Full coverage motorcycle insurance is the industry term for a policy that includes state-required liability protection and optional physical damage coverage for your bike. This type of coverage combines liability, collision, and comprehensive coverage into a single policy, creating complete financial security compared to minimum coverage policies that include only state-mandated liability.

Full Coverage Motorcycle Insurance

Full coverage motorcycle insurance refers to a bike policy with liability, collision, and comprehensive coverage included in one plan, averaging $364 yearly.

Find out if you are overpaying for full coverage motorcycle insurance below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

Full coverage motorcycle insurance covers your bike through collision and comprehensive coverage, but excludes your medical bills—add medical payments coverage to avoid $15,000-$150,000 in hospital costs.

Full motorcycle insurance coverage costs $302-$80,0, depending on the company, with Harley-Davidson offering the lowest rates.

Full coverage motorcycle insurance is worth the cost if your bike is worth over $5,000 or you can't afford replacement from savings; otherwise, liability-only coverage costs less while you self-insure.

What Is Full Coverage Motorcycle Insurance?

What Does Full Coverage Motorcycle Insurance Cover?

Full coverage motorcycle insurance protects you in three main situations: when you injure someone or damage their property, when your bike needs repairs after a crash and when it’s damaged while parked because of theft or weather.

Each part of the policy covers a different risk and comes with its own claim rules, deductibles, and limits, so it helps to review these details before choosing your plan.

Liability Coverage

Motorcycle liability insurance provides coverage into two components. Bodily injury liability covers others' medical expenses, lost wages, and pain and suffering when you injure them in a crash. Property damage liability pays for vehicle repairs, building damage, and property destruction you cause. Your insurer pays these claims to your liability limits, protecting your personal assets from lawsuits after at-fault accidents.

Most states require liability coverage as minimum motorcycle insurance. However, state minimums often provide insufficient protection. A $25,000 bodily injury limit won't cover serious injury costs exceeding $100,000. Consider carrying $100,000/$300,000 in bodily injury and $50,000 in property damage limits for adequate protection, especially if you have assets worth protecting, such as a home, savings, or retirement accounts.

Collision Coverage

Motorcycle collision coverage pays for repairs to your bike after accidents with vehicles or stationary objects, regardless of who's at fault. You pay your deductible first. Then your insurer covers the repair costs up to your bike's actual cash value. Typical deductibles range from $250 to $1,000.

Collision coverage applies when you rear-end another vehicle, sideswipe a car while changing lanes, or hit a guardrail on a curve. Without motorcycle collision insurance, you'll pay for all accident repairs out of pocket. Moderate damage often costs $3,000-$10,000, quickly draining your savings or forcing you into debt.

If you're financing your bike or it's worth more than you can afford to lose, collision coverage prevents the financial devastation of paying for repairs while still making loan payments on a damaged bike.

Comprehensive Coverage

Comprehensive motorcycle coverage protects your bike against non-collision perils: theft, vandalism, fire, flood, hail, falling objects, and animal strikes. Theft is the most common comprehensive claim. Your insurer pays for repair or replacement costs up to actual cash value, minus your deductible.

What Does Full Coverage Motorcycle Insurance Not Cover?

Full coverage doesn't cover your injuries, a critical gap many riders overlook. You'll need to add medical payments coverage or personal injury protection to cover your hospital bills, rehabilitation costs, and lost wages after accidents. Some states mandate PIP, but many don't. The gaps below are the most common surprises riders encounter when filing claims, from discovering their medical bills aren't covered to learning their custom parts have no protection.

Your Own Medical Expenses

Full coverage doesn't pay for hospital bills, rehabilitation costs, or lost wages after accidents. Liability, collision, and comprehensive coverage protect other people and your bike, not your body. You'll need to add medical payments coverage with limits from $1,000 to $10,000, or personal injury protection, which offers broader coverage, including lost wages.

The National Highway Traffic Safety Administration reports that 80% of motorcycle crashes lead to injuries. Medical coverage helps you avoid paying $15,000 to $150,000 out of pocket for treatment.

Without it, every expense comes from your savings or health insurance, which often includes high deductibles and copays. MedPay starts at just $5 to $15 a year for every $5,000 of coverage, giving you low-cost protection from major medical bills.

Custom Parts and Aftermarket Accessories

Standard collision and comprehensive coverage excludes custom exhaust systems, upgraded seats, paint jobs, saddlebags, and aftermarket equipment. Your $2,000 custom exhaust and $1,500 upgraded suspension won't be covered unless you add custom parts and equipment coverage with limits typically ranging from $3,000 to $10,000.

Progressive automatically includes $3,000 in accessory coverage with full coverage. Other insurers require you to purchase this separately. Comprehensive coverage without this endorsement will only reimburse your bike's stock value, not the $5,000-$15,000 you've invested in customizations.

Custom bikes often require modifications of over $10,000. Without custom equipment coverage, you'll lose this entire investment after total-loss crashes or theft. Custom parts coverage costs just $50-$150 annually, a small price to protect significant investments.

Mechanical Breakdown and Normal Wear

Full coverage doesn't pay for engine failures, transmission problems, or maintenance-related repairs. Motorcycle and comprehensive collision coverage only cover sudden, unexpected damage from covered perils, not age-related mechanical failures or neglected maintenance issues. You would have to purchase separate mechanical breakdown insurance to get this level of protection.

Roadside Assistance and Towing

Full coverage motorcycle insurance doesn't include towing or roadside assistance unless you add it separately. Without this $5- $15 annual add-on, you'll pay $75-$200 out-of-pocket for tow truck services after breakdowns.

Racing and Commercial Use

Track days, competitive events, food delivery work, and ride-sharing void your full coverage policy. Crashes during these activities will result in denied claims. You'll need specialized track insurance or commercial motorcycle insurance for these uses.

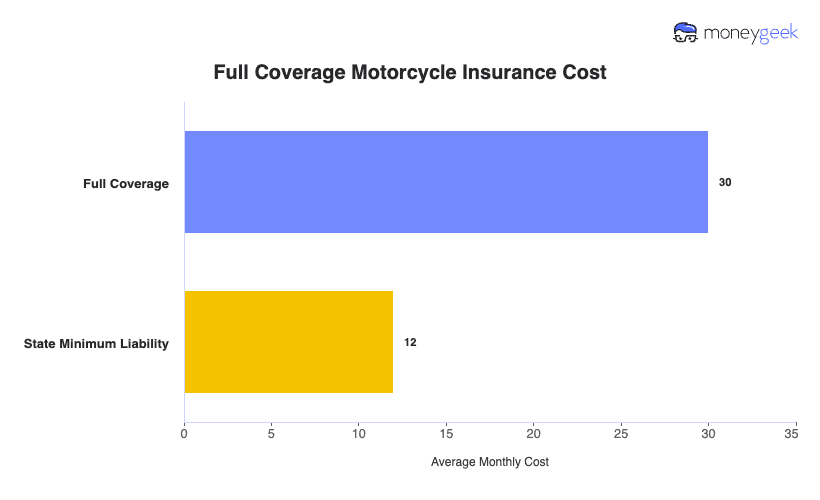

Full Coverage Motorcycle Insurance Cost

Full coverage motorcycle insurance costs $364 annually compared to $141 for state minimum liability, a difference of $223 per year. Whether this premium increase is worth paying depends entirely on your bike's value and financial capacity to replace it.

| Full Coverage | $30 | $364 | $10 | $103 |

| State Minimum Liability | $12 | $141 | $4 | $49 |

The national average above establishes a baseline for full coverage motorcycle insurance costs. The lowest and maximum monthly costs show the typical range riders pay. In the following sections, we will show how your age impacts your premium as you gain riding experience, which insurers offer the cheapest full coverage motorcycle insurance, and how your location affects your premiums.

Average Full Coverage Motorcycle insurance cost by Age

Full coverage motorcycle insurance costs $1,146 annually for 16-year-olds, $907 for 21-year-olds, $632 for 25-year-olds, and $364 for 40-year-olds. Your age creates the single most significant impact on your premium, with rates dropping by nearly 70% from your teen years to age 40. The steepest rate drops occur between ages 21 and 30, where premiums fall by almost $500 annually.

Average Full Coverage Motorcycle Insurance by Company

Harley-Davidson Insurance averages $302 annually, 57% below the national average. It is followed by Dairyland at $544, 23% below average and GEICO at $580, 18% below average.

This means identical full coverage motorcycle insurance costs anywhere from $302 to $800 annually, depending on which insurer you choose. Compare the average cost of motorcycle insurance below to see which companies offer the most affordable rates.

| Harley | $25 | $302 | -57% |

| Dairyland | $45 | $544 | -23% |

| Geico | $48 | $580 | -18% |

| Progressive | $51 | $612 | -14% |

| Nationwide | $85 | $1,025 | 45% |

| Markel | $96 | $1,157 | 63% |

Average Full Coverage Motorcycle Cost by State

Where you live has a bigger impact on your premium than any other factor, with an 835% gap between the cheapest and most expensive states. Southern states such as Alabama and Texas tend to have lower rates because of fewer people and lower theft risks.

In contrast, urban states with longer riding seasons, including Arizona and Michigan, often charge 84% to 164% above the national average.

| Alabama | $23 | $273 | -62% |

| Alaska | $17 | $200 | -72% |

| Arizona | $156 | $1,871 | 164% |

| Arkansas | $34 | $411 | -42% |

| California | $46 | $553 | -22% |

| Colorado | $27 | $321 | -55% |

| Connecticut | $29 | $349 | -51% |

| Delaware | $39 | $466 | -34% |

| Florida | $119 | $1,431 | 102% |

| Georgia | $33 | $399 | -44% |

| Hawaii | $29 | $351 | -50% |

| Idaho | $29 | $352 | -50% |

| Illinois | $35 | $417 | -41% |

| Indiana | $37 | $449 | -37% |

| Iowa | $20 | $238 | -66% |

| Kansas | $19 | $231 | -67% |

| Kentucky | $38 | $456 | -36% |

| Louisiana | $38 | $459 | -35% |

| Maine | $27 | $319 | -55% |

| Maryland | $31 | $373 | -47% |

| Massachusetts | $28 | $335 | -53% |

| Michigan | $38 | $456 | -36% |

| Minnesota | $19 | $224 | -68% |

| Mississippi | $44 | $530 | -25% |

| Missouri | $41 | $496 | -30% |

| Montana | $14 | $170 | -76% |

| Nebraska | $29 | $344 | -52% |

| Nevada | $40 | $485 | -32% |

| New Hampshire | $30 | $358 | -49% |

| New Jersey | $46 | $557 | -21% |

| New Mexico | $35 | $418 | -41% |

| New York | $23 | $282 | -60% |

| North Carolina | $31 | $377 | -47% |

| North Dakota | $19 | $222 | -69% |

| Ohio | $26 | $315 | -56% |

| Oklahoma | $27 | $319 | -55% |

| Oregon | $127 | $1,522 | 115% |

| Pennsylvania | $24 | $284 | -60% |

| Rhode Island | $47 | $565 | -20% |

| South Carolina | $30 | $360 | -49% |

| South Dakota | $20 | $237 | -67% |

| Tennessee | $34 | $411 | -42% |

| Texas | $158 | $1,891 | 167% |

| Utah | $108 | $1,290 | 82% |

| Vermont | $28 | $337 | -52% |

| Virginia | $34 | $413 | -42% |

| Washington | $24 | $288 | -59% |

| West Virginia | $41 | $490 | -31% |

| Wisconsin | $24 | $291 | -59% |

| Wyoming | $21 | $247 | -65% |

Factors That Affect The Cost Full Coverage Motorcycle Insurance

Full coverage motorcycle premiums are based on many rating factors. Some, like your age and location, are outside your control, while others give you room to lower your costs. The list below shows these factors by impact level, starting with the ones that influence your premium the most and ending with smaller discounts you can combine for extra savings.

Your Age and Riding Experience

Younger riders pay much higher premiums because they statistically file more claims. As shown in the cost tables, a 16-year-old pays about 215% more than a 40-year-old for the same coverage.

Rates gradually decrease as you get older and maintain a claim-free riding record, with the biggest drops happening between ages 21 and 30.

Your Driving Record

Traffic violations and at-fault accidents raise motorcycle insurance costs for three to five years after each incident. Speeding tickets usually increase premiums by 10% to 25%, while DUI convictions often double or triple rates.

Insurers rely heavily on your driving record to estimate future claims, so keeping a clean record is one of the strongest ways to maintain lower premiums.

Your Motorcycle's Value and Type

High-value bikes come with higher insurance costs because replacing them after theft or a total-loss crash is more expensive. Your collision and comprehensive premiums are based on your bike’s actual cash value.

Sport bikes and supersport models tend to have the highest rates since they’re linked to more high-speed crashes, while cruisers and touring bikes usually cost less to insure.

Your Location

Where you live and where you store your bike affect your rates more than any other factor. Urban areas with high theft levels lead to much higher comprehensive costs.

States with more accidents and expensive medical care push liability and collision premiums higher as well. As shown in the state cost table above, premiums differ by as much as 835% between the cheapest and most expensive states.

Your Coverage Limits and Deductibles

Higher liability limits raise your premium because the insurer takes on more financial risk, but the increase is usually small compared to the extra protection you get. Your deductible choice has a much bigger impact on cost. Moving from a $250 deductible to $1,000 lowers your collision and comprehensive premiums by 30% to 40%.

Your Credit Score

Most states allow insurers to use credit-based insurance scores when calculating premiums. According to industry practice, riders with excellent credit pay significantly less than those with poor credit, even with identical riding records. Insurers correlate credit scores with claim frequency, though California, Hawaii, Massachusetts, and Michigan prohibit this practice.

Your Annual Mileage

Riders who travel fewer miles annually face lower accident risk and qualify for low-mileage discounts. If you ride under 5,000 miles yearly, inform your insurer. Many companies offer 5-15% discounts for recreational riders compared to daily commuters covering 10,000+ miles annually.

Safety Features and Anti-Theft Devices

Anti-theft systems reduce comprehensive coverage costs by making your bike harder to steal. Anti-lock brakes (ABS) can reduce premiums by 5-10% because ABS-equipped bikes have fewer crashes. Some insurers offer discounts for additional safety equipment like airbag vests or integrated GPS tracking systems.

Multi-Policy Bundling

Bundling your motorcycle insurance with auto or home coverage generates 15-25% discounts from most insurers. This represents one of the most extensive savings opportunities and requires no change to your riding behavior or bike.

Safety Course Completion

Completing Motorcycle Safety Foundation courses or state-approved rider training reduces premiums by 5-15% with most insurers. These courses cost $150-$350 but generate premium savings for 3+ years, easily offsetting the course cost while improving your riding skills and crash avoidance.

Storage Location

Keeping your bike in a locked garage instead of on the street lowers your comprehensive premium because it reduces theft and weather risks. Many insurers offer a 5% to 10% discount for garaged bikes compared with those left on the street.

Is Full Coverage Motorcycle Insurance Worth It?

Deciding between full coverage and liability-only comes down to your bike’s value, how you use it and whether you could shoulder a total loss out of pocket. Full coverage costs about $223 more per year, but that extra amount protects you from losses of $3,000 to $25,000 if your bike is stolen or damaged in a crash.

When Getting Full Coverage Motorcycle Insurance Makes Sense

Full coverage makes sense if your motorcycle is worth more than $5,000. Without it, you'll pay for repairs or replacement yourself. If your bike is worth $10,000 or more, losing a stolen $15,000 Harley-Davidson hits your wallet hard.

Consider full coverage if you don't have much emergency savings. Even repairs on a $3,000-$5,000 bike can run $2,000 to $4,000 after an accident, draining your emergency fund or forcing you into high-interest debt.

Lenders require full coverage (collision and comprehensive) if you're financing or leasing your motorcycle. This protects you from making payments on a bike that's been totaled or stolen. If your motorcycle is your main transportation, full coverage means your insurer will cover repairs quickly so you can get back on the road.

When Liability-Only Coverage Makes Sense

Liability-only coverage works well for bikes worth less than $2,000. You'll save enough in premiums to equal your bike's value within 2-3 years. For bikes valued between $2,000 and $5,000, divide your bike's value by $223. If the result is 3 years or less, choose liability-only and self-insure.

Riders who log fewer than 1,000 miles per year and keep their bikes garaged most of the time face lower accident risk. Liability-only coverage meets legal requirements at a lower cost. But comprehensive coverage still protects garaged bikes from theft. You can keep comprehensive and drop collision if theft worries you more than crash damage.

With $10,000 or more in accessible emergency savings, you can handle your bike's total loss without financial stress. Liability-only insurance cuts your costs while meeting legal requirements. The money you save on premiums over several years often grows faster than what you'd spend on unlikely claims.

How to Get Full Coverage Motorcycle Insurance

Getting full coverage motorcycle insurance the right way saves you hundreds of dollars annually while ensuring you don't have coverage gaps that leave you financially exposed. You'll need specific information about your bike and riding history before requesting quotes, then you'll compare multiple insurers to identify the lowest rate for equivalent coverage—most riders who skip this comparison process overpay by $200-$500 per year for identical protection.

- 1Gather Your Motorcycle Information

You'll need your bike's year, make, model, and Vehicle Identification Number (VIN) to get accurate quotes. Have your current odometer reading ready since annual mileage affects your premium. If you've added custom parts or accessories, document their value with receipts or appraisals since standard collision and comprehensive coverage excludes aftermarket modifications.

- 2Collect Your Personal Information

Insurers need your date of birth, driver's license number, and riding history, including when you first got your motorcycle license. Prepare a list of traffic violations or at-fault accidents from the past 3-5 years, since these incidents affect your rates. If you've completed motorcycle safety courses, gather your certificates since most insurers offer 5-15% discounts for approved training.

- 3Decide Your Coverage Needs

Determine your coverage level by asking one question: Can you afford to replace your bike from savings if it's stolen or totaled? If you can't absorb a $5,000-$15,000 loss without financial hardship, you need full motorcycle insurance with collision and comprehensive coverage. If you maintain substantial emergency savings and your bike's worth less than $3,000, liability-only coverage costs less while you self-insure for bike damage.

Select liability limits that protect your assets from lawsuits. If you own a home, maintain savings, or have retirement accounts, choose $100,000/$300,000 bodily injury and $50,000 property damage limits—state minimums of $25,000/$50,000 won't cover serious injury costs, which leaves you personally liable for the difference and puts your assets at risk of seizure through court judgments.

- 4Request Quotes From Multiple Insurers

Contact at least three insurers to compare rates since premiums vary by hundreds of dollars annually between companies. The company comparison table above shows that the cheapest full coverage motorcycle insurance costs 57% less than average.

Since these companies consistently offer competitive motorcycle insurance rates, request quotes from Harley-Davidson Insurance (if you ride a Harley), Dairyland, GEICO, Progressive, and Nationwide. Get quotes online through insurer websites, call their agents directly, or work with independent insurance agents who can quote multiple companies simultaneously.

- 5Compare Coverage Options and Prices

Review each quote carefully to confirm identical coverage limits and deductibles across all proposals. Verify that quoted prices include the same optional coverages, such as medical payments coverage, rental reimbursement, roadside assistance, and custom parts protection.

Don't select coverage solely based on the lowest price. Check each insurer's financial strength rating from AM Best and customer complaint ratios from your state insurance department to ensure they'll pay claims promptly.

- 6Ask About Available Discount

Request all applicable discounts, including multi-policy bundling (15-25% savings), motorcycle safety course completion (5-15% savings), anti-theft devices, anti-lock brakes, low annual mileage, good credit, and mature rider discounts. Many insurers offer 10+ different discount opportunities you can stack for maximum savings. A $364 full coverage policy often drops to $250-$300 with multiple discounts applied.

- 7Purchase Your Policy

Once you select an insurer, you can purchase full coverage motorcycle insurance immediately online or by phone. You'll need to pay your first month's premium or a down payment on a six-month or annual policy. Most insurers offer monthly payment plans, though paying in full usually saves 5-10% compared to monthly installments. Your coverage becomes effective immediately after payment, and you'll receive proof of insurance documents via email within minutes.

- 8Review Your Policy Documents

Read your policy documents carefully when you receive them to verify that all coverage limits, deductibles, and endorsements match what you purchased. Confirm that the custom parts coverage, medical payments coverage, and other optional protections you selected appear in your declarations page. Check that your bike's VIN, address, and lienholder information (if financing) are accurate. Contact your insurer immediately if you spot errors; mistakes could lead to claim denials.

- 9Maintain Continuous Coverage

Set up automatic payments or calendar reminders to pay premiums before due dates. Letting complete coverage motorcycle insurance lapse creates coverage gaps that increase your future rates and leave you financially exposed. Most states require continuous insurance for registered motorcycles, and coverage lapses can result in license suspension, registration revocation, and reinstatement fees of $50-$500, depending on your state.

Comprehensive Motorcycle Insurance: Bottom Line

Full coverage motorcycle insurance protects both your legal liability and your bike's physical value by combining liability, collision, and comprehensive coverage into one policy. The decision to buy it versus liability-only coverage comes down to a simple question: Can you afford to replace your bike from savings if it's stolen or totaled? If the answer is no, full coverage is essential protection. Liability-only may be the more brilliant financial choice if you can easily absorb that loss.

Your premium changes dramatically based on your age, location, and insurer. You control several factors that lower your costs. Shop quotes from multiple companies, bundle with other policies, complete safety courses and raise your deductibles to cut your premium. Compare options instead of accepting the first quote.

Full coverage doesn't cover everything. Medical expenses, custom parts and mechanical failures need additional coverage you'll buy separately. Compare quotes now to find the right mix of protection and affordability.

Motorcycle Insurance Full Coverage: FAQ

Is full coverage motorcycle insurance required by law?

No, only liability coverage is legally required in most states. However, lenders will require full coverage motorcycle insurance with collision and comprehensive coverage until you pay off your loan. Once you own your bike outright, you can legally drop collision and comprehensive coverage, though you'll lose financial protection for your bike's value.

What's the difference between full coverage and liability-only motorcycle insurance?

Liability-only motorcycle insurance covers damages you cause to others, but not your own bike. Full coverage motorcycle insurance adds motorcycle collision coverage for crash repairs and comprehensive coverage for theft, vandalism, and weather damage. Full coverage costs 2-3 times more but protects your bike's value. Liability only protects your legal obligation to others.

Can I add full coverage to my existing motorcycle insurance policy?

Yes, you can contact your insurer to add collision and comprehensive coverage anytime. Your premium will increase immediately, and you'll need to select deductibles for both coverages, typically ranging from $250 to $1,000. Some insurers require a bike inspection before adding comprehensive coverage to verify its condition and prevent fraud.

How do I file a claim with full coverage motorcycle insurance?

For collision claims, contact your insurer within 24 hours after an accident. Your insurer will assign an adjuster to assess the damage, verify your coverage, and authorize repairs up to actual cash value minus your deductible. For comprehensive theft claims, file a police report first, then contact your insurer with the report number. Your insurer will pay the cash value minus your deductible if your bike isn't recovered within 30 days.

Does full coverage pay for a rental motorcycle while mine is being repaired?

No. Full coverage motorcycle insurance doesn’t include rental reimbursement unless you add it as an extra. Rental reimbursement covers about $20 to $40 per day for a temporary bike while yours is in the shop after a collision or comprehensive claim.

If you don’t add this option, you’ll need to pay rental costs yourself or go without a bike during repairs, which usually take two to four weeks.

What deductible should I choose for full coverage motorcycle insurance?

Pick collision and comprehensive deductibles that you can pay from your savings right away. Higher deductibles of $500 to $1,000 lower your full coverage premium by about 20–40%, but you’ll spend more out of pocket when you file a claim.

Lower deductibles of $250 to $500 raise your premium but reduce your cost after a claim. Many riders choose a $500 deductible because it balances monthly cost and out-of-pocket expenses.

Can I get full coverage motorcycle insurance on an older motorcycle?

Most insurers still offer collision and comprehensive coverage for bikes that are 15 to 20 years old, though coverage may be limited if your bike is worth under $2,000 to $3,000.

Since older bikes lose value each year, the payout from a claim also decreases. At some point, full coverage stops being financially practical. Compare the cost of full coverage to your bike’s current market value before adding it to an older motorcycle.

Does full coverage motorcycle insurance protect custom modifications?

Standard collision and comprehensive coverage doesn’t include custom modifications. To protect upgrades like custom exhausts, seats, paint jobs, saddlebags and other parts, you’ll need custom parts and equipment coverage.

This add-on usually covers $3,000 to $10,000 in upgrades. Without it, your insurer reimburses only your bike’s stock value, not the extra $5,000 to $15,000 you invested in customizations.

What is considered full coverage motorcycle insurance?

Full coverage motorcycle insurance includes liability coverage (required in most states), collision coverage (for crash repairs to your bike), and comprehensive coverage (for theft, vandalism, and weather damage).

Together, these three coverages protect both your responsibility to others and your bike’s value, which is why the package is called “full coverage.”

How much is full coverage motorcycle insurance per month?

Full coverage motorcycle insurance costs $30 per month on average nationally, ranging from $10 to $103 monthly depending on your bike's value, age, location, riding history, and coverage limits. The average cost of full coverage motorcycle insurance varies significantly by state, from $17 monthly in Alaska to $156 monthly in Arizona.

How We Analyzed Comprehensive and Collision Motorcycle Insurance

MoneyGeek's complete coverage motorcycle insurance analysis uses comprehensive rate data we gathered from major insurers nationwide. We collected quotes for multiple motorcycle types, rider ages, coverage levels, and locations to determine typical full coverage costs compared to minimum coverage. Our research team contacted insurers directly to verify coverage details, exclusions, and endorsements included in full coverage motorcycle insurance policies.

All cost data in this article, including average full coverage motorcycle insurance costs by age, company, and state, comes from MoneyGeek's proprietary rate analysis conducted in 2025. To provide comprehensive guidance, we evaluated state insurance requirements, insurer financial strength ratings from AM Best, and customer complaint data from state insurance departments.

About Rachael Brennan

Rachael Brennan is a licensed insurance agent with over a decade of experience in the industry. She holds a property and casualty (P&C) license across all 50 states and a life, health, and accidental death and dismemberment (AD&D) license in New York and surrounding states. She writes personal finance and insurance content for MoneyGeek, specializing in property, casualty, health, life and accidental death and disability insurance.

Brennan earned her Bachelor of Science in Communications from Texas A&M University-Commerce. As a writer, she uses her insurance and personal finance experience to share practical knowledge and help people make informed financial decisions.