses appreciate multi-truck discounts and fleet tools

- pros

Lowest rates in Iowa, Kansas, Nebraska, South Dakota, Vermont and Wisconsin

Strong customer experience score (4.48)

Good coverage options with 4.73 coverage score

Local agents available for personalized service

cons- Higher rates in coastal and high-population states

- Less competitive nationally compared to ERGO NEXT and The Hartford

Nationwide excels for pickup truck operators in select states. The insurer offers the lowest rates in six states, including Iowa ($188/month), Kansas ($214/month), Nebraska ($195/month), South Dakota ($269/month), Vermont ($164/month) and Wisconsin ($215/month). Monthly costs average $290 nationally, competitive with industry standards.

Nationwide ranks third for affordability at $290 monthly ($3,474 annually). While not the cheapest nationally, Midwestern operators pay substantially less. Iowa businesses pay just $188/month, 34% below the national average.

Customer experience scores 4.48, ranking Nationwide second among reviewed insurers. Local agents provide personalized service while claims handling earns strong marks from policyholders.

Coverage includes $1 million combined single limit liability with options for higher limits. Physical damage, cargo and specialized endorsements round out available protection. Bundle with other Nationwide business policies for multi-policy discounts.

How Much Does Commercial Pickup Truck Insurance Cost?

Commercial pickup truck insurance costs $285/month ($3,416/year) on average for $1,000,000 CSL coverage. Your location drives the biggest price difference. Maine operators pay just $185/month while New York businesses pay $448/month for identical coverage.

Average Monthly Premium | $285 |

Average Annual Premium | $3,416 |

Lowest State (Maine) | $185/month |

Highest State (New York) | $448/month |

Monthly Range | $185 - $448 |

Data Source

Rates for $1,000,000 CSL (Combined Single Limit) Liability coverage. Averages based on five major providers. MoneyGeek analysis, November 2025.

You want the cheapest rates and feel comfortable managing everything online. Best for startups and solo operators.

You value exceptional customer service and comprehensive coverage with agent support. Best for established businesses prioritizing claims quality.

You're planning to grow from one truck to a small fleet. Best for businesses expecting to add vehicles within two to three years.

Commercial Pickup Truck Insurance Requirements by State

State requirements vary greatly affecting mandatory coverage types and costs. Legal compliance requires understanding your state's specific mandates and commercial auto requirements.

Every state mandates minimum liability coverage of $25,000 to $50,000 per person and $50,000 to $100,000 per accident, but these limits rarely provide adequate business protection since serious accidents easily generate $200,000 to $500,000 in damages. Small businesses should carry $500,000 to $1 million in combined single limit coverage, though some states require split-limit liability (like 100/300/100) instead.

Twelve states mandate personal injury protection or medical payments coverage beyond basic liability. Many states require uninsured motorist coverage, particularly in areas with high uninsured driver rates. Florida and Virginia require FR-44 certificates for serious violations, mandating higher liability limits than standard requirements.

Financed and leased vehicles require collision and comprehensive coverage until loan payoff. Lenders mandate this to protect their financial interest. Once you own vehicles outright, physical damage becomes optional, though most businesses maintain coverage on newer trucks.

What Coverage Do Small Businesses Need?

Different coverages protect vehicles and your business finances. Choosing the right combination prevents under-insurance without overpaying for unnecessary protection.

Essential Coverage Types

Collision Coverage | Covers accident damage to your truck, regardless of fault. | $500–$2,500 | Required for financed or leased vehicles. |

Comprehensive Coverage | Covers non-collision damage (theft, vandalism, fire, flooding, etc.). | $500–$2,500 | Required for financed or leased vehicles. |

Hired & Non-Owned Auto Liability | Protects your business when employees drive vehicles not owned by the company. | None | Typically $200–$400 annually. |

Uninsured / Underinsured Motorist | Covers you if hit by drivers with little or no insurance. | Varies by state | Around $50–$150 annually (in optional states). |

Coverage Level Comparison: What Changes Your Cost

State Minimum Only | Basic liability at minimum limits | Baseline state cost | High-risk budgets, older trucks |

Enhanced Liability | Increase limits to $500k-$1M | Add $15-$50/month | Most small businesses |

Add Physical Damage | Collision + comprehensive | Add $30-$80/month | Financed vehicles, newer trucks |

Full Protection Package | Higher limits + all coverages | Add $80-$150/month | High-value trucks, contract requirements |

Data Disclaimer

Costs shown reflect additions to baseline state minimum premiums (basic liability only). Example: Maine's baseline state minimum averages $120-$150 per month; adding enhanced liability ($1 million) brings total to approximately $185 per month shown in state comparison table above. Actual costs vary by location, driving record and specific coverage selections.

Factors That Affect Commercial Pickup Truck Insurance Costs

Several factors determine your commercial pickup truck insurance premium. Insurers evaluate your vehicle, drivers, location and business operations to calculate risk. These factors also create opportunities to save:

Higher liability limits cost more. Moving from $500,000 to $1,000,000 CSL adds 10-20% to your premium. Most contractor agreements require $1,000,000 minimum, making this the standard coverage level for commercial pickup truck operators.

Higher deductibles lower your premium. A $1,000 deductible saves 5-10% compared to a $500 deductible. A $2,500 deductible saves 10-20%. Choose based on your cash reserves since you pay the deductible before insurance covers a claim.

Newer, more expensive pickup trucks cost more to insure. A 2024 F-150 costs more to cover than a 2018 model because replacement parts and repairs cost more. Older trucks with lower values qualify for liability-only coverage, reducing premiums.

Clean driving records earn lower rates. One at-fault accident raises premiums 20-40% for three to five years. DUIs disqualify drivers from most commercial policies. Insurers review MVRs for all drivers on your policy and look back 3-5 years.

How you use your pickup truck affects your rate. Light delivery and service calls pay lower rates than hauling heavy equipment or construction materials. Landscapers, plumbers and electricians with specialized equipment need additional coverage endorsements.

Your state and territory determine base rates. Maine operators pay $185/month while New York businesses pay $448/month for identical coverage. Urban operations with dense traffic pay more than rural routes due to higher accident frequency.

Experienced drivers cost less to insure. Drivers with 5+ years of commercial experience qualify for better rates than newer drivers. Operations with 3+ years of claims-free history earn 10-15% discounts.

More vehicles mean lower per-truck costs. Insuring 2-5 pickup trucks saves 5-10% per vehicle through fleet discounts. Fleets of 10+ vehicles negotiate 10-20% discounts plus dedicated account management. Single-truck owner-operators pay the highest per-vehicle rates.

Affordable Commercial Pickup Truck Insurance: Bottom Line

ERGO NEXT offers the best value at $261/month with strong coverage scores. The Hartford costs $21 more but ranks first for customer service and claims handling. Maine operators pay the lowest rates at $185/month while New York pays the highest at $448/month. Compare quotes from three or more providers to find your best rate.

Commercial Pickup Truck Insurance Quotes: FAQ

Frequently asked questions about commercial pickup truck insurance:

How much does commercial pickup truck insurance cost?

Commercial pickup truck insurance costs $285/month ($3,416/year) on average for $1,000,000 CSL coverage. Rates range from $185/month in Maine to $448/month in New York. ERGO NEXT offers the lowest national rates at $261/month. Your final cost depends on your state, driving history, coverage limits and business type.

Do I need commercial insurance for my pickup truck?

Yes, if you use your pickup truck for any business purpose. Personal auto policies exclude business use and deny claims for work-related accidents. You need commercial coverage when hauling materials, transporting equipment, making deliveries, driving to job sites or when clients require proof of commercial insurance.

What does commercial pickup truck insurance cover?

Commercial pickup truck insurance covers liability for bodily injury and property damage you cause while working. You can add collision coverage for accident damage, comprehensive coverage for theft and weather damage, cargo coverage for hauled goods, uninsured motorist protection and medical payments for driver injuries.

What is the difference between personal and commercial pickup truck insurance?

Personal auto insurance covers personal driving only and excludes business activities. Commercial pickup truck insurance covers work-related use including hauling materials, transporting equipment and employee drivers. Commercial policies include higher liability limits required by clients and endorsements for business-specific risks.

How can I lower my commercial pickup truck insurance costs?

Compare quotes from at least three insurers to find the lowest rate. Increase your deductible to $1,000 or higher. Bundle with other business policies for 10-20% savings. Install dash cams and GPS for safety discounts. Pay your premium in full for 5-10% off. Remove drivers with violations from your policy.

About Blest Papio

Blest Papio is a Content Producer at MoneyGeek specializing in small business insurance. With five years of experience in insurance and finance writing and hands-on perspective as a former business counselor, he understands the risks that come with running a business and what it takes to protect against them.

Blest focuses on commercial auto, cyber, property and specialty business insurance. He digs deep into policy details, regulations and provider offerings so businesses can find the coverage they need and avoid financial fallout. His goal is to translate technical insurance language and insurer offerings into guides you can act on.

Whether you're insuring company vehicles, managing cyber liability or protecting your commercial property, Blest aims to guide you through your risks to help you find coverage you truly need, not sell you a policy.