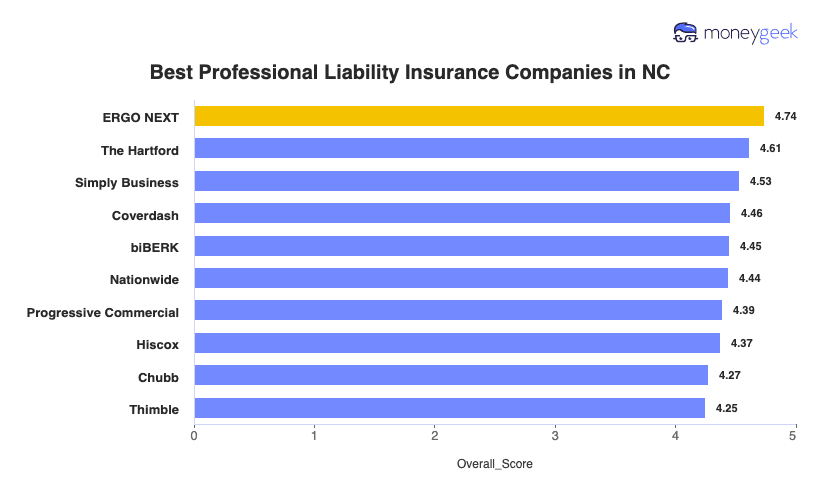

For the best professional liability insurance in North Carolina, ERGO NEXT tops our rankings with competitive rates, excellent customer service and a very easy to manage digital experience. The Hartford places second as the cheapest professional indemnity insurer in the state with rates averaging $62 per month (saving $5 monthly on average). Simply Business, Coverdash and biBerk follow as the next in line top providers you should also consider in your search for the top errors and omissions insurance in NC.

Best Professional Liability Insurance in North Carolina

Get NC professional liability insurance quotes starting at $29 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in NC for you below.

Updated: January 28, 2026

Advertising & Editorial Disclosure

The best professional liability insurance in North Carolina is offered by ERGO NEXT, while the cheapest policies come from The Hartford (Read more).

Professional liability insurance costs in North Carolina average $67 monthly ($807 annually), making it the most affordable state for this coverage (Read more).

Professional liability insurance in North Carolina protects you from damages coming from negligence and inability to meet contractual obligations (Read more).

In terms of state requirements, most North Carolina businesses are not required to have professional liability insurance, unless they're in the medical field (Read more).

Comparing small business insurance quotes, companies and coverage options specific to your needs will allow you to find the best professional liability option in NC (Read More).

Best Professional Liability Insurance Companies in North Carolina

| ERGO NEXT | 4.74 | $63 |

| The Hartford | 4.61 | $62 |

| Simply Business | 4.53 | $66 |

| Coverdash | 4.46 | $67 |

| biBERK | 4.45 | $68 |

| Nationwide | 4.44 | $72 |

| Progressive Commercial | 4.39 | $66 |

| Hiscox | 4.37 | $67 |

| Chubb | 4.27 | $77 |

| Thimble | 4.25 | $66 |

How Did We Determine The Best Professional Liability Insurance in North Carolina?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Beyond professional liability insurance in North Carolina, we've provided the following state-specific resources to get the best coverage for your business:

1. ERGO NEXT: Best Professional Liability Insurance in NC

Tops MoneyGeek's analysis on insurers in North Carolina for professional liability insurance

Ranks first for their customer service experience

Allows coverage in 10 minutes with instant certificates

Personalized coverage matching for both types and limit amounts

Less than 10 years in business

Ranks lower on claims handling

Small business owners in North Carolina will find ERGO NEXT to be the best overall professional liability insurer due to their low rates, highly rated digital experience (top by customers in our study), and personalized coverage matching service (types and amounts) online in under 10 minutes without needing an agent. The provider also offers the second-lowest E&O insurance prices, averaging $63 per month ($4 below average). Most customers really enjoy their easy policy management experience online with instant COIs (certificates of insurance) and mobile app (4.9 out of 5 stars) on the Apple Store.

2. The Hartford: Cheapest Professional Liability Insurance in NC

Lowest rates for professional liability insurance in NC

Best claims handling and agent service ratings from customers

Great personalized E&O coverage options for tech, law and medical professionals

Less ideal digital experience than competitors

Not available in Alaska and Hawaii

As a close second-place option for North Carolina professional liability insurance, The Hartford stands out as the best traditional insurer (second overall) in the state with the lowest rates, second-best-rated customer experience overall, and personalized coverage packages for specialized industries. In our study of customers specific to the provider, we found it ranked first for claims handling and agent service, with many praising its strong industry knowledge (supported by over 200+ years of experience) and quick reimbursements. It also offers many personalized errors and omissions coverage for high-risk industries, including Tech errors and omissions policies and malpractice insurance for lawyers and medical professionals.

3. Simply Business: Best Professional Liability Insurance Coverage Options in NC

Ranks first for coverage options with access to more than 16 carriers offering specialized policies

Backed by Travelers' A++ Superior financial rating

Lets you compare multiple quotes in 10 minutes instead of calling individual insurers

Broker model finds coverage for hard-to-insure businesses that other insurers reject

More expensive than other providers in MoneyGeek's study

Claims process ranks eighth nationally, indicating slower resolution times

You’d benefit from Simply Business's broker model in North Carolina if you need specialized professional liability coverage or have been rejected by direct insurers. You'll pay $66 monthly versus competitors' lower premiums but gain access to specialized policies and hard-to-find coverage through their large provider network. Business owners with unique risks or complex needs will find the broker approach worth the premium.

Average Cost of Professional Liability Insurance in North Carolina

Professional liability rates in North Carolina range widely depending on industry with home-based businesses paying the lowest price at around $32 monthly, while mortgage brokers pay the highest average rates of $143. Below you can find out how much NC professional liability insurance costs for your business by filtering for your industry.

| Accountants | $125 | $1,504 |

| Ad Agency | $86 | $1,029 |

| Auto Repair | $71 | $851 |

| Automotive | $64 | $770 |

| Bakery | $46 | $547 |

| Barber | $37 | $449 |

| Beauty Salon | $42 | $505 |

| Bounce House | $51 | $617 |

| Candle | $36 | $434 |

| Cannabis | $104 | $1,251 |

| Catering | $68 | $818 |

| Cleaning | $47 | $566 |

| Coffee Shop | $53 | $638 |

| Computer Programming | $89 | $1,065 |

| Computer Repair | $54 | $647 |

| Construction | $67 | $807 |

| Consulting | $96 | $1,146 |

| Contractor | $55 | $655 |

| Courier | $44 | $523 |

| DJ | $39 | $474 |

| Daycare | $94 | $1,123 |

| Dental | $72 | $864 |

| Dog Grooming | $47 | $570 |

| Drone | $93 | $1,110 |

| Ecommerce | $52 | $627 |

| Electrical | $56 | $674 |

| Engineering | $90 | $1,083 |

| Excavation | $59 | $709 |

| Florist | $32 | $389 |

| Food | $97 | $1,164 |

| Food Truck | $52 | $625 |

| Funeral Home | $70 | $835 |

| Gardening | $35 | $416 |

| HVAC | $71 | $854 |

| Handyman | $46 | $555 |

| Home-based business | $32 | $387 |

| Hospitality | $62 | $747 |

| Janitorial | $42 | $505 |

| Jewelry | $53 | $637 |

| Junk Removal | $58 | $698 |

| Lawn/Landscaping | $45 | $536 |

| Lawyers | $126 | $1,506 |

| Manufacturing | $52 | $627 |

| Marine | $77 | $928 |

| Massage | $92 | $1,106 |

| Mortgage Broker | $143 | $1,721 |

| Moving | $70 | $843 |

| Nonprofit | $44 | $531 |

| Painting | $56 | $667 |

| Party Rental | $48 | $582 |

| Personal Training | $61 | $735 |

| Pest Control | $82 | $988 |

| Pet | $40 | $475 |

| Pharmacy | $50 | $600 |

| Photography | $56 | $667 |

| Physical Therapy | $82 | $986 |

| Plumbing | $79 | $954 |

| Pressure Washing | $50 | $600 |

| Real Estate | $109 | $1,309 |

| Restaurant | $71 | $848 |

| Retail | $47 | $568 |

| Roofing | $85 | $1,018 |

| Security | $85 | $1,022 |

| Snack Bars | $41 | $489 |

| Software | $82 | $988 |

| Spa/Wellness | $93 | $1,122 |

| Speech Therapist | $88 | $1,054 |

| Startup | $63 | $754 |

| Tech/IT | $85 | $1,020 |

| Transportation | $82 | $988 |

| Travel | $83 | $1,000 |

| Tree Service | $65 | $784 |

| Trucking | $97 | $1,158 |

| Tutoring | $52 | $626 |

| Veterinary | $100 | $1,201 |

| Wedding Planning | $65 | $780 |

| Welding | $67 | $807 |

| Wholesale | $54 | $647 |

| Window Cleaning | $55 | $654 |

How Did We Determine These North Carolina Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and shouldn't be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does North Carolina Professional Liability Insurance Cover?

Like any other state, North Carolina professional liability insurance covers you for any liability damages from negligence and inability to fulfill contractual obligations. This also includes financial protection for any legal fees in relation to these items. You'll also hear it referred to as these terms as synonyms:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in North Carolina?

For most businesses in North Carolina, you won't be required to have professional liability coverage. Even so, you'll need $1 million per occurrence and $2 million aggregate per year coverage to cover contract work risk, or you'll be required to have it in the health care industry (malpractice insurance) by those you work for. Health care is the only exception and sets its provider requirements at $1 million per occurrence and $3 million aggregate per year coverage.

Who Needs Professional Liability Insurance in North Carolina?

If you deal with any work involving client contracts or anything that can be considered professional negligence, you need to consider professional liability insurance. North Carolina businesses in the following industries should consider getting errors and omissions insurance.

Due to the sensitive nature of tech-related businesses concerning customer and commercial data, this industry needs professional liability insurance, but it isn't required in NC. Often, these professionals need specialized tech E&O insurance policies to ensure they are covered for all necessary risks.

Lawyers often need a specialized type of professional liability insurance, called malpractice insurance, to protect them against negligence risks throughout the legal process. But it isn't required in North Carolina, according to state law.

If you are in the financial or consulting industry, your services are often required to either protect a client's investments or provide services that grow their business. If you are unable to meet these obligations or a customer claims you are negligent towards those ends, you'll need professional liability insurance in North Carolina.

Most medical professionals are required to have professional liability insurance in North Carolina, in the form of medical malpractice insurance. This is primarily due to the clear risks relating to illnesses, injuries, chronic conditions and death that may be caused while providing your services.

While not explicitly required in North Carolina, clients may require professional liability insurance. It's a good idea even if it isn't needed, since the risks of negligence and damage done by employees are high in the contracting and construction industry.

How to Get the Best Professional Liability Insurance in North Carolina

Our step-by-step guide walks you through how to get business insurance in North Carolina that matches your professional liability insurance needs and budget.

- 1Assess your professional liability insurance coverage needs

Understand your business risks and any client requirements you must meet. A Charlotte architect working on commercial projects needs different coverage than a Raleigh freelance consultant serving small businesses.

- 2Work with a local agent

Look for an agent who knows North Carolina's business landscape and understands how business insurance costs vary by location and industry. Local agents can explain whether your Asheville consulting practice needs different coverage than similar businesses in Charlotte's corporate environment.

- 3Get quotes and compare coverage details

Request quotes from at least three insurers, comparing both affordable business insurance rates and policy terms like exclusions and deductibles. A Research Triangle Park IT consultant should examine coverage differences, not just premium costs, when evaluating $1 million liability policies.

- 4Research the best providers

When researching business insurance in North Carolina, look beyond price. Find insurers with strong financial ratings, good claims handling and experience in your industry. Check AM Best ratings and read reviews from other professionals in your field.

- 5Consider bundling discounts

Many North Carolina insurers offer better premiums when you combine professional liability with other types of business insurance coverage like general liability or business owner policies. For example, a Wake County CPA firm saves 15% by bundling its professional and general liability coverage.

- 6Don't let your coverage lapse

Professional liability policies protect you only from lawsuits filed while your policy is active, even if the work happened years ago. A Greensboro consultant switching carriers should ensure their new policy covers prior acts or purchase tail coverage (extended reporting coverage) from their old insurer.

Get North Carolina Professional Liability Insurance Quotes

MoneyGeek can get you professional liability insurance coverage in North Carolina by matching you to top providers for your industry area. Use our tool below to get your top company match and get tailored quotes for your business.

Get Matched to the Best NC Professional Liability Insurer for You

Select your industry and state to get a customized NC professional liability insurer match and get tailored quotes.

North Carolina Professional Liability: Bottom Line

Finding the right professional liability insurance in North Carolina comes down to understanding your business risks and working with the right provider. ERGO NEXT earns our top rating, but your industry, client contracts and budget should guide your final decision. Start by assessing your needs, then let a local agent help you compare options and secure coverage that financially protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Alliance Health. "Provider Insurance Requirements." Accessed February 8, 2026.

- AM Best. "AM Best Places Credit Ratings of Next Insurance US Company Under Review With Positive Implications." Accessed February 8, 2026.

- Better Business Bureau. "Next Insurance, Inc. | BBB Complaints." Accessed February 8, 2026.

- Travelers. "Financial Strength Ratings." Accessed February 8, 2026.

- Trustpilot. "nextinsurance.com Reviews." Accessed February 8, 2026.

- Trustpilot. "Simply Business US Reviews." Accessed February 8, 2026.