ERGO NEXT and The Hartford separate themselves from the pack, but for different reasons. ERGO NEXT delivers the lowest rates for budget-conscious warehouse operators, while The Hartford justifies its slightly higher cost with superior claims handling and coverage flexibility.

Best Cheap Commercial Forklift Insurance (2026 Picks)

NEXT Insurance offers the best cheap forklift insurance at $316 per month, combining top affordability with strong coverage for warehouse and industrial operations.

Get matched with top forlift insurers today.

Updated: February 1, 2026

Advertising & Editorial Disclosure

NEXT Insurance offers the best cheap forklift insurance, ranking first for affordability and second for coverage. The Hartford follows with top marks for customer experience and coverage flexibility.

NEXT Insurance charges $316 per month ($3,790 annually), saving businesses about $286 per year compared to the provider average.

Commercial forklift insurance runs $344 per month on average, or $4,124 per year. State rates range from $227 monthly in Maine to $530 in New York.

Compare quotes from at least three insurers, document operator OSHA certifications and bundle forklift coverage with general liability for discounts up to 20%.

MoneyGeek scored forklift insurers on affordability (55%), customer experience (30%) and coverage options (15%). Premiums reflect 100/300/100 liability with a $1,000 deductible for comprehensive and collision. Customer experience draws from satisfaction surveys and complaint data; coverage scores reflect policy flexibility and endorsement availability.

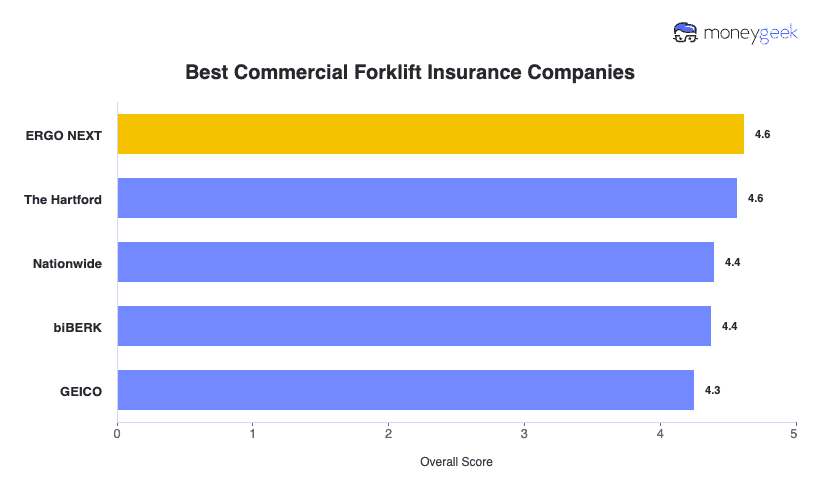

Best Commercial Forklift Insurance Companies

| ERGO NEXT | 4.62 | $371 | 4.27 | 4.97 |

| The Hartford | 4.57 | $399 | 4.63 | 4.98 |

| Nationwide | 4.40 | $411 | 4.43 | 4.69 |

| biBERK | 4.38 | $468 | 4.39 | 4.87 |

| GEICO | 4.25 | $411 | 4.16 | 4.48 |

Data Disclaimer

Rates reflect average monthly premiums for $1,000,000 CSL liability coverage with $1,000 deductible for comprehensive and collision. Actual rates vary by location, fleet size and claims history. Data collected November 2025.

Get Your Commercial Forklift Insurance Quote

Compare rates from top providers for your business. Enter your fleet size and location to see customized quotes in minutes.

Cheapest Overall

Average Cost

$316/monthlyOur Survey: Claims Process

4.3/5Our Survey: Likely to Recommend

4.6/5

- pros

Offers the cheapest forklift insurance rates nationally

Second-highest coverage score reflects comprehensive policy options

Digital-first platform streamlines applications and claims

No agent fees reduce overall costs

Flexible coverage for warehouse and construction use

consCustomer experience ranks fourth among reviewed insurers

Limited in-person support compared to traditional carriers

ERGO NEXT offers the lowest rates in our forklift insurance analysis at $316 monthly ($3,790 annually), saving you $286 a year compared to the provider average. The digital platform cuts out traditional overhead and passes those savings straight to you. The 4.94 coverage score shows these policies handle forklift operators' needs well.

ERGO NEXT wins on affordability, making it ideal for budget-conscious forklift operators. You'll pay $316 monthly, $24 less than the $340 provider average for 100/300/100 liability coverage. Your business gets reliable financial protection without straining the budget.

ERGO NEXT scores 4.27 for customer experience, landing in fourth place. The digital-first model excels at quick quotes and policy management but offers less personal support than traditional insurers. Reviews highlight fast claims processing and transparent pricing.

ERGO NEXT provides 100/300/100 liability coverage with a $1,000 deductible for comprehensive and collision as the standard. You can increase limits based on your operation needs, add physical damage coverage and get endorsements for warehouse or construction site use. The flexible structure lets you build exactly the protection you need without paying for extras you don't.

Best Value for Comprehensive Coverage

Average Cost

$337/monthlyOur Survey: Claims Process

4.6/5Our Survey: Likely to Recommend

4.7/5

- pros

Ranks first for both customer experience and coverage options

Established reputation for handling commercial equipment claims

Dedicated support teams for small business policyholders

Top coverage score at 4.98 out of 5

Financially stable with long commercial insurance track record

consCosts $21 more per month than the cheapest option

Less competitive for businesses focused purely on price

The Hartford earns the top spot for customer experience and coverage quality, scoring 4.63 and 4.98 respectively. You'll pay $337 monthly ($4,048 annually), about $21 more than ERGO NEXT, but gain access to superior claims handling and policy support. For businesses that value service alongside savings, The Hartford delivers excellent overall value.

The Hartford ranks second for affordability at $337 per month, just below the $340 provider average. You'll pay about $21 more than ERGO NEXT, but that extra cost buys you first-place rankings in both customer experience and coverage options.

The Hartford leads all reviewed insurers in customer experience with a 4.63 score. The company built its reputation on commercial insurance and offers dedicated small business support teams. Policyholders report smooth claims processing and responsive service when issues arise.

The Hartford scores 4.98 for coverage, the highest among reviewed providers. Standard policies include 100/300/100 liability with comprehensive and collision options. You can add equipment breakdown coverage, hired and non-owned auto protection and specialized endorsements for different forklift types. The Hartford's policy flexibility makes it easy to match coverage to your specific operation.

Data Disclaimer

ERGO NEXT and The Hartford rates and features are based on MoneyGeek's analysis of policy offerings and customer surveys conducted in October 2025. Individual rates may vary based on location, driving history, and the selected coverage. Contact providers directly for a personalized quote.

Best Commercial Forklift Insurance by State

ERGO NEXT dominates most states due to its pricing advantage, but The Hartford and Nationwide outperform in specific regions where their local underwriting delivers better value. The table below shows the top-rated insurer for each state based on our combined scoring of affordability, customer experience and coverage.

| Maryland | GEICO | 399.85 | 4.21 | 4.48 |

| New Jersey | GEICO | 426.8 | 4.16 | 4.48 |

| Alaska | ERGO NEXT | 343.37 | 4.27 | 4.97 |

| Arizona | ERGO NEXT | 361.55 | 4.27 | 4.97 |

| California | ERGO NEXT | 425.77 | 4.27 | 4.98 |

| Colorado | ERGO NEXT | 383.93 | 4.27 | 4.97 |

| Connecticut | ERGO NEXT | 408.73 | 4.27 | 4.97 |

| Florida | ERGO NEXT | 460.19 | 4.27 | 4.97 |

| Georgia | ERGO NEXT | 322.07 | 4.27 | 4.97 |

| Hawaii | ERGO NEXT | 272.16 | 4.27 | 4.97 |

| Idaho | ERGO NEXT | 254.35 | 4.27 | 4.97 |

| Illinois | ERGO NEXT | 389.9 | 4.27 | 4.97 |

| Indiana | ERGO NEXT | 309.49 | 4.27 | 4.97 |

| Maine | ERGO NEXT | 227.09 | 4.27 | 4.97 |

| Massachusetts | ERGO NEXT | 409.58 | 4.27 | 4.97 |

| Michigan | ERGO NEXT | 440.16 | 4.27 | 4.97 |

| Minnesota | ERGO NEXT | 370.34 | 4.27 | 4.97 |

| Mississippi | ERGO NEXT | 322.27 | 4.27 | 4.97 |

| Missouri | ERGO NEXT | 391.9 | 4.27 | 4.97 |

| Nevada | ERGO NEXT | 375.02 | 4.27 | 4.97 |

| New Hampshire | ERGO NEXT | 239.3 | 4.27 | 4.97 |

| New Mexico | ERGO NEXT | 319.35 | 4.27 | 4.97 |

| New York | ERGO NEXT | 539.05 | 4.27 | 4.97 |

| North Carolina | ERGO NEXT | 299.72 | 4.27 | 4.97 |

| Ohio | ERGO NEXT | 323.17 | 4.27 | 4.97 |

| Oregon | ERGO NEXT | 338.95 | 4.27 | 4.97 |

| Pennsylvania | ERGO NEXT | 362.8 | 4.27 | 4.97 |

| Rhode Island | ERGO NEXT | 428.79 | 4.27 | 4.97 |

| South Carolina | ERGO NEXT | 327.65 | 4.27 | 4.97 |

| Texas | ERGO NEXT | 402.96 | 4.27 | 4.97 |

| Utah | ERGO NEXT | 285.08 | 4.27 | 4.97 |

| Virginia | ERGO NEXT | 337.05 | 4.27 | 4.97 |

| Washington | ERGO NEXT | 414.35 | 4.27 | 4.97 |

| Iowa | Nationwide | 265.3 | 4.51 | 4.75 |

| Kansas | Nationwide | 298.13 | 4.5 | 4.69 |

| Nebraska | Nationwide | 283.6 | 4.5 | 4.69 |

| South Dakota | Nationwide | 379.32 | 4.42 | 4.69 |

| Vermont | Nationwide | 228.11 | 4.42 | 4.69 |

| Wisconsin | Nationwide | 312.54 | 4.48 | 4.69 |

| Alabama | The Hartford | 280.81 | 4.62 | 4.98 |

| Arkansas | The Hartford | 315.06 | 4.62 | 4.98 |

| Delaware | The Hartford | 338.83 | 4.62 | 4.98 |

| Kentucky | The Hartford | 328.73 | 4.62 | 4.98 |

| Louisiana | The Hartford | 502.68 | 4.62 | 4.98 |

| Montana | The Hartford | 292.38 | 4.62 | 4.98 |

| North Dakota | The Hartford | 258.77 | 4.62 | 4.98 |

| Oklahoma | The Hartford | 298.16 | 4.62 | 4.98 |

| Tennessee | The Hartford | 344.2 | 4.62 | 4.98 |

| West Virginia | The Hartford | 316.18 | 4.62 | 4.98 |

| Wyoming | The Hartford | 294.3 | 4.62 | 4.98 |

Data Disclaimer

Best company determined by overall MoneyGeek score combining affordability, customer experience and coverage. Rates reflect state averages for $1,000,000 CSL liability with $1,000 deductible.

Cheapest Commercial Forklift Insurance Companies

ERGO NEXT offers the cheapest forklift insurance at $315.87 per month, saving businesses nearly 7% compared to the average provider. The Hartford comes in second at $337.37 monthly, proving that affordable coverage doesn't require sacrificing quality.

| ERGO NEXT () | $316 | $3,790 |

| The Hartford | $337 | $4,048 |

| GEICO | $352 | $4,221 |

| Nationwide | $353 | $4,237 |

| biBERK | $400 | $4,802 |

Data Disclaimer

Premium data reflects average rates for 100/300/100 liability coverage with $1,000 deductible. Your actual premium depends on factors including fleet size, operator experience and claims history.

How Much Does Commercial Forklift Insurance Cost?

The $344 monthly national average masks considerable regional variation. Businesses in low-cost states like Maine and Vermont pay 30-34% below average, while operations in New York and Louisiana should budget 44-54% above these figures.

National Average (Monthly) | $344 |

National Average (Annual) | $4,124 |

Lowest State Average (Maine) | $227/mo |

Highest State Average (New York) | $530/mo |

Cheapest Provider Average | $316/mo (ERGO NEXT) |

Most Expensive Provider Average | $400/mo (biBERK) |

States with high commercial activity, dense urban areas and frequent litigation charge the most. Maine, New Hampshire and Vermont offer the lowest rates due to lower population density and fewer claims.

Commercial Forklift Insurance Requirements

Coverage requirements increase with forklift size and operational complexity. Class I-IV indoor warehouse forklifts need standard liability limits, while Class VII rough terrain units operating on construction sites typically require higher limits and specialized endorsements.

Class I (Electric Sit-Down) | 3,000-12,000 lbs | $1,000,000 CSL | No | Warehouse liability |

Class II (Electric Narrow Aisle) | 3,000-5,500 lbs | $1,000,000 CSL | No | Rack damage coverage |

Class III (Electric Pallet Jack) | 4,000-8,000 lbs | $1,000,000 CSL | No | Basic liability only |

Class IV (IC Cushion Tire) | 3,000-15,500 lbs | $1,000,000 CSL | No | Fire/combustion coverage |

Class V (IC Pneumatic Tire) | 3,000-36,000 lbs | $1,000,000 CSL | Varies | Outdoor operation endorsement |

Class VI (Electric/IC Tow Tractor) | 4,000-50,000 lbs | $1,000,000 CSL | Varies | Trailer liability |

Class VII (Rough Terrain) | 5,000-50,000+ lbs | $2,000,000 CSL | Often | Construction site endorsement |

Forklifts operated on public roads require commercial auto insurance meeting state minimums, though $1,000,000 CSL is the industry standard for commercial operations. Private property use has fewer legal mandates, but landlord and customer contracts typically require $1 million in liability coverage regardless of equipment class.

Factors That Affect Flatbed Truck Insurance Costs

Location, equipment type and lifting capacity drive most of your premium, but you can't change those. Focus instead on the controllable factors below, where operator training, safety equipment and bundling can reduce costs 15-30%.

Electric forklifts used indoors cost less to insure than propane, diesel or rough terrain models. Outdoor forklifts face greater exposure to accidents, weather damage and theft. Rough terrain forklifts carry the highest premiums due to their use on uneven surfaces and construction sites.

Higher lifting capacity means higher premiums. Insurers base coverage costs on the replacement value of your equipment, so you'll pay more for a $50,000 forklift than a $15,000 model. Upgrading to higher-capacity machines raises your insurance costs.

Warehouse forklifts operating indoors have lower accident rates and theft risk. Outdoor operations expose equipment to weather, traffic and more variable conditions. Expect higher premiums if your forklifts work outside regularly.

Larger fleets qualify for volume discounts, but more forklifts also mean more potential claims. A five-unit fleet costs less per forklift than insuring a single unit. Your final rate reflects the balance between discount eligibility and total risk exposure.

OSHA-certified operators with clean safety records lower your insurance costs. Companies with documented training programs and regular refresher courses qualify for discounts. A well-trained team signals lower risk, which translates to lower premiums.

Forklifts running multiple shifts face more wear and accident exposure. Part-time operations with limited hours cost less to insure. You'll answer questions about daily and weekly usage when getting a quote.

Moving hazardous materials, fragile goods or high-value inventory increases liability exposure. Standard warehouse goods carry lower risk. What your forklifts transport directly affects your premium.

Rental companies require specific coverage minimums for leased forklifts. Owned equipment gives you more flexibility in structuring your policy. You'll often pay more for leased forklifts when mandatory coverage requirements exceed what you'd otherwise carry.

How to Get Commercial Forklift Insurance

The process takes 30-45 minutes with proper documentation. Having your fleet inventory, OSHA certifications and business records ready before requesting quotes speeds up approval and often results in better rates.

- 1

Gather Your Information

Collect your EIN, years in operation and annual revenue. Document your forklift fleet including make, model, age, lifting capacity, power source and replacement value for each unit. Have operator certification records showing OSHA compliance and training dates.

- 2

Request Quotes from Multiple Providers

Contact at least three insurers including ERGO NEXT and The Hartford. Use the same coverage specs for each quote: $1,000,000 CSL liability with $1,000 deductible for comprehensive and collision. Request quotes online or call during business hours.

- 3

Review Coverage Details

Compare policy documents, not just prices. Check liability limits, deductibles and exclusions. Verify coverage extends to all locations where your forklifts operate including customer sites. Confirm the policy covers your specific forklift types.

- 4

Provide Required Documentation

Submit your business license, EIN verification and operator certification records. Provide forklift titles or lease agreements. Some insurers require photos of equipment or facility safety documentation.

- 5

Pay Your Premium

Choose monthly or annual payment. Annual payment often saves 5-10% compared to monthly billing. Set up autopay to avoid coverage lapses.

- 6

Add Certificate Holders

Request certificates of insurance for landlords, customers or lessors who require proof of coverage. Most insurers provide COIs within 24-48 hours through online portals.

Commercial Forklift Insurance: Bottom Line

ERGO NEXT offers the best value at $316 per month with strong coverage scores. The Hartford costs more but leads for claims support. Get quotes from at least three providers to find your best rate.

Related Resources:

Forklift Insurance: FAQ

These questions cover the basics of forklift coverage, legal requirements and cost factors that warehouse and distribution operators ask most frequently:

What is forklift insurance?

Forklift insurance protects businesses against financial losses from forklift accidents. Policies include liability coverage for injuries or property damage, collision coverage for equipment damage and comprehensive coverage for theft or fire. Most businesses buy this through commercial auto or inland marine policies.

Do I need forklift insurance for my business?

Yes, if you operate forklifts commercially. Liability coverage protects you if a forklift damages property or injures someone. Lease agreements and customer contracts often require proof of insurance. Coverage shields your operation from repair costs, legal fees and injury claims.

What does forklift insurance cover?

Standard policies cover liability for bodily injury and property damage, collision damage to equipment and comprehensive losses like theft or fire. Options include attached equipment coverage, loading operations protection and temporary replacement equipment. Exclusions typically include intentional damage and operation by uncertified operators.

Is forklift insurance legally required?

Forklifts on public roads need commercial auto insurance meeting state minimums. Private property use has fewer legal mandates, but lease agreements and customer contracts often require coverage. OSHA workplace safety rules also support maintaining proper insurance for material handling equipment.

How much does forklift insurance cost on average?

Commercial forklift insurance costs $344 per month on average, or $4,124 per year. Rates range from $227 monthly in Maine to $530 in New York. Your cost depends on forklift type, lifting capacity, fleet size, operator certifications and claims history.

Can I get forklift insurance for rented equipment?

Yes. Rental companies typically require you to buy their damage waiver or show proof of coverage meeting their specs. Your commercial auto or inland marine policy may extend to rentals with proper endorsements. Verify requirements before signing rental agreements.

What factors affect forklift insurance rates?

Key factors include forklift type and power source, lifting capacity, indoor versus outdoor operations, fleet size, operator certifications, materials handled and claims history. Location plays a major role, with urban areas and high-litigation states charging more than rural regions.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.